Weekend Update – Parsons (PSN)

Parsons (PSN), the government services company, was a featured write-up in our September 11th W/E Research. The following day in JaguarLive, it was recommended that clients simply buy common stock. Over a month has now passed and the stock is up close to 7%. Just this past Sunday, in our W/E Tracker, I updated the ranking on Parsons to A from B simply because of the technical picture as it was attempting to break out. This company will be reporting its Q3 earnings on November 2nd and wanted to pass along some recent positive developments related to this company.

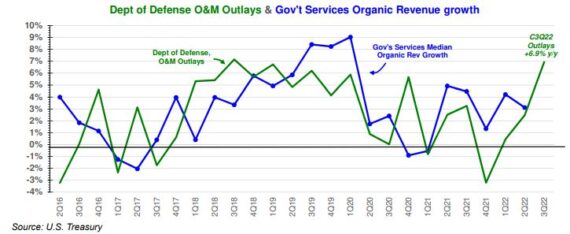

To begin with, we now have the Department of Defense outlay data for the month of September, which came in better than expected. In their monthly SITREP note, Stifel would highlight that “September outlays ramped month-over-month, outpacing our expectations and likely providing some momentum into FY23.” In the following chart below, it shows that TTM O&M outlays (where the majority of government services’ contracts are funded) came in at $291B, +1.8% Y/Y. This represents nearly 17% Y/Y growth in the month, which is a notable uptick. In addition, FedCiv outlays have a direct impact on the Government Services universe. Outlays among the 12 agencies was +6.9% Y/Y on an LTM basis (approximately 5 points better than DoD noted above) and approximately +18% Y/Y in September.

Next up, Stifel analyst Bert Subin would point out to investors that there is a positive correlation between DoD outlays and organic revenue growth within the government service companies. In the following chart, they highlight that Q3 DoD O&M outlays were +6.9% Y/Y, which is a significant Q/Q improvement and is what gives them greater confidence in better sector results this quarter.

As it relates to Parsons, Stifel believes the company saw improving core results Q/Q with it having the better setup given Middle East infrastructure exposure and limited FX exposure. Regarding the Middle East, two items were discussed in W/E Research that will continue to act as catalysts:

-On the last earnings call, Parsons highlighted two large CI awards in Saudi Arabia whose contract values have yet to be finalized.

-Management noted that projects in the Middle East, a region that represents nearly 16% of revenue, have accelerated due to the rise in oil prices and the focus on Saudi Arabia’s Vision 2030. Management highlighted key projects in the Middle East with significant funding that Parsons is working on/can pursue: 1) Neom, a city-building project in Saudi Arabia valued at $500B, and, 2) Qiddiya, an entertainment megaproject in Riyadh valued at $250B.

“As of late, 2022-2024 estimates for Parsons have been trending higher. The rest of the group has seen estimates trending down to flat. We believe Parsons will have a good opportunity to land near the high-end of FY22 guidance (Revs: $3.95-4.15B, adj-EBITDA: $330-360M) as infrastructure spending and the RDT&E account trend positively, so we remain confident Parsons can outpace the midpoint of guidance. Parsons’ exposure to cyber, missile defense, infrastructure in North America and the Middle East region, broadly, could help the company grow faster than peers with labor challenges now starting to fade.”