Unlock: Crown Holdings (CCK) – Calls Closed for +96% Gain

It pays to do fundamental research. This trade was recommended on September 10, when we bought CCK January 45 Calls for $2.50. On September 20, they were sold for $4.90, (+96% gain)! To learn more about our approach and how you can become a successful trader, sign up for a 4-week trial and test drive the JaguarLive chat room: SUBSCRIBE

Trade – Sell to close CCK January 45 Calls for $4.90 credit or higher.

We bought these calls for $2.50 last week on September 10 (see below). Stock has gone straight up since with big breakout in our hands. I am taking full profits of +96% here and stepping aside. Giddy up!

Crown Holdings

Ticker: CCK

Sector: Packaging Containers

Current Price: $44.17

Target: $50.00

Stop Loss: $41.00

Time Duration: 130 days

Trade Idea – Buy CCK January 45 Calls for $2.50 or less.

The bid/ask spread currently is 2.40 x 2.50 and moments ago large bull stepped in with 5,560 January 45/50 call spread bought for $1.70. Approx $945,000 bullish bet on 14x daily average call volume. I am going with straight calls for $2.50 or less.

The bull case for CCK was presented few weeks ago by Jay in Weekend Research on August 19. See HERE. With background already in place, this note will focus on specific channel checks and pricing trends in packaging business that have recently appeared which is likely the reason why we saw large bull step in leap call options.

Latest channel checks show total July flexible packaging shipments (the aggregate of food and non-food volumes) increased mid single-digit percentages YoY in July, compared to low single-digit percentage decline in shipments a year ago. Separately, based on industry sources BAML research points out for plastic closure volumes were down mid-single-digit percentages YoY in July versus a double-digit increase in July 2017. These checks corroborate with Random Length (RL) which shows after precipitous decline in Framing Lumber prices since May, prices have started to pick up again with noticeable increases being noticed across all packaging companies.

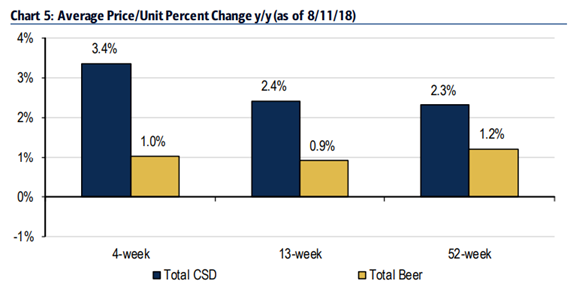

Beer Volumes and Pricing Improvement – Based on the most recently released retail scanner data (as of 8/11/18) from Nielsen, beer volumes rose 0.5% for the most recent 4-week period within the c-store and AOC (all outlets combined) channels. That’s an improvement from decline of -0.3% in past 13 weeks. Most importantly, CSD pricing was up +3.4% for the recent 4-week period. See chart below. Nice steady sequential improvement.

Fahad