Unlock: Red Hat (RHT) – Mid Quarter Checks on OpenShift and OpenStack

It pays to do fundamental research. Picked up calls when market sold off in mid May after noticing strong mid quarter checks of OpenShift and OpenStack, setting the bar for clean earnings beat. Paid off well today with +150% gain. To learn more about our approach and how you can become a successful trader, sign up for 4 week trial and test drive live chat room with some of the best traders: SUBSCRIBE

Notes sent to clients on May 15

Red Hat

Ticker: RHT

Sector: Software

Current Price: $88.73

Target: $100.00

Stop Loss: $82.50

Time Duration: 123 days

Trade Idea – Buy RHT September 92.5 Calls for $3.60 or less.

The bid/ask spread currently is 3.30 x 3.60 and volume at this strike is zero. Placing the alert on the offer.

RHT caught my attention on Friday when buyers of 3,000 September 90 calls paid up to $4.60 offer. Over $1.3 million call premium bought on 1.5x daily average call volume, now reflected in open interest. This morning these bulls are back again with 1,100 September 90 calls bought for up to $4.60. That’s another nearly half million bullish bet.

Chart may seem it has run too much in past few months but we have to look at it context of where it was in long term weekly scale and how the fundamental story is changing. I have been bullish on this starting with June 2016 when first detail bull case was presented followed by another one in December. See my notes in Activity Tracker.

Mid Quarter Update – Next earnings report is expected last week of June (after June expiration). On May 2 company held Analyst Day and hinted at possible revenue acceleration. Focused on the inflection point of customers using RHT not just as a cost reduction tool, but an increasing use of RHT’s broader portfolio in a strategic way as digital transformation is in full swing. Major Takeaways:

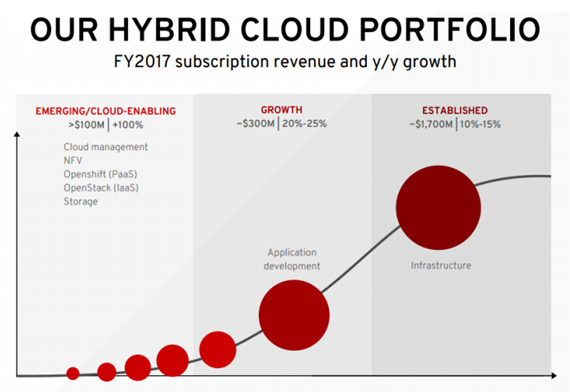

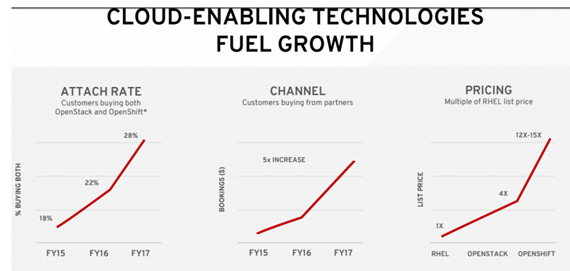

“Several metrics to back up this inflection. Number of customers spending $1mn+ has more than doubled over the last five years from 222 to 606 (five-year CAGR of $10mn+ customers 32%+, $5-$10mn 21%+, $1-$5mn 17%+), attach rate of customers buying both OpenStack and OpenShift has increased from 18% in FY15 to 28% in FY17, with OpenShift paying customers at 300+ and OpenStack at 375 (both 3x higher than in FY15), 96% of top 100 customers use 3+ RHT technologies and 93% of top 1,000 use 2+ RHT technologies. OpenStack and OpenShift carry 4x and 12-15x higher list price than RHEL, resulting in higher wallet share. Within the $440mn subscription revenue business, middleware is $300mn,+ growing 20-25% and emerging/cloud-enabling (OpenShift, OpenStack, Storage, cloud management, NFV) are at $100mn+, growing 100%+. RHEL is growing 10-15% per year, catalyzed by traction of OpenShift and OpenStack.”

However, despite this extremely bullish view presented by management on May 2 at Analyst Day, analysts like BAML remain on sidelines with Neutral rating which tells me there remains a disbelief in the market, hence the case for further upside in stock.

The key takeaway from that Analyst Day was Red Hat Enterprise Linux (RHEL) is the platform that is driving the move to the hybrid cloud and container adoption, a vision shared by AWS, Azure and Google public cloud that puts Red Hat in a unique position as a standalone asset, but also potentially as an acquisition target. As a result, customers buying both OpenStack and OpenShift together is expected to accelerate from +22% to +28%. Customers buying from Partners is rising and more importantly all this growth is coming with share increases in RHEL list price.