Unlock: Gilead Sciences (GILD) Trade Idea

(This trade was issued on June 11. The call butterfly spread was closed Today for $1.75 or 40% gain)

Gilead Sciences

Ticker: GILD

Sector: Pharmaceuticals

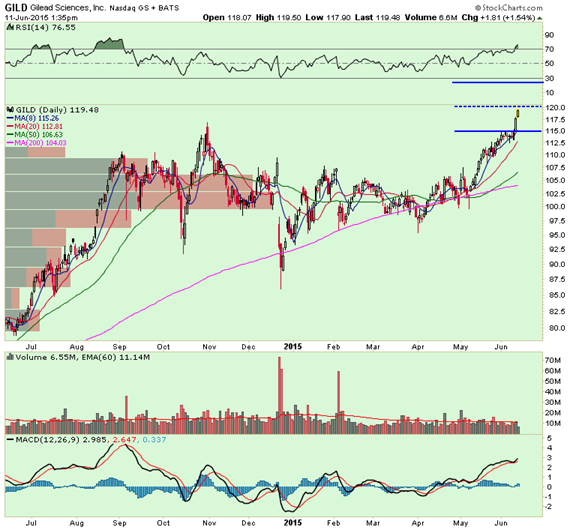

Current Price: $119.48

Target: $115 to $125 Range

Stop Loss: Below $115 and Above $125

Time Duration: 36 Days

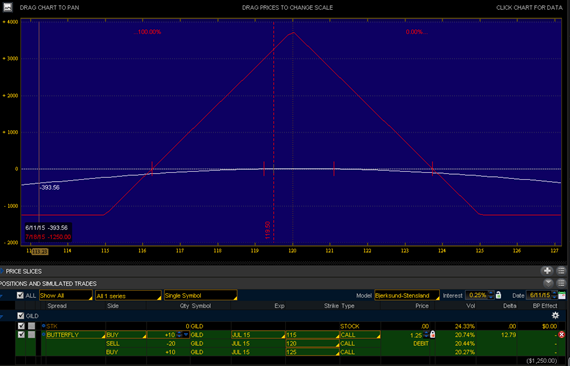

Trade Idea: Buy July 115-120-125 Call Butterfly Spread for $1.25 debit or less.

GILD has been ripping higher since announcing earnings in late April. The stock is up 18% in one month. It is one of the large cap stocks we have liked for a long time due to extremely low valuation, higher Free Cash Flow yield and visibility into the Hep-C franchise. We believe the reason for the rally was due to a large share buyback program announced with earnings along with management commentary about acquisitions up to $5 billion, which put some fears to rest stemming from expectations that Hep-C growth will stall over next 12 months.

The trade above is a Neutral bet after this powerful rally in the last month. The quiet period for share buyback activity starts after June and buybacks may not resume until the next earnings are out in late July. That creates a gap for a month, and without clear M&A related news, we believe there is a good chance the stock will stall here near $120. Additionally we expect the implied volatility to remain low as it is currently near 21% and the structure above will profit from gradual time decay.

We are looking for the butterfly spread to expand to $2.00+ in coming weeks. Solid horizontal lines in chart below show our break even points up and down with stop loss and maximum profit of as much as 300% will arrive if the stock is exactly at $120 on July expiration.