Glaukos (GKOS) – iStent inject for Glaucoma

It pays to do fundamental research. This bullish view was first presented in the 3Q2018 Quarterly Outlook on July 1 with the stock at $40.65. The stock is now at $68.50 (+68.5% gain) and the call options recommended were closed for +300% gain! To learn more about our approach and how you can become a successful trader, sign up for a 4-week trial and test drive the JaguarLive chat room: SUBSCRIBE

August 29

Glaukos (GKOS) – BOOOOM! One of our Key Debates/Catalysts from the Q3 Outlook is higher by over 20% in the pre-market following news from Novartis (NVS) which said its Alcon unit has voluntarily withdrawn its CyPass Micro-Stent globally following a new analysis of data from the COMPASS-XT long-term safety study. “We believe that withdrawing the CyPass Micro-Stent from the market is in patients’ best interest and is the right thing to do,” remarked Stephen Lane, Alcon’s chief medical officer.

William Blair out with a note this morning saying that this is a clear positive for near-term numbers at Glaukos. “By our math, if iStent takes all of the CyPass market share while it is off the market, we believe this could add as much as $50M to 2019 revenues of around $155M in the United States alone.” William Blair is holding off formally updating their models until after their meeting with management first thing this morning (Pacific Time) as part of their West Coast Bust Tour.

July 1

Buy Glaukos (GKOS) stock for $40.65 or less.

Alternately, buy January 45 Calls for $4.50 or less.

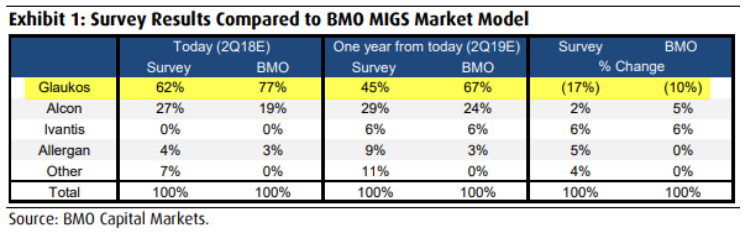

Glaucoma is a progressive disease of the eye that if left untreated, can eventually lead to blindness. Glaucoma is commonly associated with increased pressure in the eye due to an imbalance in production and outflow of ocular fluid. In a healthy eye, fluid is produced to help maintain the eye’s shape. If the fluid does not drain at the same rate that it is produced, pressure will begin to build in the eye. Over time, this increased pressure can damage the optic nerve and destroy vision. There are 4 medtech addressing Glaucoma disease by varying degree of treatments. GKOS is the leader with 45% market share (31% newly approved iStent Inject and 14% iStent gen-1). Alcon at 29% share, followed by Ivantis at 6% and Allergan at 4%.

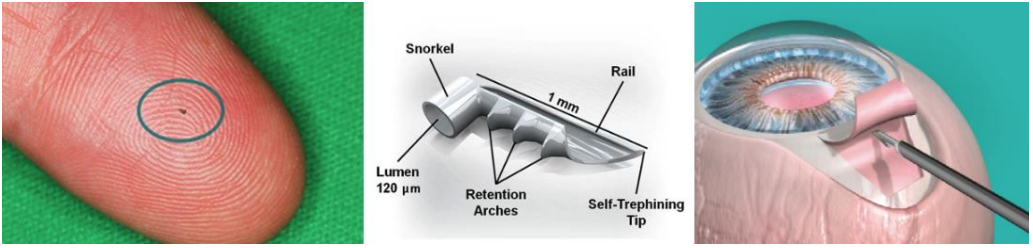

On June 25, GKOS announced FDA approval for the iStent inject Trabecular Micro-Bypass System which is shown in picture above. This approval was about 3 months earlier than expected despite the fact competitor Ivantis filed its PMA (pre-market approval application) with the FDA 2 months before GKOS and Ivantis published its clinical data 9 months before GKOS (GKOS clinical data was issued on April 14). The key reason why FDA prefers GKOS over competitor Ivantis is because several large lawsuits have piled onto Ivantis creating plenty of uncertainty. This brings me to discuss 3 critical points highlighting why GKOS stock move substantially higher from here:

• Expect Summer Launch – iStent inject approval (3 months earlier than expected) happened only a week ago on June 25. Analysts have not caught up yet. With approval, GKOS announced it would be launching product in Q3 after completing “check the box” administrative tasks with the FDA. Basically expect a launch sometime this summer. In last earnings report issued on May 9, company reiterated FY2018 revenue guidance of $162.5M pretty much in line with $163M street estimate. BAML was out with a note after iStent inject approval stating they expect GKOS to raise FY2018 guidance but analyst doesn’t want to increase estimates because docs surveys about the use of iStent inject aren’t concluded yet. All this tells me forward revenue estimates on the street are low and I expect company to beat and raise.

• Expect Market Share Gains – iStent Gen-1 has been selling for few years. The treatment is widely accepted among doctors, already approved in several countries, and the procedure is not significantly different than newly approved iStent inject. However, given 2 years of gap in product refreshes, GKOS in recent quarters lost market share (though still remains the leader). In fact, in February company’s FY2018 revenue guidance implies loss of 15 points of market share in 2018 and that guidance has not been changed since. Moreover, a survey done by BMO Capital on June 1 (before iStent inject early approval) indicated GKOS market share trending down over the course of next 4 quarters despite GKOS industry’s best efficacy. As shown in table below, notice how BMO Capital survey indicates GKOS market share dropping sharply from 62% in 2Q18 to 45% in 2Q19. I believe there is a disconnect in story here. First of all, the same survey points out that Micro-Invasive Glaucoma Surgery (MIGS), which is bread and butter for GKOS, to see number of physicians performing 16-20 procedures per week to dramatically rise from near 0% to 33% in next 12 months. Meaning, the acceptance rate to accelerate. That is bullish for GKOS. Secondly, it makes no sense to believe GKOS market share will come down after the FDA approved iStent inject 3 months earlier than expected while delaying approval of competitor’s product due to lawsuits. If anything, GKOS market share should go up after summer launch, not down. Another reason why I believe consensus is likely too low.

• Management Bonus Tied to Acheivinig Targets – Back in September 2017 company reduced revenue guidance. As a result you can see in chart stock suffered badly during last 6 months of 2017. Along with earnings release in February in which company issued FY2018 revenue guidance of $162.5 million, the Board of Directors took a bold step and modified all top management bonus structure to add “a financial acheivement mitigator” in which 100% of each executive’s FY2018 bonus payment is entirely dependent on achieving preset financial targets related to net sales and expenses (now that is a motivator for sure).

Bottom line – The sentiment around stocks remains low. Analysts are expecting market share losses, nobody is building upside from iStent inject early approval which is launching this summer, company hasn’t raised guidance since September last year, and valuation of 6.1x EV/Revenues is 2x to 4x below some of our other favorite medtechs that have commanding leadership position in their own respective markets (PEN, INGN, XENT, IRTC all four of Jaguar’s favorite medtechs trade at much higher multiple, NVRO is the only one of our favorite that trades at same EV/Revenue valuation as GKOS).