Unlock: Raytheon (RTN) Trade Idea

(This RTN Trade Idea was issued on September 28 for $2.50. The Jan’16 110/120 Call Spread was closed today for $4.50 or +80% gain)

Raytheon

Ticker: RTN

Sector: Aerospace & Defense

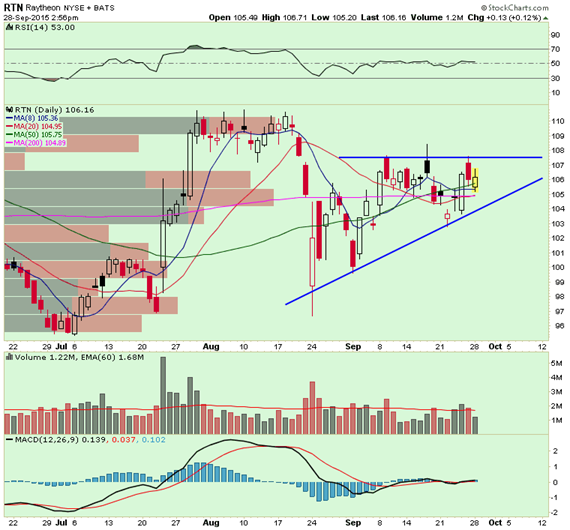

Current Price: $106.16

Target: $110.00+

Stop Loss: $100.00

Time Duration: 109 Days

Trade Idea: Buy RTN Jan’16 110/120 Call Spread for $2.50 or less.

Ugly day in the market with 488 issues in S&P 500 index in red. Only 12 in green. Within those 12 that are green, one of them is Raytheon, the maker of Tomahawk missiles and other defense projects. Interestingly, not only the stock is completely avoiding today’s sell off without any specific news, it has been holding up well for several days. That gets our attention.

Next earnings report will be on October 22 before market opens. Some background ahead of that collected from various analyst notes:

On Sep. 1, Raytheon hosted a dinner with investors and senior leadership of the company in which management discussed new program wins, international sales and capital deployment. The company did highlight that 44% of its backlog is now from international customers and international markets remain strong. In addition, the new programs wins such as Family of Beyond Line-of-Sight Terminals (FAB-T) and Next Generation Jammer are progressing well. Management is preparing to start FY2016 with a continuing resolution (CR), but all of the newer programs were started in FY2015 and so would not be considered new starts impacted by a CR. Lastly, management remains pleased with the Websense

acquisition.

US sales are improving. In Q2 RTN’s US government sales were flattish y/y–an improvement from the 3-5% annual declines we have seen since 2011. We believe these comparisons have an upward bias going forward (2016E: +2% total sales, ex-Websense). Recall the company has won a number of meaningful competitions over the past year–notably, Next-Generation Jammer and Air/Missile Defense Radar–that suggest its DoD sales should grow at least as fast the overall budget.

Non-US sales now account for 30% of revenue (2009: 21%), and have outpaced US sales growth for nearly a decade. International bookings should account for 32-35% of 2015 orders. Management said international represents 44% of the backlog.

Regarding Websense, excluding certain acquisition/restructuring-related costs, Websense already would be generating a 17-18% margin (total company 2015E: 13%). The high-single-digit growth expected for 2016 remains intact.

The company remains on track to buyback about $1B worth of stock in 2016. While RTN is focused on a balanced capital deployment strategy, we believe the stock market weakness could lead to a higher than average Q3 buyback.

Lastly, Raytheon management highlighted several key technologies that should lead to further growth in the future including international cyber, solid state high energy lasers, and hypersonics. We think this development spending is what has led to market share gains on programs such as Next-Generation Jammer and Air/Missile Defense Radar (AMDR), FAB-T and Three Dimensional Expeditionary Long-Range Radar (3DELRR).

Putting this whole picture together, we feel very confident about company reaching $7 EPS next year which would imply YoY growth of 5.8%. Stock is in line with historic valuation at 15.2x PE multiple and there is room for PE expansion with new drivers of growth.