Vintage Wine Estates (VWE) – Waiting for the Vote

Back in late-February, a Home Page article (See HERE) was written about The Duckhorn Portfolio (NAPA), a California-based producer and seller of wines. Today, I will be focusing on another wine company, Vintage Wine Estates. Back on February 4th, the special purpose acquisition company Bespoke Capital Acquisition (BSPE) acquired Vintage Wine Estates. Once this deal closes, the stock ticker will change from BSPE to VWE.

Bespoke does have a scheduled shareholder meeting for this Friday, May 28th to approve that merger. Assuming shareholders vote in favor of the transaction, Bespoke’s merger with VWE is expected to close on or around June 7th, 2021. In addition, Vintage Wine plans to report its Q3 earnings on or prior to June 11th, 2021.

Who is Vintage Wine Estates? They are a wine producer, seller, and industry consolidator based in California that generated $190M in sales in the fiscal year ended June 30th, 2020. The company is led by CEO Pat Roney, who founded the company in 2007 through the combination of the Girard wine brand with the Windsor Vineyards direct-to-consumer brand. Vintage Wine is now the 15th largest wine producer in California, based on cases shipped. Vintage Wine has a portfolio of more than 50 brands, including B.R. Cohn, Cameron Hughes, Girard, Laetitia, Layer Cake, and Swanson. Looking at a sales breakdown, 80% of its wine bottles are sold in the $10-$20 premium segment and the other 20% are in the over $20 luxury segment.

According to Telsey Advisory Group analyst Joseph Feldman, an attractive characteristic of Vintage Wine is its diversified revenue stream. The largest percentage of revenues at 41% comes from the wholesale segment, through which the company sells to distributors that then sell to retail establishments. Then, the Direct-to-Consumer segment accounts for ~30% of sales, much higher than the industry average of 8%-9%, and consists of sales through its websites, 14 tasting rooms, 19 wine clubs, QVC, and telemarketing. Vintage Wine also has a large Business-to-Business (B2B) segment, representing 29% of sales, where it develops private label wines for large retailers such as Albertsons, Costco, Kroger, Target, and Total Wine & More.

Interestingly, Hedgeye analyst Daniel Biolsi pointed out in a recently note that at the company’s recent investor day, management laid out their plans to grow the company over the next five years as it is pivoting more to the U.S. with the Chinese market closed to Australian wine. China placed 200% tariffs on Australian wine last year in retaliation for disagreements with the Australian government. At the time 30% of Treasury Wine’s earnings came from China.

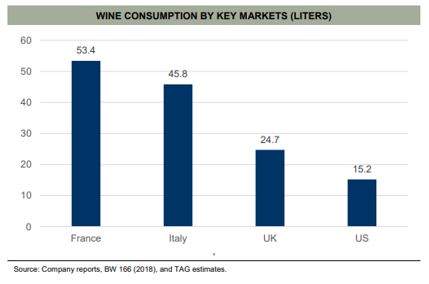

From an industry perspective, in the US, wine has an opportunity to benefit from a potential increase in per capita consumption. According to BW166 and company reports, US wine consumption has doubled since 1970, but remains well below several developed European countries (See Below). Specifically, US annual per capita wine consumption is 15.2 liters, compared to France at 53.4 liters, Italy at 45.8 liters, and the UK at 24.7 liters. The wide gap in wine consumption offers a multi-year growth opportunity for the industry, notes Telsey.

M&A

At the onset of this report, we referred to Vintage Wine as an industry consolidator. According to Telsey Advsory, the company’s M&A strategy targets family-owned brands from small wineries, non-core brands from larger competitors, and larger competitors. Of the 11,000 wineries in the US, the company estimates 2,000-3,000 are within its pool of targets. It reviews 40-60 transactions a year and sends four letters of intent on average a year, resulting in two to three acquisitions. Vintage Wine acquires the brands and inventory of a target business, eliminates redundant corporate overhead, and integrates the assets into its production and distribution networks.

The company has completed 20 acquisitions in the last 10 years, including 10 in the last five years. An example of a successful acquisition was Firesteed. Vintage Wine purchased the business in 2017 for $6MM, equivalent to the value of its inventory. Vintage Wine then scaled the DTC business, expanded wholesale distribution, and improved its supply chain. In FY21, Firesteed is projected to have sales of $8.2MM, with a gross margin of 52.3%.

Finally, the most recent acquisition was Kunde, a top winery in Sonoma, California. Vintage Wine agreed to pay $52M for projected sales of $18MM and EBITDA of $6MM in 2021, equating to an EV/EBITDA multiple of ~7.5x. Before the markets opened on Monday, May 24th, it was officially announced that Vintage Wine closed on this acquisition.