ICU Medical (ICUI) – Acquisition Audit

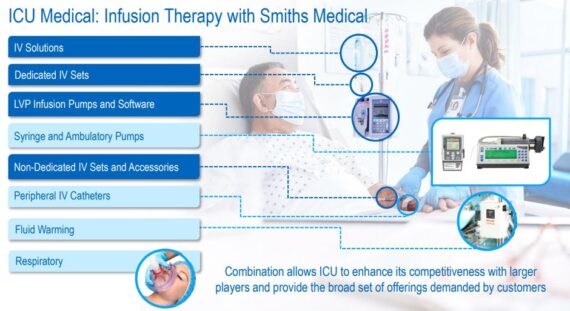

Back on September 8th, a press release was issued announcing that ICU Medical (ICUI) would acquire the Smiths Medical division from Smiths Group in a transaction that was superior to the existing proposed sale of Smiths Medical to Trulli Bidco Limited. The Smiths Medical business includes syringe and ambulatory infusion devices, vascular access, and vital care products. When combined with ICU Medical’s existing businesses, the combined companies will be a leading infusion therapy company with estimated pro forma combined revenues of approximately $2.5B.

Fast forward to September 28th when Smiths Group issued its annual results. In the prepared remarks, management stated:

“Smiths Medical is undertaking remediation activity to address the findings of an FDA audit, and it has also written down the value of capitalised R&D relating to its large volume pump.”

KeyBanc analyst Matthew Mishan was out last week with a note after catching up with ICUI management primarily to discuss its early takeaways around Smiths Medical’s estimated $100M remediation plan to address 483 observations stemming from an FDA audit of its MedFusion syringe pumps. “While not new, it was an easy to miss piece of news that Smiths Group disclosed in its 9/28 earnings release and was only briefly alluded to in its prepared remarks.”

For context, MedFusion is Smiths Medical’s major syringe pump platform with approximately 40% market share in the U.S. Syringe pumps are typically used in Neo-natal, pediatric applications or with infusion that requires precise dosage at small volumes. It only represents $65M in annual revenue for Smiths Medical (~15% of Infusion systems segment and ~5% of total), but is one of the major complementary pieces to ICUI’s portfolio and important to the strategic rationale of the acquisition.

According to KeyBanc, $100M of remediation costs were included as liabilities in the Enterprise Value of its deal model and was also a consideration as part of ICUI’s pro-forma 2022 EPS guidance. Smiths has engaged a number of experienced consultants who developed the response plan and cost estimate and, while ICUI has not had hands on access, the initial assessment from its Quality & Regulatory team was that the plan seemed appropriate based on the recall and 483 observations. As part of the merger agreement, ICU has monitoring rights around this issue and needs to be consulted and updated on progress.

At this point, Smiths Medical has submitted a written response to the FDA but has not received a formal warning letter or other formal conclusion. “We consider FDA scrutiny a primary risk in the space, and believe the $100M in expected costs and >2-year time-frame to completion are representative of the seriousness of the situation. We are uncertain of the next steps, and while a warning letter is possible, it does not guarantee restrictions from additional sales.”