Unlock: Alcoa (AA) – Call Options Tripled With Rising Aluminum Prices

It pays to do fundamental research. Started out with Jag’s fresh new bullish view on November 23 based on improving aluminum pricing. Then Morgan Stanley followed with big upgrade on December 14, then call option activity picked up on December 28, then government filed complain with WTO on January 12. Now stock is breaking out big time and February 32 call options have tripled in value. Below are all notes shared with clients. To learn more about our approach and how you can become a successful trader, sign up for 2 week trial and test drive live chat room with some of the best traders: SUBSCRIBE

November 23, 2016

Alcoa (AA) – No unusual option activity to see yet but keep an eye on this stock Jags! I expect this to breakout and make a run towards $35+ over time. The reflation trade has resulted in major breakouts in coal, steel, copper and iron ore producers. For some reason AA has been left behind but likely not for too long.

Aluminum Price Increasing – China’s aluminium price has increased rapidly by +11.2% for spot and risen by +13.4% for SHFE future. These are monster moves in very short amount of time, which probably explains why Elliott Management bought 4.4% stake in company in Q3. This is all largely driven by China restocking of basic commodities.

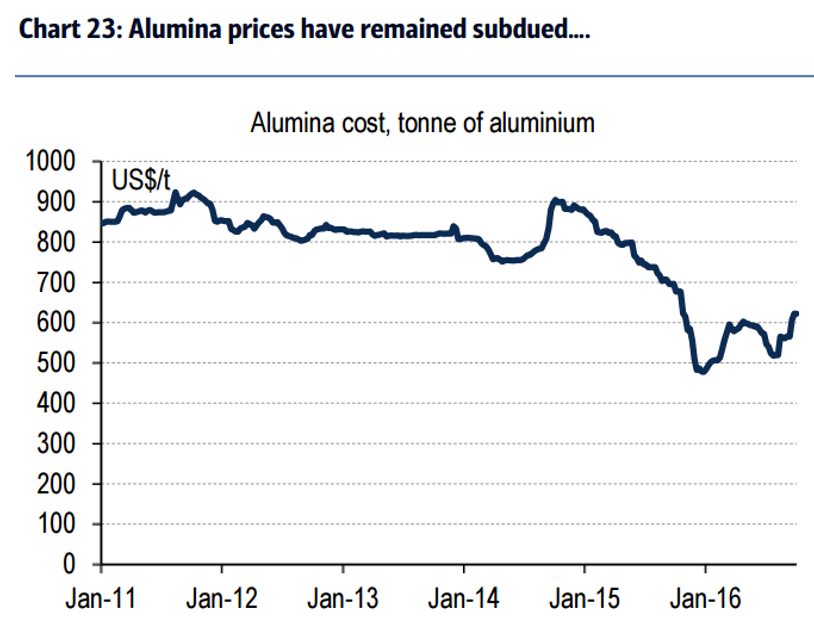

China Swing Factor – Some background here: Back in August 2015 China decided to cut back its aluminum production sharply by as much as -18% even as global aluminum demand remained pretty strong at +2.8% YoY. That production still hasn’t come online yet. While there are concerns it may return by the end of 2017, that’s way out in the future and a big IF. For now, tight supply and healthy demand is keeping a bid aluminum prices. To reaffirm that view, an announcement from June 2016 is worth remembering, when 6 Chinese aluminium producers (Chinalco, SPIC, China Hongqiao Group, JISCO, Yunnan Aluminium and Jinjiang Group) confirmed their commitment to supply-side reforms, keeping the Chinese domestic market stable and cut output if the SHFE price falls to RMB11,500/t. Below is Alumina cost chart, rising rapidly with new leg higher since October.

(Update on December 14)

Morgan Stanley note: “Raising PT for AA by 37% on strong pricing leverage. Our commodity team has raised its next 3 year average price for aluminum by 7% to $0.83/lb and alumina by 11% to $308/t. Every $0.01/lb increase in aluminum adds ~$1.70 to the stock price at 6x EBITDA and every $10/t increase in alumina adds ~$1.25/shr. With higher pricing, we have lowered our upstream valuation multiples to a normalized level of 6.0-6.5x EBITDA.”

(Update on December 28)

Buyer of 10,000 February 32 calls for $1.20. Approx $1.2 million bullish bet looking for major technical breakout in chart with improving fundamental outlook driven by rising aluminum pricing.

(Update on January 12)

The Obama administration is expected to launch a complaint against Chinese aluminum subsidies with the World Trade Organization on Thursday. The complaint will likely add to rising trade tensions between the world’s two largest economies as President-elect Donald Trump prepares to take office next week with pledges to reduce U.S. trade deficits with China as a top priority. The complaint, to be filed by the U.S. Trade Representative’s office, is expected to cite “artificially cheap loans” from Chinese banks and artificially low-priced inputs for Chinese aluminum makers including electricity, coal and alumina – Reuters