Behind The Numbers – Blue Bird Corp (BLBD)

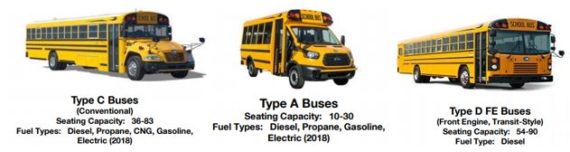

Blue Bird Corporation is a leading school bus OEM, designing and producing school buses primarily for the North American market. It offers a complete line of Type A, C, and D buses in a variety of options and configurations.

Q1 Results

-EPS of $0.05 vs ($0.03) estimate – Beat

-Revenue of $154.9M vs $154.15M estimate – Beat

-Net Sales decreased 4.7% Y/Y

-Bus Unit Sales were 1,600 Units vs 1,705 Units Y/Y – Declined

CEO Philip Horlock reminded everyone, “The school bus industry is extremely seasonal, and the first quarter is always the softest quarter of the year, with unit sales typically representing no more than 15% of the full year volume.”

As shown above, the company sold 1,600 buses in the first quarter, and while this was 105 units below last year, it was their third highest first quarter volume in the past 10 years. Importantly, management stated that the shortfall versus a year ago is more than explained by 120 fewer sales to 1 customer, the government, their General Services and Administration as its known. “This is simply timing of deliveries. And through the course of the year, we expect the GSA to order their usual volume of buses from us.”

Alternative Fuel Buses

Management would comment on the conference call, “We did see yet another first quarter record sales mix for alternative fuel-powered school bus sales, up 34% of our total bus sales. This compares with a mix of 31% last year.”

In terms of sales performance, Q1 saw an increase of 4% and as they move from the softest volume quarter of the year, however, they remarked that they’ve seen a significant surge in orders. As of Monday this week, they had 1,860 units booked, and are in the firm order backlog, which reflects a very strong 25% increase over the same time last year.

Additionally, Blue Bird’s CEO said their Type C electric-powered bus will launch later this year and “I can tell you that we have a very strong pipeline of customer orders for both electric and propane buses that we’re pursuing.”

VW $$$

In the Q&A portion of the conference call, Blue Bird was asked if they had been seeing some of the districts pushing decisions out into this year pertaining to the VW settlement money.

Blue Bird stated that so far, 30 states have finalized their plans for deploying the VW settlement. “And the good news is about 40% of their funding in the first year has been directed towards school buses. That’s potentially another strong boost to the industry, and we’re in a great leadership position to capitalize on these funds.” More specifically, they added that Louisiana was one state that has released their money and Blue Bird did very well with capitalizing on it.

Analyst Commentary

Roth Capital analyst Matt Koranda was out with a note this morning reiterating his Buy Rating and increasing his price target to $23 from $22 and adding, “We see encouraging signs that BLBD is on track to fulfill FY’19 guidance due to (1) unit pricing +3% YoY; (2) waning commodity headwinds for the remainder of FY’19; and (3) a developing line of sight to cost savings initiatives. Importantly, we view BLBD’s reiterated FY’20 EBITDA margin target as a positive, as margin improvement in the specialty vehicle comp group typically drives higher valuation multiples.”