Unlock: Vertex Pharma (VRTX) Trade Idea

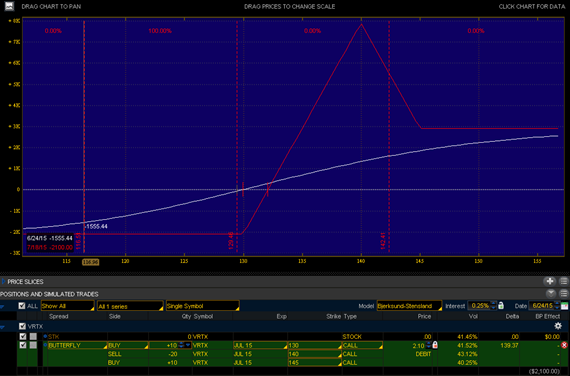

(This trade in VRTX was issued on June 24 for $2.10. The skip-strike call butterfly spread was closed today for $5.00 or 140% gain)

Vertex Pharma

Ticker: VRTX

Sector: Biotechnology

Current Price: $129.42

Target: $140.00

Stop Loss: $123.00

Time Duration: 23 Days

Trade Idea: Buy VRTX July 130/140/145 Skip Strike Call Butterfly Spread for $2.10 or less.

On 5/12 The FDA Pulmonary-Allergy Drugs Advisory Committee voted 12 to 1 in favor of approving Orkambi (lumacaftor and ivacaftor fixed dose combination) for the treatment of cystic fibrosis (CF) patients with homozygous F508del mutation with the only no vote from the consumer representative on the committee. Now the PDUFA is scheduled for July 5. Upon approval, we expect a strong launch based on positive MEDACorp key opinion leader feedback echoed by commentary from physicians and patients during the panel.

Although this particular catalyst may already be priced into the stock considering the 12-to-1 AdCom favorable vote has largely removed any surprises, we still believe the consensus is pricing the drug too low at $221,000. We think there is a good chance net price will be well above $230,000 and possibly as high as $275,000. The consensus is currently modeling $347M Orkambi sales in 2015 post approval, rising to $3.7B in 2018. We believe with higher drug pricing and better volumes, VRTX can reach as high as $485M sales in 2015, well above consensus estimates. As such, when we factor this into peak sales estimates, we believe VRTX can hit more than $9.00 in EPS three years out, which makes the stock currently near $130 pretty compelling.