Trupanion (TRUP) – Health Insurance For Your Pets

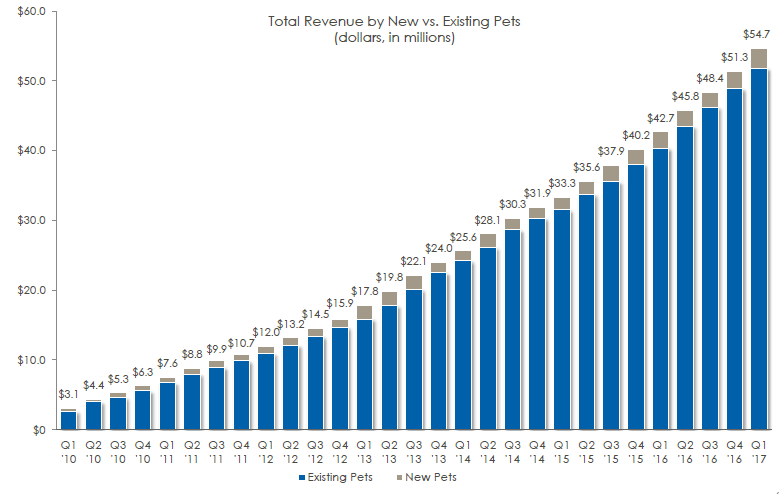

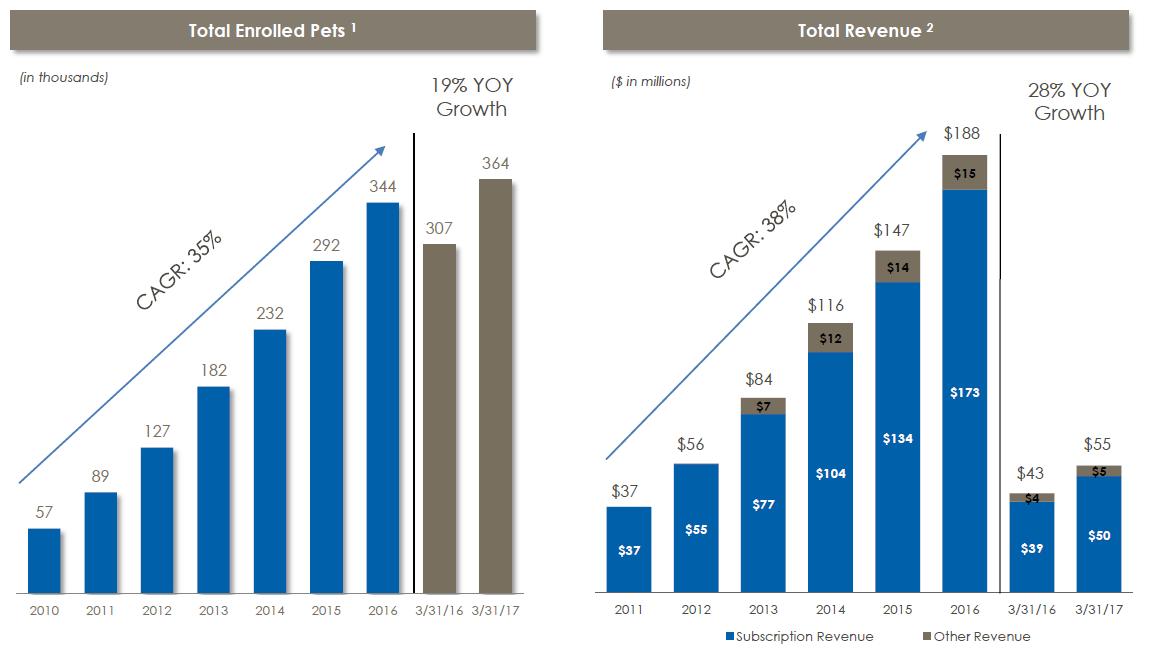

Trupanion (TRUP) was originally founded in Canada by CEO Darryl Rawlings in 1999, subsequently relocated to Seattle in 2005 and went public in 2014. While it is not the largest player in the US or Canadian marketplace, it is probably the most flexible with regards to policy plan options, unrestricted payout coverage, and direct-to-vet payments among other benefits. In his 2016 letter to shareholders, the CEO put their total enrolled pets at 343,649, a 17.7% increase over 2015.

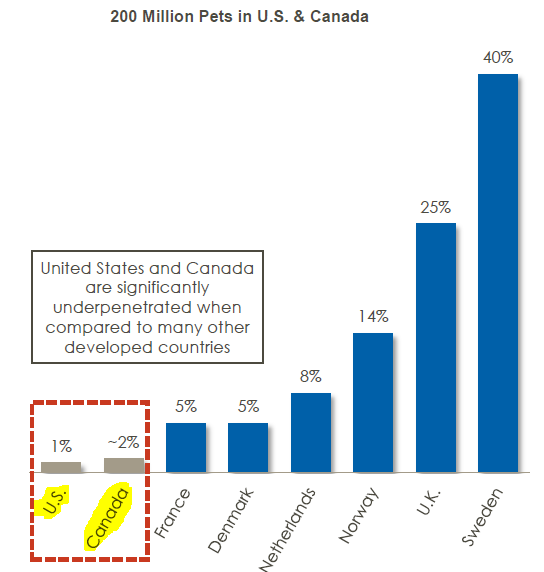

Total spending on pets the North American market keeps increasing, having reached $66.7 billion in 2016 in the US and expected to hit the $69 billion mark for 2017. Pet ownership has risen to 68% of households with dogs leading the way at 48% and cats at 38%. With 200 million pets in the US and Canada, it is understandable that food accounts for 42% of all the industry’s spending while veterinary care accounts for just under 16% at $15.95 billion in the US.

With this enormous amount of money being lavished on companion pets, it’s not surprising that there is a market for healthcare insurance for these furry friends, with many providers competing in a very under-penetrated space: only around 1% market reach in the US and about 2% in Canada. This pales in comparison to European countries which have a far larger market with Norway at 14%, the UK at 25% and Sweden at an incredible 40% penetration. It’s hard to imagine North American numbers reaching anywhere near those levels, although with the large amount of total pets, even 1% would translate to nearly 2 million policies valued at close to $1.2 billion. The opportunity for large-scale expansion is out there, however realistically, doubling today’s reach would probably take many years. Increases are more likely to trickle in at lower rates which will still be accretive to overall revenues for all the insurance providers.

According to Trupanion, the reason for the low number of insured pets in the US is that prior to their market presence, “there was not a high-quality, high-value option that veterinarians and their staff could “confidently” recommend”. This, they say, is the necessary precursor to making medical insurance “normal” for pet owners. They also feel that the standard reimbursement model does not work: those that can’t pay up-front tend to forgo treatments altogether, and for those that do pay for procedures, the subsequent paperwork, invoice gathering and claims submissions followed by a waiting period to receive a payment is not conducive to satisfied clients who will in turn refer services to others.

Trupanion Express – As a way to eliminate the claiming process, Trupanion wants to pay veterinarians directly and instantly. At the end of 2016, over 1,400 animal hospitals were set up to do just this, and during the same year $30 million in claims were paid to the vets right away with the policy holder being responsible solely for their portion of the bill. Of all the insurance providers in both Canada and the US, Trupanion is the only one that offers this option which is an atteactive selling point.

Large Market

The North American pet-health market is considerably larger than its international counterparts with around 28,000 veterinary hospitals – 26,000 of which are independent entities. Of those, 8,100 actively recommend Trupanion’s services with management having set a long-term target of 20,000. Through their 104 Territory Partners (essentially their sales reps), they have been increasingly building trust and professional relationships through the years, adding 440 in 2016.

Marketing Plans

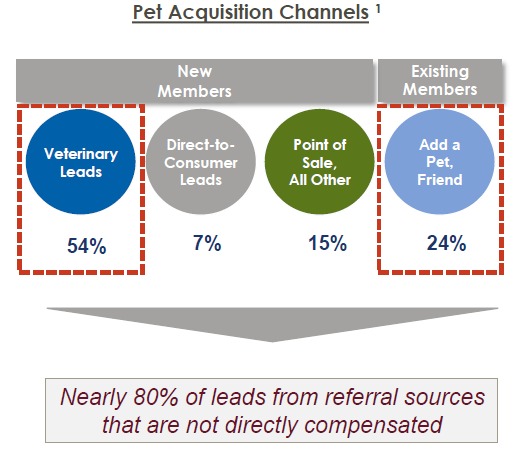

To date, Trupanion’s main marketing and new pet enrollment venue has been through vets’ offices with 54% of referrals, followed by existing clients adding a pet or referring friends at 24%.

Management’s efforts into various methods to increase same-store-sales but had not been very successful – until the end of 2016. According to their most recent shareholder letter they mention a “small but encouraging pilot” they ran in the latter part of last year. While they won’t give out any further details, they describe it as “having a road map” to where they want to go, even if it will take some time to get there, perhaps several years.

Aside from same-store targeting, they are also planning to expand direct-to-consumer marketing more than they did in 2016 with more testing to happen this year in cost-effective use of television and radio marketing.

Management’s Goals

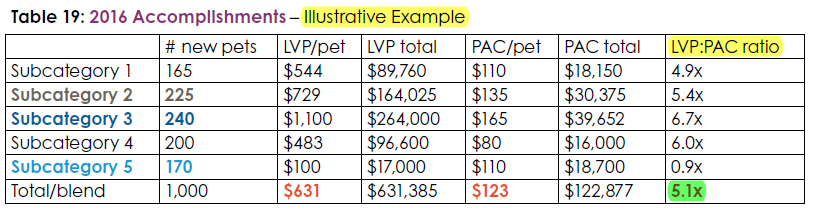

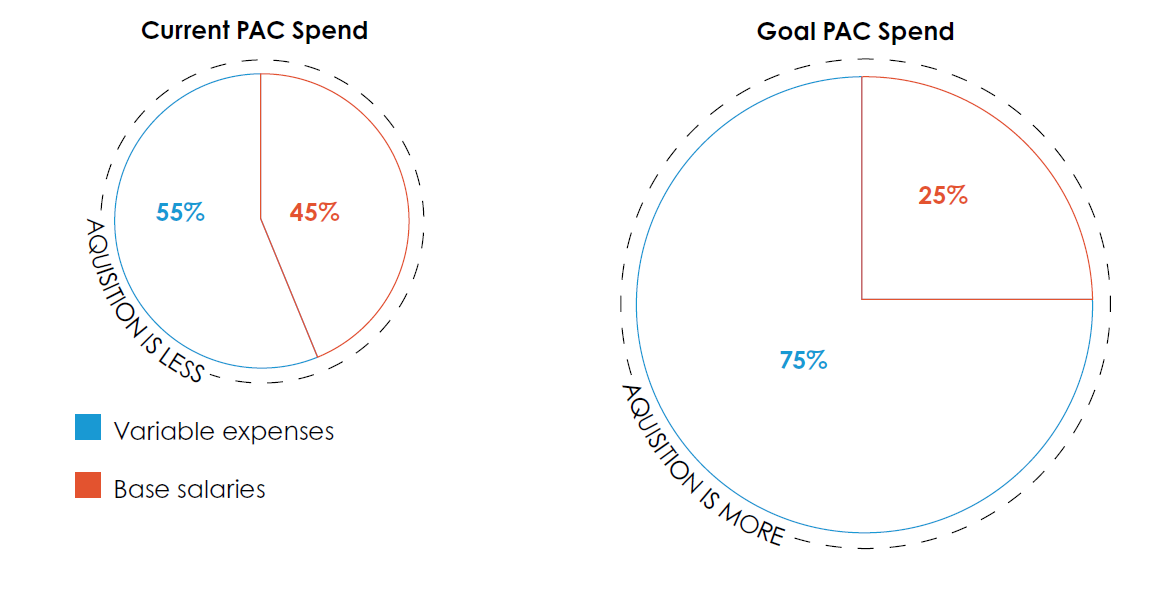

The company’s goal over the past few years has been to maximize their Lifetime Value of a Pet (LVP to Pet Acquisition Cost (PAC) ratio to 5.0x or better. They have been trying to balance the mix to shift towards higher lifetime-value policy subcategories that bring in higher revenue per pet over the course of their lifetime.

For example, in 2016 Trupanion attempted to stop enrolling the least profitable category of pets (generally older and smaller animals classified as Category 5) as they brought in the lowest LVP:PAC ratio at 0.8x (2015). Efforts were redirected towards Category 2 & 3 pets which have much higher LVP:PAC ratios. However, at the end of 2016 the low Category 5 still had new enrollments although the overall percentage as part of the total policies declined from 20% to 17%. More importantly though they did achieve an overall LVP:PAC ratio improvement over 2015, increasing from 4.5x to 5.1x.

The bottom line is to increase PAC spending in the higher lifetime-revenue categories to maximize their internal rate of return.

PAC Spend

A shift to higher-value policies will in turn result in fewer enrollment numbers required to achieve revenues that are necessary to cover Base Salaries and Variable Expenses. With increased available spending capital, the ability to access more cost-effective leads and convert them to policy holders becomes possible. As well, alternate channels of marketing and promotion become easier to fund, with less reliance on word-of-mouth or veterinary referrals as is the present situation. According to the CEO, this may take some time but he feels “confident (they) are making progress in the right area”.

Analyst Coverage

There is very little coverage on Trupanion. RBC Capital has been a long-time proponent with an Outperform rating and a $19 price target.

On May 26th, Northland Securities initiated coverage with also an Outperform rating and a $22.75 target.

Other firms that cover Trupanion are Canaccord, Stifel, Lake Street Capital, Barclays and Cowen, however none of their analysts have given updates since August 2016.

Options and Shorts

Although there are plenty of strikes and expiries available, options activity is extremely sparse and bid/ask spreads tend o be fairly wide.

Short Float is at 16.6 to 20.5%, depending on the source. With a daily average volume of 131,000, it would take 30 days to cover the 4.1 million short float.

Final Observations

Trupanion will be participating at two upcoming investor conferences:

- Stifel 2017 Dental and Veterinary Conference on May 31st in New York, NY

- Cowen and Company 2017 TMT Conference on May 31st and June 1st, also in New York, NY

Shortly after these conferences, the company will host their annual Shareholder Meeting in Seattle WA on June 7th.

Trupanion is gaining new customers at a steady pace – just as importantly, their rate of retention is very high at 98.58%, showing a very strong and loyal member base. Revenue is steady and increasing every year. The company has adequate cash, very little debt and no immediate plans or need for a secondary offering – aside from any opportunistic acquisitions, which the company is always looking for to add to their growth.

With a product that stands out from its peers in making claims as easy as possible, 24-hour call center, variable deductible and many other configurable options designed to enhance customer experience, Trupanion could very well see improved market share as time goes by and could reward the patient investor with interesting returns.