Unlock: Altria Group (MO) Trade Idea

(This MO trade idea was issued two days ago on July 14 for $0.95. The call options were closed today for $1.73 or 82% gain)

Altria Group

Ticker: MO

Sector: Tobacco

Current Price: $51.38

Target: $55.00

Stop Loss: $48.60

Time Duration: 66 Days

Trade Idea: Buy MO September 52.5 Calls for $0.95 Debit or less.

Back on April 23 the company reported Q1 earnings that beat on EPS by a penny coming in at $0.63 vs. $0.62 estimate on revenues of $4.27B vs. $4.13B estimate. Re-affirmed FY2015 EPS guidance of $2.80 in line with expectations, which calculates to 9% YoY growth and spits out forward PE multiple of 18.3x, in line with peer group. It was solid quarter in all metrics and with dividend yield of 4.05% the stock remains very attractive to value buyers.

Drilling deeper into the earnings report, the part that gets us excited was volume growth. Smokeable tobacco volume grew +1.6% while the street was expecting 2.9% decline. Smokeless tobacco volume grew +2.7% compared to +1.8% street expectations. Even more importantly, on June 24 at the Analyst Day, management spent a considerable amount of time talking about growth in next generation products, particularly vapor, as a key long term upside opportunity as MO continues to methodically roll out new products. This is key to MO long term growth and it does not get enough attention in our view.

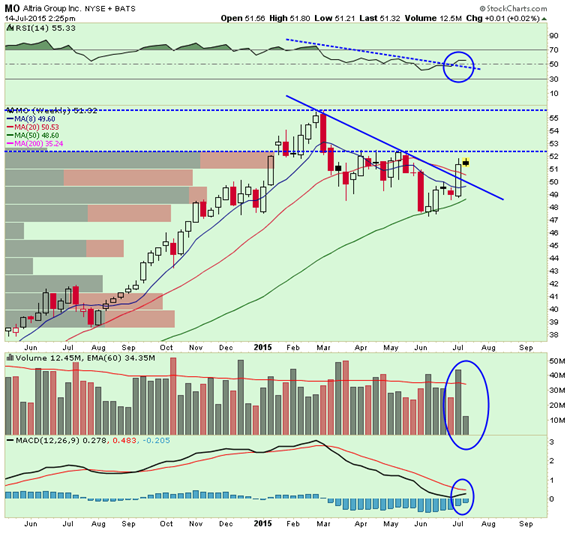

To show how important vapor is to MO growth prospects, notice in the chart below the sharp uptick in stock price on July 7 on high volume. That was when WSJ ran a story discussing that the FDA is soon expected to require federal approval for nicotine juices and e-cigarette devices, and companies would then basically have 30 months to get approval, which is expected to cut the supply of liquid nicotine to a degree that would be prohibitive for many small vape shops. Citing a consulting firm, the WSJ reports that the approval process might cost $2-10M per item, which isn’t a big deal to Big Tobacco, but may be more than some smaller companies can afford. The article says that a lobbying group expects 99% of vape shops to go out of business after the new rule is finalized.

Here is the link to full story: FDA Cloud Hangs Over Vape Shops

Technicals – After that WSJ story, the chart broke out sharply on high volume through downtrend resistance. MACD and RSI are now starting to show bull crosses and we believe the stock gradually grinds higher back towards previous 52-week high of $55 per share.

Unusual Option Activity – Buyers of 2,800 August 52.5 calls today paid up to $0.72, rolling out positions from July 50 and 50.5 calls.