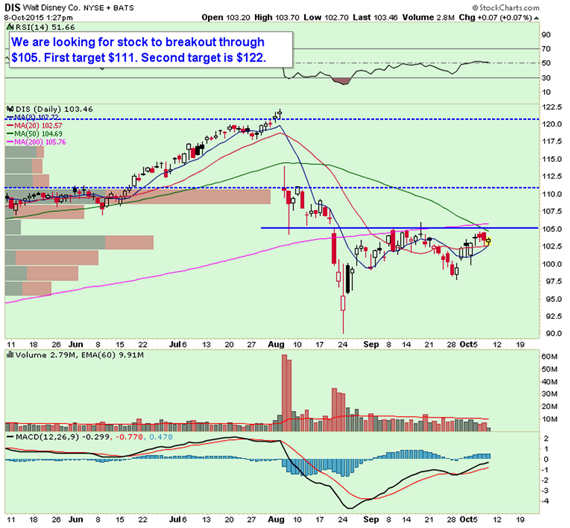

Unlock: Disney (DIS) Trade Idea

(This DIS Trade Idea was issued on October 8 for $4.35. The Jan’16 $105 Calls were closed today for $7.50 or +72% gain)

Disney

Ticker: DIS

Sector: Media, Entertainment, Theme Parks

Current Price: $103.46

Target: $111.00

Stop Loss: $98.00

Time Duration: 99 Days

Trade Idea: Buy Jan’16 $105 Call for $4.35 or less.

We expect Disney shares to outperform near-term based on a strong Studio, accelerating Parks (including the upcoming opening of Disney Shanghai and ongoing benefit from Disneyland’s 60th Anniversary celebration), improving capital returns (including increased share repurchases), an improving advertising environment and strong Consumer Products.

Catalyst 1: Upcoming film releases including Star Wars and The Good Dinosaur. DIS is the only studio with a branded film strategy. Marvel/Pixar/Disney film releases have been performing well. The highly anticipated revival of the LucasFilm label with the next Star Wars trilogy begins on December 18th (FY16) with the release of Star Wars: The Force Awakens. In addition, Disney’s Pixar will release its second Pixar movie of the year, The Good Dinosaur, on November 25th. Disney also has a solid home entertainment slate with the release of Avengers: Age of Ultron, the results of which will be shown in Disney’s FY15, and the upcoming release of Inside Out.

Catalyst 2: Star Wars bolsters Consumer Products and Interactive. Disney began its Star Wars Interactive and Consumer Product momentum during back to school season with the August 30th release of Infinity 3.0 and a successful Consumer Product launch event, Force Friday, on September 4th. Consumer Product momentum will likely accelerate ahead of the release of Star Wars: The Force Awakens.