Talos Energy (TALO) – Growth in the Gulf

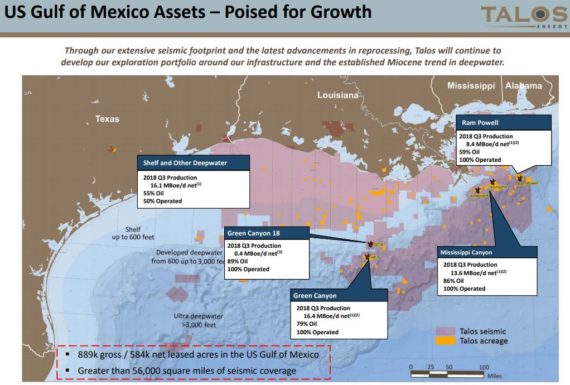

Talos Energy is an E&P company with operations in the Gulf of Mexico (GoM) and in the shallow waters off the coast of Mexico. Their focus in the Gulf is the exploration, acquisition and development of deep and shallow water assets near existing infrastructure. The shallow waters off the coast of Mexico provide them with high impact exploration opportunities.

Seaport Global was recently out with a note following meetings with investors new to the Talos story. Among the themes discussed were the contributing factors that differentiate TALO from the significant majority of GoM operators, which include differences to TALO’s development strategy, as well as basin-wide economic improvements. These would include:

• Steady and significant improvements in oil services, such as day rates for rigs dropping from >$600K/day for long-term service contracts, down to the mid- to low-$100K range for shorter-term periods.

• Significant improvements in the quality and quantity of GoM geologic data.

• TALO’s development and M&A strategy that now focuses more so on lower risk prospects near in-place infrastructure vs. higher risk/cost greenfield opportunities.

• And more recently, improvements in Gulf Coast pricing.

Zama

In a press release on April 15th, Talos provided an update on its Zama appraisal program in Block 7, located in the offshore portion of Mexico’s prolific Sureste Basin. Talos is the operator of Block 7 in a consortium with partners Sierra Oil & Gas and Premier Oil plc.

The Zama-2 ST1 appraisal well is the second of three appraisal penetrations drilled by the Consortium to better define the resource potential of the Zama discovery. The goals of the Zama-2 ST1 well were to test the northern limits of the reservoir, acquire a whole core to collect detailed rock properties, and perform a well test in several perforated intervals. The Zama-2 ST1 well was drilled 589 feet updip of the Zama-2 well and approximately 1.4 miles north of the Zama-1 exploration well, and generated the following results:

• The well logged 873 feet (266 meters) of gross true vertical depth (“TVD”) pay, within expectations for the northern extension of the Zama discovery and confirming a consistent net-to-gross ratio range of 68%-73% through multiple penetrations. Talos also captured an unprecedented 714 feet of whole core with 98% recovery, the longest whole core acquired in a single well in the history of offshore Mexico.

• The well test operation was completed approximately 5 days ahead of schedule and more than 30% below budget.

Talos Energy President and CEO Timothy Duncan commented, “The Zama-2 ST1 operation was another success for the consortium. With each stage of the appraisal program, our experience and understanding has continued to strengthen in the region, and this is evident in our operational performance. We will now move to the southern end of the discovery with the Zama-3 appraisal well to continue to collect data before concluding appraisal operations. Concurrently, we are working with Petróleos Mexicanos (“Pemex”) on unitization prior to submitting a development plan to the regulator. Our goal is to reach final investment decision (“FID”) and first production as soon as possible.”

Roth Capital was out with a note titled, “Impressive Appraisal Well: Very Positive,” where analyst John White said he will incorporate this recently published data together with TALO’s 4Q and full year 2018 results, and update his estimates accordingly.