Yum China Holdings (YUMC) – Digital & Delivery Momentum

On November 1st, 2016, Yum China began trading on the NYSE after being spun off from Yum Brands, the parent company of Taco Bell, Kentucky Fried Chicken (KFC), and Pizza Hut. In an interview soon after, CEO of YUM Greg Creed would tell CNBC, “We think there’s unlimited growth potential in China. We are so far from being saturated it’s not even funny.”

Since being spun off, the company has reported two quarters of earnings. Here is a quick recap on how same store sales have performed:

Q416 – Same Stores Sales came in flat with KFC comps increasing by 1% and Pizza Hut declining by 3%

Q117 – Same Store Sales were up 1% with KFC comps increasing by 1% and Pizza Hut increasing by 2%

A day after its Q1 earnings, Oppenheimer analyst Brian Bittner said Yum China’s “solid” comps, sharp earnings performance and interesting cash positioning highlight his attraction at a discounted valuation. He reiterated an Outperform rating and raised his price target to $35 from $31 as he believes Yum China’s risk-reward remains unique.

In addition, on April 10th, Form 4 filings showed that Yum China CEO Muktesh Pant purchased 100,000 shares for $31.166 for a total value of 3,116,660. In addition, on April 13th, there was a buyer of 1,000+ July 32.5 Calls for 1.95, a $351,000 bullish bet that remains in open interest.

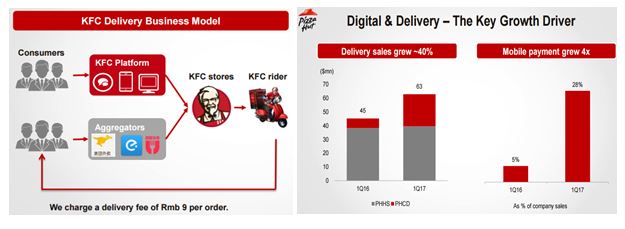

Looking ahead, the company believes digital and delivery trends will be a major driver for comp sales growth. Delivery as a percentage of online sales for the Chinese Quick Service Restaurant overall was 8% in 2015 and 11% in 2016. During this time, KFC’s digital sales moved from 7% to 10% and Pizza Hut moved from 14% to 18%. With YUMC targeting a 25% overall digital share of total sales, this channel should continue to drive same store sales growth.

Just yesterday, Yum China announced that it had entered into a definitive agreement to acquire a controlling interest in the holding company of DAOJIA.com.cn. Daojia, was founded in 2010 and is an established online food delivery service provider focusing on higher-end orders in large cities in China including Beijing, Shanghai, Guangzhou and Shenzhen.

In a press release, Yum China said, “This transaction marks another step in executing Yum China’s strategy to accelerate growth through digital and delivery by building know-how and expertise in this growing segment.”

Lastly, another avenue Yum China has been focused on is its promotional activity (examples shown below). According to a Deutsche Bank note from April 21st, they comment that marketing in China continues to remain “intense.”

For its KFC chains, most of the promotional events last only about two weeks. Apart from frequent product promotion/coupons to attract traffic, it launched campaigns that target specific age groups. The launch of “Back to 1987” in March was not just about having its original recipe fried chicken and mashed potatoes back to its prices 30 years ago, but also about consumers sharing their childhood memories with KFC. According to Deutsche Bank, it has gone viral in Wechat group.

In April, it focused on tapping the young age group by collaborating with NetEase(NTES) and its online game Yinyangshi. This campaign covered over 5000 stores, with thematic stores opened in 8 cities (Shanghai, Xiamen, Nanjing, Guangzhou, Hangzhou, Nanjing, Changsha and Chengdu). Players received special SSRs (virtual trading cards) if they played the game at KFC stores. This campaign went viral on social media with a 130M readership on Weibo (WB) during Ching Ming holiday.