West Pharmaceutical Services (WST) – Addressing The Surge

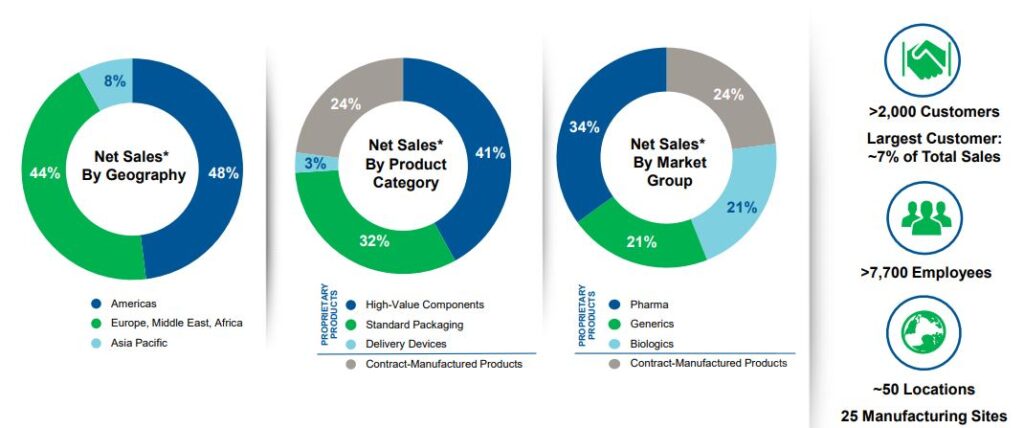

West Pharmaceutical Services (WST) is a leading global supplier of packaging components and delivery systems, such as rubber seals and stoppers, that are used in vials and syringes for injectable drugs, including COVID vaccines in development. According to BofA, the company has about a 70% market share in the injectable drug rubber packaging components space and its products have achieved close to a 100% participation rate in new biologic drugs and vaccines approved in recent years.

Back on July 23rd, the company reported a very impressive Q2 report which resulted in the stock rising by approximately 3%. Here was a more complete breakdown:

-EPS of $1.25 vs $0.91 estimate – Beat

-Revenue of $527.2M vs $496.09M estimate – Beat

-Net Sales increased 12.2%

-Raised FY EPS and Revenue Guidance

Within its Proprietary Products segment, net sales increased 10.9% with high-value products (HVP) generating double digit sales growth. More specifically, their Biologics market unit had double-digit organic sales growth, led by customer purchases of film-coated components (Flurotec and Daikyo), self-injection platforms, Westar and Crystal Zenith components. Their Generics market unit posted double-digit organic sales growth as well, and their Pharma market unit grew organic sales by low-single digits.

Turning to its Contract Manufactured Products, this segment increased 16.8% with performance being led by strong sales of healthcare-related injection and diagnostic devices.

Another key item, in my opinion, that management said on the earnings call was that the majority of their organic growth in the second quarter was from their base business, with some incremental growth coming from COVID-19 sales. This leads me to believe that any potential tailwinds in Q3/Q4 from COVID vaccines will only be icing on the cake in what is already a well-established business.

Now, regarding COVID, management did comment that it is preparing for potential volume surges that could come if an when vaccines are approved for human use. “All the work over the past few years across the enterprise to drive commercial and operational excellence, along with globalizing West’s manufacturing operations has put us in the best possible position to meet the future pandemic demand. We are accelerating our capacity expansion to manufacture FluroTec and NovaPure components. These investments were in our five-year plan, and we have brought them forward to address the expected increase in demand the latter part of this year and into 2021. From our perspective, it is still too early to estimate how much volume could be generated by vaccine packaging. However, whether it’s hundreds of millions or billions of doses, our West team is prepared and ready when the time comes.”

FluroTec & Crystal Zenith

When asked about the mix between its FluroTec and NovaPure products, CEO Eric Green highlighted that in the vaccine area, the company is seeing more interest from their FluroTec products as the primary technology. Now, there are certain situations where NovaPure is a better solution and customers have elected to go in that direction, but the majority is still in FluroTec.

In addition, when asked about CapEx expansion from William Blair analyst John Kreger, management highlighted that it decided to bring forward capital in regards to specifically equipment that will be placed strategically in three of our center of excellence sites of high-value products. “We had this equipment earmarked for latter years based on trajectory of our current business and our current portfolio, but due to our discussions with customers, we are preparing to make sure that we will be able to address this surge that we’ll see specifically around FluroTec stoppers in the marketplace.”

Another interesting topic BofA analyst Juan Avendano brought up was regarding a number of announcements on the glass vial supply side for COVID-19. BofA was expecting to have seen something on Crystal Zenith from WST. “And so my short question is, what can you tell us about Crystal Zenith, how it compares competitively versus some of the other solutions out there that have gotten government grants for the COVID response? And what sort of COVID opportunities are you seeing for Crystal Zenith?”

CEO Eric Green would respond by saying that when you think about the preferred solution in the market right now, it is still glass. “When you think about Crystal Zenith it’s already a proven technology in the marketplace with a number of critical drugs specifically around the Biologics. And the demand that we have for Crystal Zenith is increasing. In fact, we are in process of increasing capacity in our Scottsdale, Arizona facility to address the increase around insert needle technology. But I would say right now what it looks like is that the preferred solution on the immediate phase would be around glass.”