Behind The Numbers – Oceaneering International (OII)

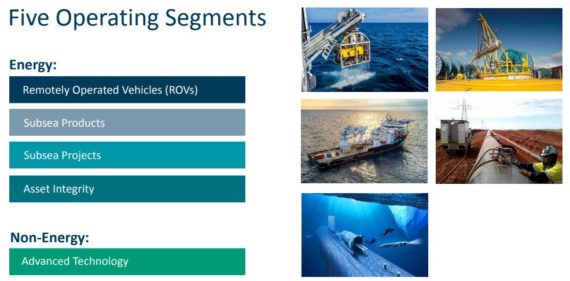

Oceaneering is a global oilfield provider of engineered services & products primarily to the offshore oil & gas industry, with a focus on deepwater applications.

Last week, on October 24th after the close, the company reported its Q3 earnings which ultimately saw its stock fall by 9%. Here was the breakdown:

-EPS of ($0.14) vs ($0.16) estimate – Beat

-Revenue of $519M vs $489.21M estimate – Beat

-ROV Days on Hire increased 4%

-Average ROV Revenue Per Day on Hire decreased 6%

-Subsea Operating Income increased 13%

One of the reasons for the share decline was due to management saying, “Looking forward, we believe our fourth quarter 2018 results will be lower than our adjusted third quarter results due to the onset of seasonality leading to reduced levels of offshore energy activity. Sequentially, we expect lower operating income from each of our energy segments, with most of the decline expected to be in Subsea Products and Subsea Projects segments. Additionally, in our Subsea Products segment we are expecting an unfavorable impact at our manufacturing facility in Panama City, Florida due to damage caused by Hurricane Michael in mid-October 2018. Accordingly, looking into 2019, we are projecting increased activity levels in each of our segments, likely led by revenue gains in our Subsea Products manufacturing business unit. However, the pace of recovery is still difficult to determine, and at this time we are not prepared to offer more detailed guidance on 2019.”

Barclays was out with a note this morning lowering their price target to $18 from $20 and saying that the earnings call did little to inspire confidence that solid 3Q results were more than just an aberration. ROVs day rates and margins are expected to trend lower given higher costs due to short-term rig contracts (these aren’t going away anytime soon). In addition, Subsea Projects is a bit of a black box, expected to encounter seasonal weakness in 4Q and then likely steps down again in 1Q.

Ecosse

*Back on March 5th, OII announced it acquired Scottish-based Ecosse Subsea Limited (“Ecosse”), a provider of offshore engineering, seabed preparation, route clearance and trenching services to the renewable energy and oil and gas industries, for approximately 50 million pounds.

The purpose of this transaction was to expand their service line capabilities and grow their market position within the offshore renewable energy market. Unfortunately, on the Q3 call, management noted that Ecosse results were lower than projected due to equipment modifications and field trials that delayed execution. However, in an October 25th post-earnings note, RBC Capital analyst Kurt Hallead would comment that investors could be missing the underlying revenue opportunity from Encosse as Oceaneering now has the ability to provide communications, tooling and ROV solutions in the Renewables segment.