Align Technology (ALGN) – Before The Doctors Arrive

As I mentioned this morning in Conversations, we will eventually receive specific channel checks and survey results for Align Technology (ALGN) from orthodontists and general practitioners. In the interim, we have other various data points we can use to gauge sentiment for the stock. It was back in October 2021 when I wrote a piece for clients detailing “Soft Channel Checks.” It’s safe to say that since that write-up and continuous updates, it was the right call. Shares have gone from $700 to under $300. The following checks, at this time, do not change my opinion:

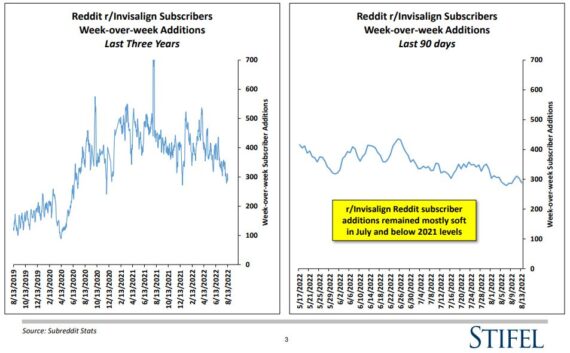

Reddit – From May 2019 to May 2021, the number of r/Invisalign Reddit subscriber additions accelerated at a solid pace. However, from the middle of 2021 until roughly Q1 of this year, the trend line flattened out, which Stifel believes coincides with their survey work since Q321 and Align’s Invisalign case volume. Analyst Jonathan Block notes that when we isolate results over the past 30+ days (July and into early August), the trend line appears to have moderately deteriorated from previously flattish to more representative of a slight downward trend.

My Invisalign – For the company’s “My Invisalign” app store rankings, recent interest for iPhone and Android is showing more flattish over the past 60 days.

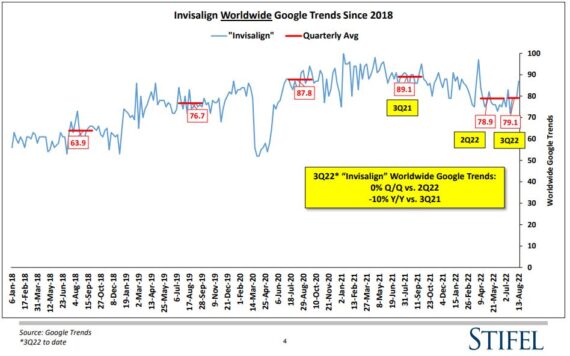

Google Trends – With regards to Q2 results, Stifel notes that Invisalign worldwide and U.S. Google Trends were both flattish sequentially (U.S. down -1% and worldwide down -2%). This basically matched Align’s results with Q2 Invisalign Americas case volume +1% Q/Q and worldwide +0% Q/Q. As for Q3, quarter to date Google Trends worldwide figures, search volume is flat Q/Q and down -10% Y/Y. This basically matches Stifel’s Q3 worldwide case volume estimate, which is flattish sequentially (+1% Q/Q) and down -8% Y/Y.

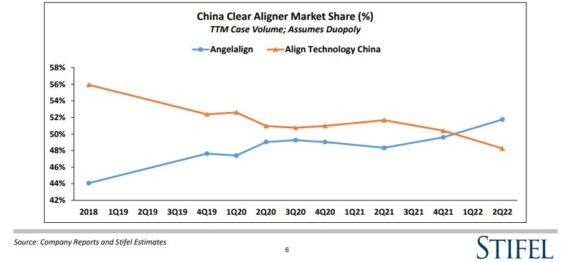

Competition – It should be obvious to everyone that while Align Technology continues to dominate the market share category, there is plenty of competition out there. You have SmileDirectClub (SDC), Byte via Dentsply Sirona (XRAY), as well as Spark via Ormco Corporation. Stifel highlighted that while Invisalign is the dominant player, they saw Spark started to make inroads in the 2H 2021. “Figures suggest that the momentum continued into 1H22. In 2023, we have Spark revenue reaching $227M. This would represent 6.5% market share in the hypothetical Invisalign / Spark duopoly.” While this competition is U.S.-based, you’ll also want to keep an eye on Angelalign in China. In the 1H of this year, it appears based on the chart below that Align’s rate of share losses again accelerated.