Triumph Group (TGI) – Time for a Turnaround?

Triumph Group (TGI) is a designer, supplier and provider of aftermarket services of commercial and military OEM aircraft components worldwide. Their products include the entire tail section of Boeing’s (BA) 747, various wing sections for both the 767 and 777, fuselage sections of Sikorsky (LMT) Black Hawk helicopters, Airbus (EADSY) A-350 rudder components, among many other integral structures of engines, nacelles, empennages and other aircraft structures. One of the few companies in the world that can offer a total solution of products, services and systems to the largest aerospace and airline companies in the industry,Triumph has production plants and maintenance facilities in the US, as well as a corporate presence in Europe, Asia, Mexico and Thailand.

The Company operates in four segments, all related to aviation:

- Aerospace Structures – The largest source of revenue at this time with 3Q bringing in $304.2 million, it is expected to decline in terms of percentage over time. Global 7000 wing program is transitioning to production.

- Integrated Systems – The most profitable business at 20% operating margin, 3Q net sales were $256 million, it was impacted by nearly $10 million from GBP currency exchange and a small divestiture in 2Q.

- Precision Components – Next with net sales of $226.3 million, this segment is undergoing intense restructuring with machine shops and facilities undergoing consolidation.

- Product Support – Although Support brought in just $87.2 million in 3Q, its operating margin stood at 17%. The strong margins are supported by increasing organic sales, cost reductions and key contract wins.

Bad News First

Jumbo Elephant in the Room – Triumph manufactures the tail assemblies for Boeing’s (BA) 747 aircraft in all its configurations. With the announcement of this model’s ramp down and possible passenger plane program termination, management is waiting for notice of future plans. At this time, Boeing has not discontinued the model and is exploring further marketing opportunities of the cargo version with UPS (UPS) having ordered 14 of the 747-F variant back in late October. Assembly prosecution though has been reduced to just 0.5 aircraft per month.

The other Jumbo, the twin-engine 777, is also in the midst of a slowdown as airlines are ordering smaller aircraft with lower fuel consumption.

Bombardier Dispute – Management provided an update on their situation with Canadian regional jet manufacturer Bombardier (BBD/b.to) with whom they have been unable to reach a resolution. Triumph is building the wings for their Global 7000 executive jets which have run into significantly higher than expected development costs that Bombardier is unwilling to share in. Since the matter is in litigation, details were limited. In the meantime, Triumph has delivered the test aircraft’s wings and has started work on production units. The aircraft is expected to enter into service sometime in early or mid 2018.

Good News Displacing Bad

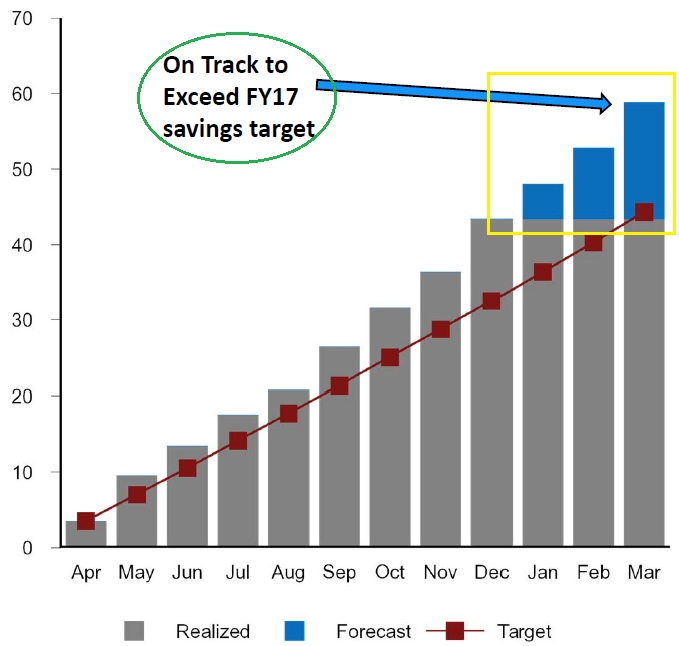

Planning for the Future – The company’s last two quarters have seen stabilization with cost reductions ahead of the year’s targets. New business contracts were gained at a higher rate QoQ and cash usage saw improvement from better capital management. The business is already seeing early benefits of turnaround efforts and it expects to see cost reduction to exceed its goals.

During the last quarter, consolidation work on five facilities continued, targeting 450,000 square feet of floor space reduction which should translate to $25 million in savings per year: an additional five more are planned for FY2018, netting more savings. Alongside physical space eliminations, there are also reductions in redundant, overlapping workforce which are expected to “enhance competitiveness”, in the company’s own words. Overall cost reduction for FY2017 is expected to exceed the $44 million forecast by $12 million, on track towards a three-year goal of $300 million.

There are continuing plans to divest portions that do not fit into the core aspect of the enterprise, as was done with Triumph Air Repair, their APU business in Thailand and Tempe, AZ. New product development for “plug-and-play” type electronic modules in aircraft is also ongoing to compete with technological advances in automated fields.

Acquisitions are also possible especially in the fragmented aftermarket supply chain segment and the $67 billion aftermarket support sector.

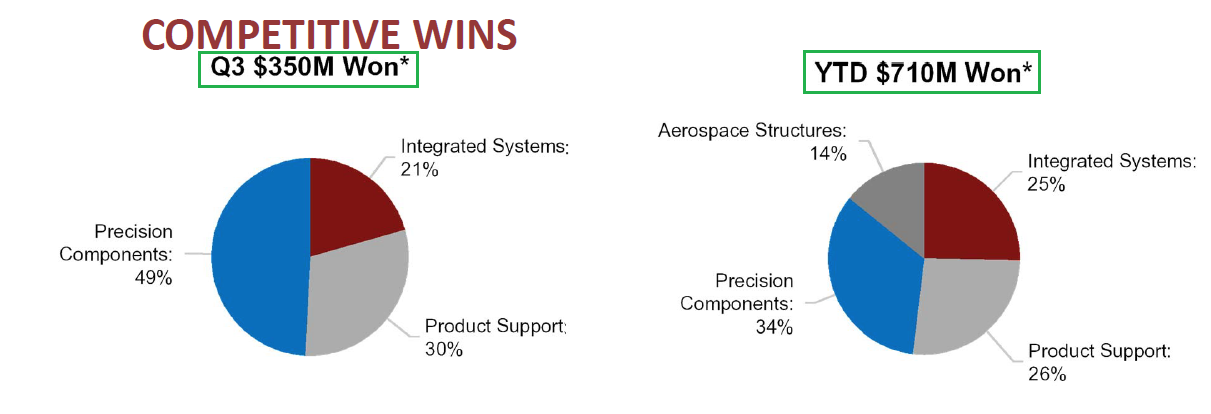

Organic Growth – Triumph Group’s management has been finding new ways to win contracts and grow. Pipelines are expanding and last quarter alone the company was able to generate new business worth over $350 million. This is more than the previous two quarters combined and brings fiscal year-to-date contract wins at over $710 million, equivalent to 3% net sales growth. This is in addition to their $4 billion backlog and they aren’t content to sit back – recently there have been meetings and visits with both Northrup Grumman (NOC) and Lockheed Martin (LMT) and overall industry opportunities worth over $16 billion are being tracked.

Recent, post-earnings contract awards include Airbus Industrie’s A-350XWB rudder components and South Korean KF-X fighter jet’s engine accessory drive parts.

New Management – As of January 2016, Triumph has had a new CEO and President. Daniel J Crowley has extensive experience in the aerospace industry having worked with Raytheon (RTN) and Lockheed Martin (LMT). In August 2016, James McCabe Jr. joined the company in the role of CFO and Senior VP. And most recently, in February Gary Tenison was appointed as the New Business Development Lead. Mr Tenison was VP of marketing and development at Kaman (KAMN), another aerospace specialist.

Compensation incentives for the two gentlemen are based on total stockholder return, meaning that bonuses are awarded with higher share prices instead of sales or revenue based model.

Final Observations

Air transport is still a growing industry with both Airbus and Boeing predicting demand for over 32,000 new aircraft in the next 15 years and air traffic growth of 4.8%. Deloitte’s 2017 aerospace and defense industry forecast mentions passenger and freight volumes increasing at an annual growth rate of 4.8% and 4.2% respectively over the course of the next 20 years along with continued increases in aircraft units over the same period.

Military expenditures are expected to keep increasing with US DOD budget alone approaching $640 billion for 2018, a $52 billion increase from 2017. Continued geopolitical unease is providing a backdrop for further strengthening of defense sectors worldwide and aging aircraft fleets are coming up for refurbishment and replacement with extended life-cycles.

Both RBC and Credit Suisse rate shares at Outperform with price targets at $35 and $40, respectively while BAML rates it as Underperform with a price target at $30.

Based on all of the factors above, good and bad, it is possible that Triumph Group is at the bottom of their decline. Trading at a discount to their peers, further contract wins and cost savings could be presenting a compelling opportunity for the patient investor as cash flows increase and debt gets paid down.