What Are Chances of Thermo Fisher (TMO) Going after Agilent (A)?

Thermo Fisher (TMO) has been acting very strong last few days. Check out that chart with power candles yesterday and today.

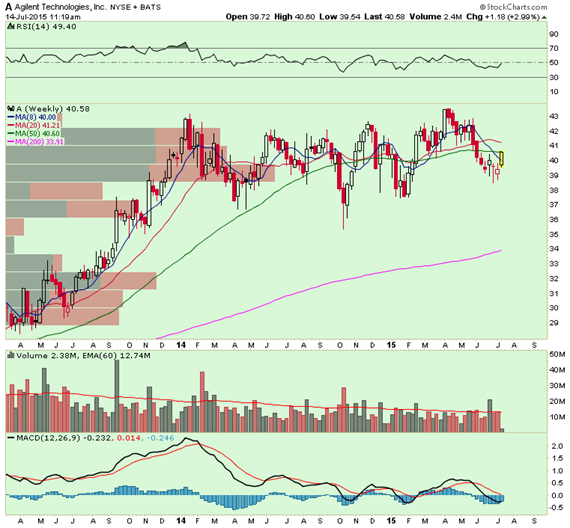

Agilent (A) today saw large seller of 10,000 November 37.5 Puts for $1.30 credit to buy 10,000 November 42.5/50 call spread for $1.12. A highly leveraged play done for small net credit that can pay off big time in a buyout scenario. On weekly chart, Agilent has had trouble holding above $43. This large player is looking for major rally through $43 by November.

We like to point out to one article published on Bloomberg back in December 2014 to give some background color: Agilent’s Evolution Since Spinoff May Lead to Takeover