American Vanguard (AVD) – Crop Progress

American Vanguard Corporation is a diversified specialty and agricultural products company that manufactures and formulates chemicals, including insecticides, fungicides, herbicides, growth regulators, and soil fumigants in liquid, powder, and granular forms for crops, turf and ornamental plants, and human and animal health protection. The company operates in three primary markets: U.S. Crop, Non-Crop, and International.

Within these markets, the company has an extensive list of products that they use such as BIDRIN, a cotton insecticide, THIMET, used on peanuts and sugarcane, and DACTHAL, a fruits and vegetables herbicide. Below, you will find the breakdown of crops it has products for:

Roth Capital, on July 10th, reiterated their Buy rating and raised their price target on shares from $19 to $21 and said they believe American Vanguard is poised for a “catalyst filled second half of 2017.” Here are some of the catalysts investors should keep an eye on:

M&A

Chief Executive Officer Eric Wintemute summarized it best when talking about the company’s mergers and acquisitions strategy: “Growing by acquisition has been a key strategy for American Vanguard. I hasten to add, however, that were are always judicious about how we spend our acquisition dollars and consistently apply rigorous acquisition criteria when valuing and bidding on new products. The idea here is that we seek to add products and or businesses that will be accretive, that will grow, and that will give us improved market access.”

Per the company’s recent Investor Presentation, here are just some of the acquisitions the company has made over the years:

Most recently, on April 5th, the company, through its principal operating subsidiary, AMVAC Chemical, announced the signing of an agreement to acquire certain U.S. assets relating to the three crop protection product lines – Abamectin, Chlorothalonil and Paraquat – from subsidiaries of Adama Agricultural Solutions, which is part of ChemChina. The acquisition is part of a consent agreement between the FTC, on the one hand, and ChemChina and Syngenta (SYT), on the other hand, under which ChemChina is required to divest these assets as a pre-condition for ChemChina’s proposed acquisition of Syngenta.

After this announcement, SunTrust Robinson analyst James Sheehan was out with a note saying that he estimates that the deal will increase American Vanguard’s EPS by 10c-15c. He also says that the products will fit in well with American Vanguard’s existing portfolio. He would wind up keeping an $18 price target and a Buy rating on the shares.

In addition, Roth Capital said they believe management will continue to evaluate additional acquisition opportunities and that the second half of the year will include one or more transactions after noting that AVD announced an amendment to its existing credit agreement on July 6th that increased the borrowing capacity by $50M and extended the maturity to June 30, 2022. It believes this could be a precursor to further M&A announcements.

SIMPAS

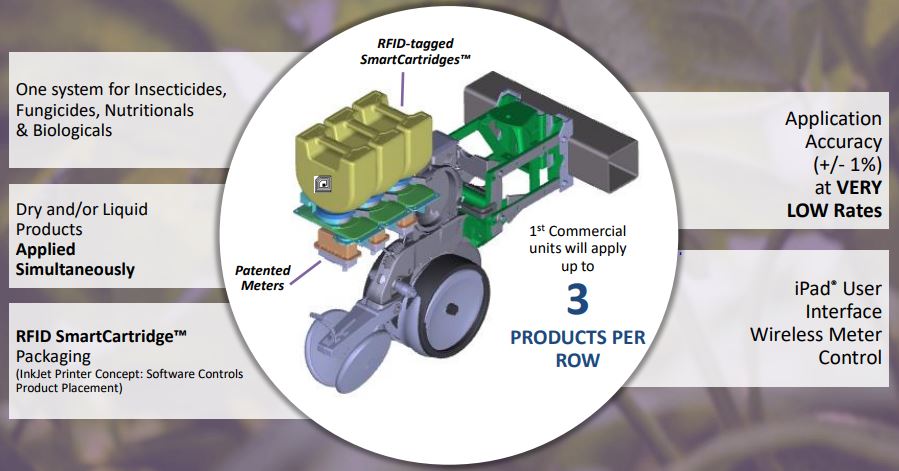

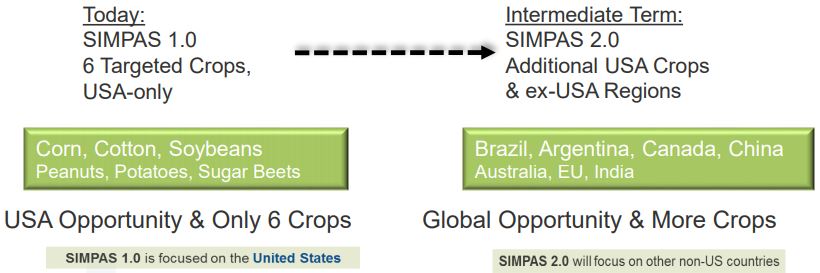

Another catalyst to keep an eye on is the company’s new industry standard, the SIMPAS system. SIMPAS stands for Smart Integrated Multi-product Prescription Application System and this cutting-edge technology will enable the grower to take prescriptions for treating a field and automatically apply multiple inputs at varying rates per row.

The company believes SIMPAS will not only facilitate growth of their own product sales, but also become a medium for delivering all manner of third -party products including plant nutrients, biologicals, insecticides, fungicides and nematicides onto many crops and into many regions in which AMVAC Chemical does not have coverage today. In other words, they believe that SIMPAS will be a gateway for improved market access both at home and abroad.

On the company’s conference call, CEO Eric Wintemute would say, “To bring you up -to -date on development efforts, we are presently running field trials of the SIMPAS system with a dozen growers and are planning a demonstration to take place at the Farm Progress Show at the end of August this year.”

In that same July 10th Roth Capital research note I reference at the beginning of this report, they said that they continue to believe the market assigns little-to-no value to AVD’s SIMPAS system due to a lack of clarity on how it will be marketed and monetized. However, they believe management could provide significant clarity on SIMPAS in the second half of 2017 as the company looks to launch the technology commercially in 2018. They believe this clarity will result in an improved market valuation for the company as analysts and investors assign a specific value to the technology.