Unlock: ANET Trade

(This idea was issued as premium trade alert on June 9; The bull risk reversal was bought for net zero cost and closed today for $3.70 net credit)

Arista Networks

Ticker: ANET

Sector: Technology – Networking Solutions

Current Price: $78.81

Target: $90.00

Stop Loss: $70.00

Time Duration: 101 Days

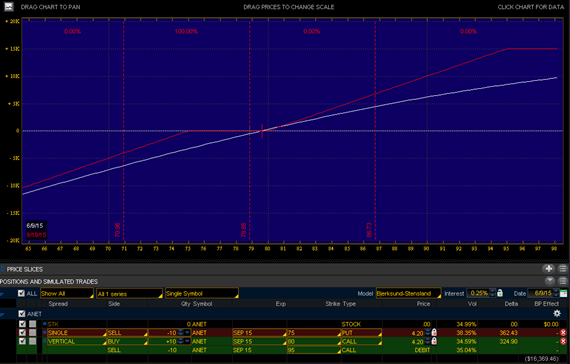

Trade Idea: Sell September 75 puts for $4.30 credit and buy September 80/95 call spread for $4.30 debit. This is zero cost trade. Must be willing to get long below $75 if the stock settles below $75 on September expiration.

Fundamentals – Arista has been on a tear, spiking ~13% in the past week, as a number of analysts have upgraded or initiated buy with price targets in the $90 range. We don’t blindly follow the crowds, but we do believe there is still plenty of upside from here.

Arista’s core business is supplying ethernet switches to large data centers. There are a few key drivers that, when taken together, paint a different picture of where the stock price should be:

- The trend towards the public cloud will take IT spending in that arena from $57B to an expected $128B by 2018. Much of this is in mega data centers like the new Facebook DC planned in Iowa at 1.5 million sq. ft!

- Increasing speed in networking. As the market moves from 10GbE speeds to 40GbE and beyond, Arista has a real technological advantage, and holds some ~80% market share.

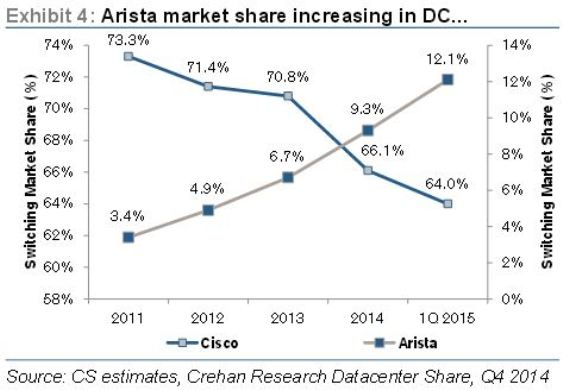

- Most importantly, continued market share growth, gaining rapidly on top competitor Cisco (see below).

Some quick napkin math: total addressable market rising from current $8B to $14B, and market share increasing from current 12% to a very reasonable 15% predicts revenue just about doubles in two years. At current margins and forward PE, that is a stock price of $95.

Unusual Option Activity – ANET continues to see put sellers under the stock on every downtick. Prior to last earnings, they were selling May 65 and 60 puts that expired worthless and the bulls collected maximum profits. After earnings they sold 5,000 of June 65 puts for $2.00 credit and these are also expected to expire worthless. Lately, the bulls have been July 70 and 75 puts.

Technicals – The weekly chart broke out through $75 on high volume after multiple attempts. That resistance is now support, hence why in trade structure above we like selling puts at that strike to finance call spreads. We believe over time the stock is heading back to $90+