Valvoline (VVV) – Retail Momentum

Valvoline (VVV) is a leading provider of automotive services and marketer and supplier of premium branded lubricants. The company currently operates through two segments: Global Products and Retail.

Within the Global Products segment, the company sells engine and automotive maintenance products globally for consumer and commercial vehicles. The segment sells motor oil to customers in the US and Canada performing their own auto maintenance (i.e. Do-It-Yourself or DIY). The DIY business represents about 50% of the core North America business. Valvoline sells to DIY consumers via 30,000 retail outlets not owned by Valvoline. The larger customers in the DIY market are big box retailers, such as Wal-Mart (WMT), and auto parts retailers, such as AutoZone (AZO), Advanced Auto Parts (AAP), O’Reilly Automotive (ORLY), and NAPA, which represent 90% of the company’s DIY sales.

Meanwhile, the Quick Lubes/Retail business services passenger cars and light truck vehicles through company-owned and independent franchised retail quick lube service center stores. The quick lube market is a Do-It-For-Me (DIFM) oil change market that has better growth characteristics than the DIY market. Increasingly, consumers prefer to have their oil changed and are less inclined to do it themselves.

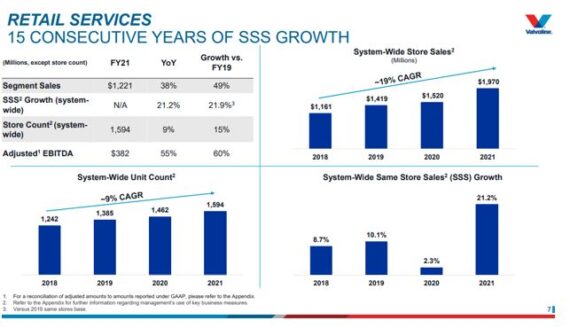

In early-November, Valvoline beat on both EPS ($0.50 vs $0.47 estimate) and Revenue ($835M vs $828.88M estimate) with both the Retail and Products segments exceeding analyst expectations. It would also provide FY22 guidance with revenue above the Street and adjusted EBITDA in line. Based on the earnings commentary, its clear that the standout was the Quick Lubes business as JPMorgan noted that a combination of store growth, higher prices, positive product mix effects stemming from growth in synthetic oil changes, and volume growth led to an excellent year in FY2021, despite sharp raw material cost inflation. Retail EBITDA came in at $382M in FY2021 compared to $212M in FY2020, and $214M in FY2019. “A combination of 7.5% growth in the Store base, an improved mix from higher synthetic sales, and volume growth, should lead to a strong year in 2022. We estimate volume growth of ~12%. We estimate Retail EBITDA of $451M in FY2022 or 18.0% EBITDA growth versus $382M in FY2021.”

Meanwhile, Truist analyst Stephanie Moore commented on how Retail segment sales increased 39% Y/Y with SSS up 21%. While labor pressures are a hot topic in this current environment and VVV is certainly not immune, they note that the pressure is coming more from needing adequate staffing levels vs. major step ups in wages. Specifically, given its high customer-service oriented model, VVV pre-pandemic was already paying well above minimum wage to attract top talents. Truist notes the guidance has factored in additional hourly wage rate increases and they would look that any loosening in the labor market as a positive.

“Overall, the Retail segment has posted 15 consecutive years of SSS growth, including a record 21% growth in FY21. We see no reason why the momentum shouldn’t continue as (1) its high-customer service oriented, stay-in-your-car model heavily resonates with consumers during a pandemic and after; (2) it benefits from the ongoing shift toward synthetics in which just over a third of its oil changes are synthetic, while roughly 70% of new cars would have a recommendation for a synthetic lubricant; and (3) it continues to emphasize quick, ancillary services beyond oil changes, increasing its average ticket.”

Business Separation – It should be noted that back in October, the company announced that it was planning to separate its two businesses into separate entities. Valvoline did not provide a time frame for the possible separation, but it would appear that analysts are looking for a separation in the March 31, 2022–June 30, 2022 time period.

JPMorgan analyst Jeffrey Zekauskas was out with a note saying, “Valvoline is intent on separating its Retail business from its Global Products operations: it is the form, conditions and timing of the separation that are outstanding questions. We think that there is a good sum-of-the-parts investment argument to be made for Valvoline with the catalyst for the investment being the separation. We value the Global operation at a 7x-9x EBITDA multiple and the Retail business at a 12x-15x multiple. We think the Retail operation would be valued closer to RPM or Scotts because of its comparable gross margin in the high 30s%, or closer to VVV’s auto after-market peers. These ranges provide a target share price range of $34-$45 with $39 at the midpoint.”

EV Market – Finally, CEO Sam Mitchell said on its last earnings call that they are exploring relationships with EV OEMs for both products and services including their joint intent to partner with a rival to service their future fleet of electric vehicles in the US. “Our nearly 1,600 locations, our customer-centric brand and leading operating model best positions Valvoline to expand service offerings and delivery in the future.”

Fast forward to December 2nd in which the company issued a press release indicating that they were in search of new Board members with “significant experience in the areas of electric vehicles, energy transition, and/or autonomous transportation.”