Unlock: Hain Celestial (HAIN) Trade Idea

(This HAIN Trade Idea was issued on December 15 for $2.35. Trade was closed today for $4.00 or +70% gain.)

Hain Celestial

Ticker: HAIN

Sector: Food Processing

Current Price: $38.95

Target: $45.00

Stop Loss: $36.50

Time Duration: 66 Days

Trade Idea – Buy HAIN February 40 calls for $2.35 or less.

This is a contrarian bullish bet and we are looking for stock to bottom soon. Stock has been decimated in steady decline from high of $70.65 just four months ago to under $40 today. But last week large buyer of 6,000 May 40 calls paid up to $4.00. More than $2.4 million bullish bet that now remains in open interest.

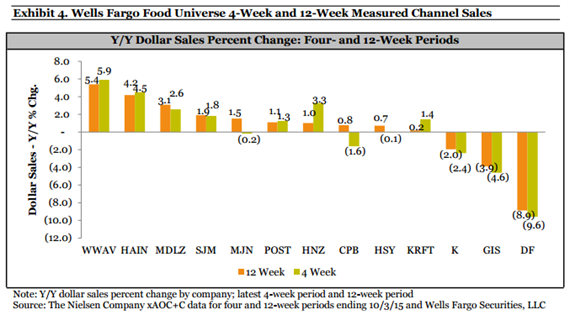

Assessing last earnings report, we view HAIN’s results as mixed. Solid expense controls and strength in HPPC more than offset weakness in the US segment. Management commentary suggests a few factors including temporary disruptions from certain customers and below plan performance in the natural channel contributed to the top-line shortfall. A stronger recovery for the remaining quarters is now necessary to achieve FY16 sales targets which has been primary driver of significant stock underperformance. With shares down more than 30% from recent highs, we see limited downside from here. Shares are likely range-bound in the mid to high-$40s range for now as investors wait for clear signs of a recovery in HAIN’s US business.

HAIN remains a leader in organic food growth category. There are increasing signs of concerns around competition leading to some margin erosion, but it remains the best in category which could easily lead to M&A with larger players looking to make an entry.