Unlock: Lantheus Holdings (LNTH) – Partnership With GE Pays Off Handsomely

It pays to do fundamental research. This bullish view was presented to clients on November 13. Stock is up +30% today after posting strong earnings. To learn more about our approach and how you can become a successful trader, sign up for 2 week trial and test drive live chat room with some of the best traders: SUBSCRIBE

November 13, 2016

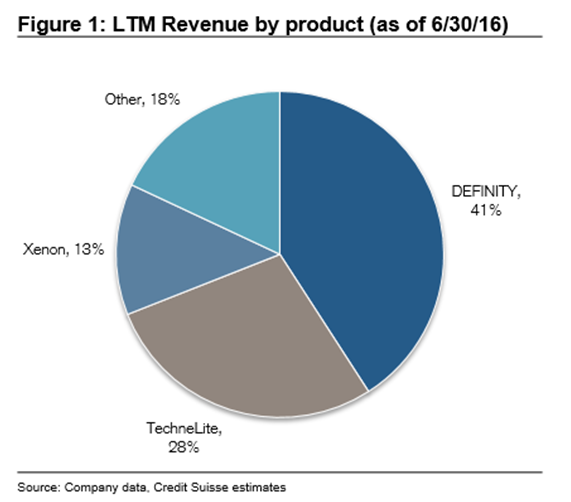

Lantheus Holdings (LNTH) – Lantheus Holdings is a medical appliance company that develops, manufactures, and commercializes diagnostic imaging agents and products that help healthcare professionals identify disease and improve treatment and care. Their products are used to diagnose coronary artery disease, congestive heart failure, stroke, and other diseases. The company has 9 products across numerous imaging modalities, but here is a breakdown of their primary products:

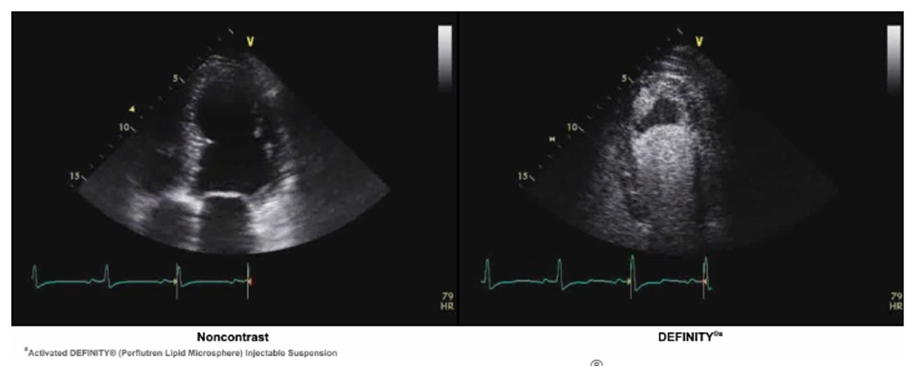

In this note, we’ll take a look at Its lead product DEFINITY. This product is an injectable ultrasound contrast imaging agency used in echocardiography to improve the interpretability of images. To be more specific, it is comprised of lipid-coated echogenic microbubbles filled with octafluoroproane gas that enhances clinicians’ views of the left ventricle of the heart during an echocardiogram to aid with diagnosis.

In a third party study, DEFINITY significantly increased the percentage of adequate studies compared with no contrast imaging agents, from a dismal 1.6% to 89.9%, with virtual no uninterpretable studies. Lantheus currently competes with GE Healthcare and Bracco within this segment.

The global contrast agents market is currently worth an estimated $4 billion, growing at a 5% CAGR to $5 billion by 2020. In 2015, North America comprised the largest portion of the market, followed by Europe and Asia Pacific. However, Asia Pacific is expected to grow at the fastest rate over the next five years. Within the contrast agents market, relevant to its core DEFINITY product, is the ultrasound contrast agents market, which is worth an estimated $175 million globally (2015), growing at a 30% CAGR to $650 million by 2020. This market is dominated by DEFINITY, with only two other FDA-approved products: Optison (GE Healthcare), and Lumason (Bracco). There are currently an estimated 31 million echocardiograms performed annually in the U.S. (currently the largest echocardiogram market), 20% (6 million) of which are suboptimal, which could be better addressed with contrast agents.

As shown Figure 1 on the previous page, DEFINITY currently comprises 41% of toal sales, growing double digits, and it is LNTH’s fastest growing, highest margin product. In the US, sales will continue to be driven through its direct sales force of ~80 salespeople, the largest in the echocardiography industry. It is focused on increasing sales internationally as well, including reentering key European markets, China (via its partnership with DoubleCrane), and other Asia Pacific countries. In the most recent quarter, LNTH continued to gain share in the ultrasound contrast agent market, despite Bracco’s (Lumason) continued presence in the market, with overall share stability attributable in part to increased promotional activity. Its next generation program for DEFINITY is active with potential new formulations and indications that could help drive increased sales and potentially extend patent protection and prevent generics from entering the market. Analysts do not expect any revenue contribution from the next-gen products this year, but look forward to timing updates as the program progresses.

Some risks that investors should consider with LNTH:

- DEFINITY sales begin to slow or it begins to lose significant market share to competitors.

- Lantheus has distribution agreements with major radiopharmacy customers pursuant to multu-year contracts and purchase volume commitments. Early termination or non-renewal of supply agreements could negatively affect sales growth and operating performance.

- Looking at the company’s short interest, it has jumped from 69,009 shares on 8/15 to 1,233,437 as of 10/31.

As we look at the chart on the next page, we can see that the stock is on the verge of breaking out above a key resistance level.