Total System Services (TSS) – CUP and CFPB Catalysts

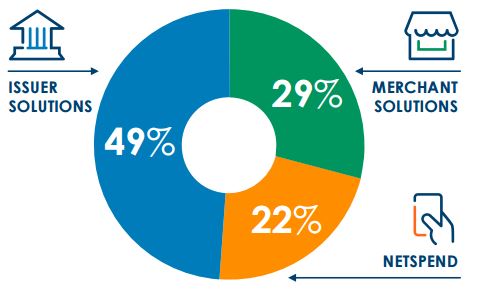

As a leading global solutions provider to financial and non-financial institutions in the United States and internationally, Total System Services’ business is derived from third-party processing for issuers and merchant acquirers. Per the company’s May Investor Day, here is how revenues are broken down:

On April 25th, the company would release its Q1 results in which it beat on EPS and Revenue, said total revenues increased 60.2%, and even offered better-than-expected guidance.

On the company’s earnings call, management provided results on each of these segments:

Issuer Solutions – Net Revenues increased 5.2% with transactions increasing 6.3% and over 10M net new accounts were added.

Merchant Solutions – Net Revenues increased 116% with Point-of-Sale transactions increasing 3.4%. Margins also came in at 35%, up 320 basis points Y/Y and ahead of the 34.3% forecast. They also announced they renewed their agreement with Dollar General (DG) for an additional 4 years.

NetSpend – Net Revenue increased 6.7% on GDV growth of 4.9% During a challenging tax season, NetSpend showed positive account growth for the quarter and finished Q1 with total debit active cards of over 5 million, a new record

Following the company’s earnings and analyst day on May 24th, the following sell-side firms provided their commentary:

On April 26th, Stifel analyst John Davis said that the company’s results were “solid” and give him more confidence in its ability to beat margin expectations going forward. He kept a Buy rating on the stock but increased his price target to $65 from $60.

On May 7th, Goldman Sachs analyst James Schneider upgraded TSS to Buy. He said the company’s organic revenue growth can accelerate this year and next as its Issuer Solutions business stabilizes and management announces new portfolio wins in the coming months (Signed a long-term agreement with Valley National Bank on June 19th and extended its payments agreement with Tesco Bank on June 20th). He would also raise his price target to $68 from $60.

On May 25th, Citi analyst Ashwin Shirvaikar called TSS’ analyst day “well-executed” and believes the stock has further room to run. The company detailed “several positive changes” being made in product development, distribution and operations. He believes these factors should draw heightened investor interest and kept a Buy rating on the shares with a $64 price target.

In addition, according to Form 4 filings on May 20th, President and COO Pamela Joseph acquired 5,000 shares at $53.40 for a total value of $266,980. This was a new position from her and the first insider purchase since early February.

![]()

China UnionPay

On TSS’ Q1 conference call, CFO Paul Michael Todd was speaking on behalf of its Issuer Solutions segment and made the following remark:

“Before I leave this segment, I do want to call out the outstanding performance of our CUP Data JV (China UnionPay Joint Venture) since it is issuing related. While we do not include the financial performance of CUP Data in our segment results, our CUP Data JV continued its fantastic track record of growth, and this quarter’s impact from our CUP Data joint venture was exceptionally strong.”

“The venture has expanded its market presence and processing capabilities in the Chinese card processing market, and this quarter’s results reflect the strong finish to 2016 and the new plateau of growth in 2017 from both core processing as well as value-added products and services. And all of this growth is derived entirely from organic growth. In all, we are pleased with the start of the year for our Issuer segment and our CUP Data joint venture.”

In a research note published on June 13th, Stifel analyst John Davis felt this was an important observation as he said, “We would argue that TSS’s CUP Data JV is underappreciated and largely ignored by investors. Importantly, given TSS’s 45% stake, the JV’s results are largely excluded from TSS’s financial statements with the exception of the minority interest line. As such, we estimate it robs the company of over 100 bps of reported organic revenue growth in its Issuer solutions segment and overstates TSS’s EBITDA multiple by a half turn. Looking at it differently, we believe the CUP Data JV is worth at least $4/share to the stock using a conservative multiple.”

Consumer Financial Protection Bureau

For those that do not know, the CFPB is a regulatory agency charged with overseeing financial products and services that are offered to consumers. Specifically, it helps consumer finance markets work more efficiently by providing rules, enforcing those rules, and empowering consumers to take control of their personal financial lives.

Back in 2016, the CFPB issued a rule on prepaid accounts under the Electronic Fund Transfer Act and Truth in Lending Act that was originally set to take effect on October 1st, 2017. Well, in late-April, the CFPB officially announced that the implementation date for the prepaid rule would be delayed by 6 months to April 1st, 2018.

This rule requires financial institutions to limit consumers’ losses when funds are stolen or cards are lost, investigate and resolve errors, give consumers free and easy access to account information and provide protections if credit is offered. It would also adjust requirements for resolving errors on unregistered accounts and provide greater flexibility for credit cards linked to digital wallets.

Total Systems acknowledged on their earnings call that they are continuing to analyze all of the implications a 6-month delay would have on the business plan.

In a BMO Capital note, they said that clients, to their surprise, did not hammer in the potential loss of revenues in the NetSpend segment from the CFPB regulatory change around overdraft fees from prepaid cards. Investors seem comfortable with management’s consistent guidance and explanation around this issue for the past few quarters. Still, BMO thinks uncertainty remains around the impact on 2018 and 2019 results and this still represents overhang for the stock.

We’ll need to monitor this situation as I’m sure more discussion will come up in the near future.