Behind The Numbers – TransMedics Group (TMDX)

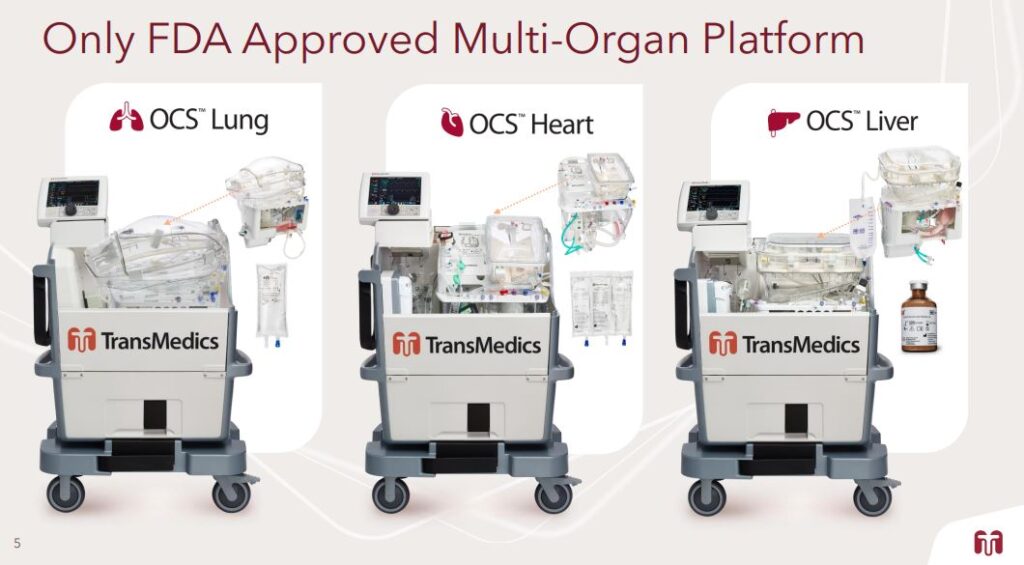

TransMedics Group (TMDX), a medtech company that has developed an Organ Care System (OCS), which is a technology that replicates many aspects of the organ’s natural living and functioning environment outside of the human body. “As such, the OCS represents a paradigm shift that transforms organ preservation for transplantation from a static state to a dynamic environment that enables new capabilities, including organ optimization and assessment.”

On Monday, after the close, the company reported its Q1 earnings that saw EPS come in at ($0.08) vs ($0.25) estimate while Revenue came in at $41.6M vs $36.05M estimate. Total Revenue increased 162% Y/Y and management would raise their FY23 Revenue Guidance to $160M – $170M from $138M – $145M.

On the call, the company acknowledged that its National OCS Program, or NOP, continued to be the primary driver for their revenue growth. Q1 represented another new high watermark for case volumes, driven by liver and heart cases, which increased sequentially for the fifth consecutive quarter. Meanwhile, lung volumes continue to lag as it works to help rebuild this very important market.

CEO Waleed Hassanein highlighted that there were 32 liver programs that used OCS and NOP in Q1, of which 15 were active repeat users. For heart, there were 40 programs that used OCS and NOP, of which 11 were active and repeat users. Meanwhile, there were 9 lung programs that used the OCS and NOP, of which 6 were repeat users. “We are not concerned by the lung center trend given the small numbers and our previous guidance that our initiatives will take approximately 12 to 18 months to materially impact lung program growth.”

In the quarter, the company said it also began to increase production and sterilization capacity. The increase was driven primarily by the scaling of their second shift in their operational existing clean room. They expect to see further gradual capacity expansion as it brings its new clean room online. “Given that we received FDA certification of our new clean room in 1Q, we are confident that the time line for the new clean room to be operational remains on track for late Q2.”

Lastly, it plans to opportunistically add 2 to 3 new launch points later this year to expand their coverage and reach larger pools of potential donors faster and more efficiently. The next steps will be to revamp and scale the logistical management of the NOP case flow. “We have recruited a senior logistics executives from Amazon to lead our initiative to streamline, scale and digitize the entire logistical workflow of our NOP program, literally, starting from the initial transplant centers call to the NOP hotline through the organ arriving at the transplant center. One key feature of this exciting new initiative is creating a digital, central command, control and dispatch center here in and over to oversee and manage our national NOP workload. We hope to start sharing more granular detail on this exciting initiative towards the end of 2023.”

JPMorgan analyst Allen Gong was out with a post-earnings note saying that with significant upside to this guidance range supported by continued momentum for OCS and improved manufacturing in the back half, they continue to like TransMedics at today’s levels and are reiterating their price target of $99.

Buying into Aviation

On May 1st in Conversations (Subscribe HERE), I discussed the new Aviation venture the company will be implementing later this year.

In his prepared remarks, CEO Waleed Hassanein said they saw firsthand in 2022, the massive cost inefficiencies that exist in the current model, and they believe TransMedics managing their own logistical network will create value for its clinical users, its patients, and other critical stakeholders in organ transplantation in the United States. “We believe strongly that securing this dedicated national network of charter flights under TransMedics aviation, would act as an additional significant catalyst for the growth of NOP and TransMedics business in the United States.”

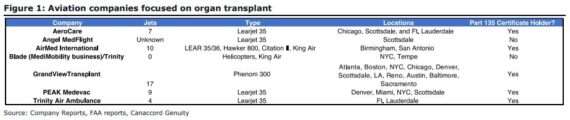

JPMorgan noted that management made it clear that the two avenues it was choosing between would be focused externally, with plans to either acquire or create a joint venture with an existing operator with (1) A 135 air carrier certificate and (2) A significant number of jet assets that could be quickly leveraged. This would be supported by some form of external financing with an eye for limiting dilution, but further details on the potential size of the raise was not elaborated on yet. “We continue to view this as a logical step forward for TransMedics as it aims to cement itself as the clear partner for transplant centers, although we continue to await further details before incorporating this upside driver in our models.”

For reference, here is the list that Canaccord Genuity compiled of potential acquisitions.