Unlock: Freeport McMoran (FCX) Trade

(The trade idea below was issued on June 22. The September 19 puts were closed today for $1.88 or 71% gain)

Freeport McMoRan

Ticker: FCX

Sector: Basic Materials

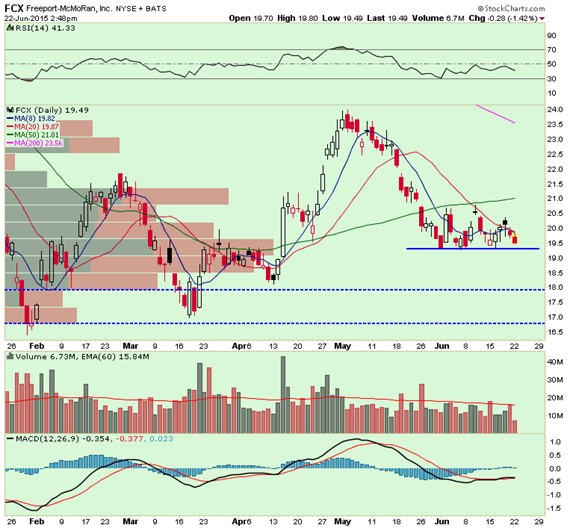

Current Price: $19.50

Target: $18.00

Stop Loss: $20.75

Time Duration: 88 Days

Trade Idea: Buy FCX September 19 Puts for $1.10 or less.

FCX has three businesses: Copper, Gold and Oil extraction. So far in Q2, Copper is down 6.2%, Gold is flat and Oil is up 26.9%. Copper is by far the biggest component of the total business and it is acting extremely weak. The real issue for FCX is to raise capital substantially in 2015 and part of 2016 to stem declining Free Cash Flow which is resulting in a sharp cash burn in each quarter. The management is talking about liquidating certain under performing assets in the energy space to raise cash and return back to core, which is copper. That does not address the main issue of declining copper prices though.

A lot of problems that FCX faces are over the next 6-9 months. Large equity dilution is necessary to bring the debt on the balance sheet back into reasonable level. Currently there is over $18 billion in long term debt while EBITDA is negative with declining commodity prices.

The chart is setting up for a technical breakdown. A large buyer of 5,000 November 19 puts paid $1.59 today, over $795,000 bearish bet. Separately, large bears are holding firmly in 42,000 Jan ’16 20 puts accumulated over last few months. In the short term we are looking for a breakdown and move towards $18. We will use $20.75 as stop loss.