Unlock: Priceline (PCLN) View from Strong Channel Checks Played Out as Expected

It pays to do fundamental research. Here is bullish view we presented to clients today before earnings. Stock is guided higher by +5% after hours. To learn more about our approach and how you can become a successful trader, sign up for 2 week trial and test drive live chat room with some of the best traders: SUBSCRIBE

Priceline (PCLN) – Got a buyer of 400+ November 1530/1590 call spread for ~$13.20 with stock currently at $1480. Approx $528,000 bullish bet ahead of earnings tonight after the close. Overall approx $1.5 million call premium bought and $494,000 put premiums sold so far today. Generally pretty bullish bias. First note in each of last 3 years, Priceline has beat Q3 street estimates by an average of 9%. Will they do it again? Here is two sides of story:

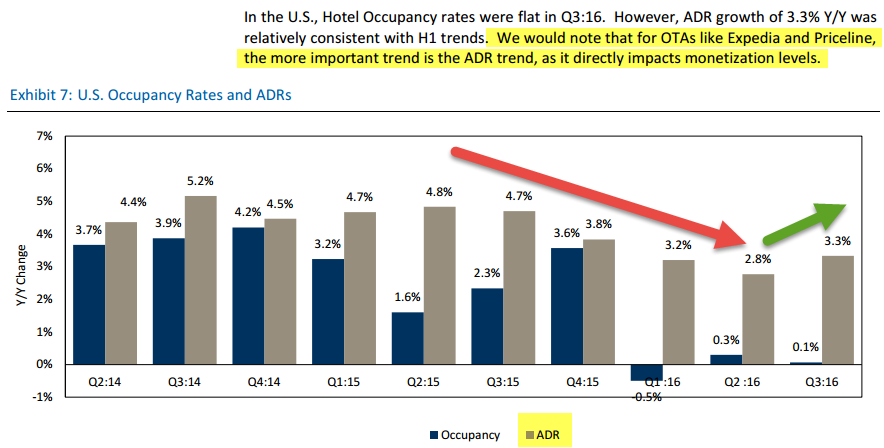

Q3 Channel Checks Strong – In Q2 mobile and desktop total minutes increased by +23% YoY. For Q3 Nielsen channel checks show an increase of +36% YoY. One has to assume more minutes spent on Priceline platform (desktop and mobile combined) means more sales. Additionally note Comscore data shows number of Unique Users in Q2 were up +10% YoY and it accelerated to +12% in Q3. Lastly, Smith Travel Research shows while hotel occupancy went down slightly but the loss was more than made up by increase in Average Daily Rate (ADR) which showed rebound first time after 5 straight quarters of deceleration. That is very positive for Priceline. See chart below.

Q3 Read Through Mix – Accor posted RevPar of +1.1% vs. +1.6% in Q2, decelerated. Intercontinental posted RevPar of +1.3% vs. +2.5% in Q2, decelerated. Hilton posted RevPar of +1.3% vs. +2.9% in Q2, decelerated. Pebblebrook Posted RevPar of -0.1% vs. +0.5% in Q2, decelerated. On the bright side, Extended Stay posted very strong RevPar of +3.7% vs. +2.4% in Q2, sharply accelerated. Choice Hotels posted RevPar of +4.5% vs. +3.7% in Q2, accelerated and raised guidance. We haven’t heard from Marriott yet which reports tonight as well.

Bottom Line –

I give it A+ on Strong Channel Checks

I give it A on Mix Read Throughs

Overall expecting pretty good quarter from Priceline.