The Middleby Corporation (MIDD) – The Restaurant & Kitchen Juggernaut

The Middleby Corporation designs, manufactures, markets, distributes, and services commercial foodservice, food processing, and residential kitchen equipment in the United States and internationally. The company’s revenue is broken down by the following segments:

Commercial Foodservice Equipment (55% of Total Revenue) – Offers cooking and warming equipment for quick-service restaurants, full-service restaurants, convenience stores, retail outlets, hotels, and other institutions. This segment provides conveyor, convection, baking, proofing, deck, speed cooking, and hydrovection ovens. Per the company’s Investor Presentation, here are the institutions the company works with:

Residential Kitchen Equipment (30% of Total Revenue) – Manufactures, sells, and distributes kitchen equipment comprising ranges, ovens, refrigerators, dishwashers, microwaves, cooktops, ventilation equipment, and outdoor equipment for the residential market. Per the company’s Investor Presentation, here are some of the brands:

Food Processing Equipment (15% of Total Revenue) – Offers processing solutions for customers producing pre-cooked meat products, such as hot dogs, dinner sausages, poultry, and lunchmeats, as well as baked goods. This segment offers batch, baking, proofing, conveyor, and continuous processing ovens.

Within each segment, the company has been able to deliver consistent revenue growth over the past several years.

Commercial Foodservice

![]()

Food Processing

![]()

Residential Kitchen (Started in 2013)

![]()

In a recent report from Nation’s Restaurant News, they spoke on how equipment innovations are providing broader options for operators in both the front and back of the house. The right equipment choices can increase labor savings, accommodate dietary-restriction food prep and lead to more efficient footprints. “It’s an interesting time for restaurants when it comes to equipment,” said Charlie Souhrada, Vice President for regulatory and technical affairs, North American Association of Food Equipment Manufacturers. “Labor is definitely at the forefront of everyone’s minds because of the difficulty of finding people to do the work but also in the cost of labor and healthcare benefits,” Souhrada said. “We’re seeing more and more tools to try to do jobs more efficiently, faster and better.”

Bojangles (BOJA) spent more than a year planning out a Greenville, S.C., prototype to ensure the design would hold up years into the future. That especially included the equipment choices, said Randy Icard, Bojangles Vice President of Construction and Development. “Equipment got a starring role.” The 699-unit Charlotte, N.C.-based quick-service company created a “Biscuit Theater” to showcase its signature product — the in-house biscuits made every 20 minutes throughout the day — and the equipment was part of that stage.

Middleby understands the ever-changing technological landscape within the food and restaurant industry. Last week, the NAFEM trade show took place in Orlando, Florida where foodservice equipment manufacturers touted their latest and greatest for operators and buyers. Companies are trying to turn attention to new pieces that incorporate technology as a way to make equipment smarter, adding an element of automation and eliminating some of the guess work currently placed on both management and staff. Taking a look at Middleby, they seem well-equipped and well prepared to take advantage of this opportunity with their own selection of products:

• BroilVection (Automatic broilers that guarantees a delicious, flavorful, flame-broiled meal that is both quick and efficient)

• SmartOIL Sensor (Knowing when to precisely re-use oil and when to change to ensure top quality food)

• Blast Chilling Technology and Refrigerated Transport

• Viking TurboChef Oven, Zero Preheat Ovens

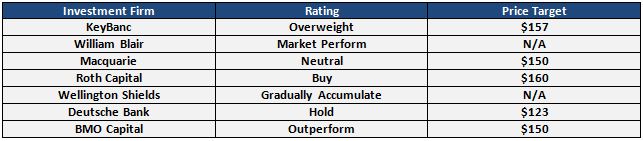

There isn’t a wide array of sell-side coverage on this name. But, for what it’s worth, here is how analysts view the stock coupled with specific commentary from certain analysts.

February 13th, 2017 – KeyBanc analyst James Picariello initiated Middleby with an Overweight and a $157 price target saying it has amassed a collection of best-in-class brands with leading share positions across multiple customer channel categories. Mr. Picariello believes Middleby possesses significant long-term holding qualities around its proven ability to deliver mid to high single digit core revenue growth, highly active M&A, and consistent margin expansion.

November 18th, 2016 – Roth Capital analyst Anton Brenner raised his price target for Middleby to $160 from $150 following the company’s analyst day. Mr. Brenner says Middleby’s management outlined strategies that should generate sustained revenue growth and meaningful margin improvement in each operating segment. He also reiterated his Buy rating on the shares.

August 12th, 2016 – BMO Capital analyst Joel Tiss says that Middleby reported “excellent” Q2 results, with “impressive operating execution.” Mr. Tiss raised his price target on the shares to $150 from $125 and keeps an Outperform rating on the stock.

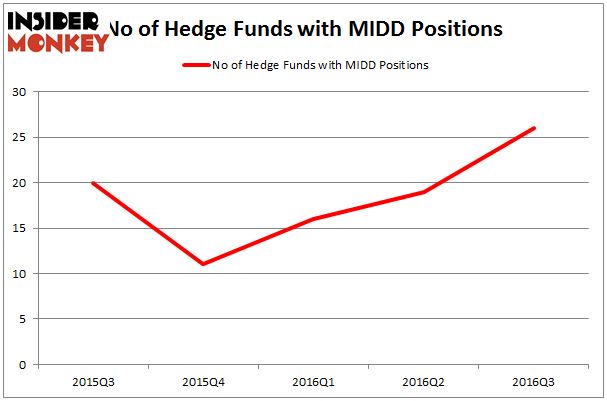

Lastly, according to Insider Monkey, at the end of Q3, a total of 26 hedge funds were long shares of Middleby, a jump of 37% from the prior quarter (figure shown below). As more and more Q4 filings begin to roll in, we’ll have to keep an eye out to see if this trend continues. For now, we can identify Columbus Circle Investors and Osterweis Capital Management as two funds that have increased their holdings.