Brown-Forman (BF.b) – Can it Withstand the Double-dose of Adversity?

Can Brown-Forman (BF.b BF.a) withstand the double-dose of adversity?

Last quarter, management reported weakening sales in Emerging markets, mainly Turkey and Russia where geopolitical instability and economic conditions remained weak. Turkey was also affected by terrorist events that decreased tourism, a large constituent of sales in a predominantly Muslim country. Brazil’s overall retail sales, although off this year’s lows, are still in negative growth territory.

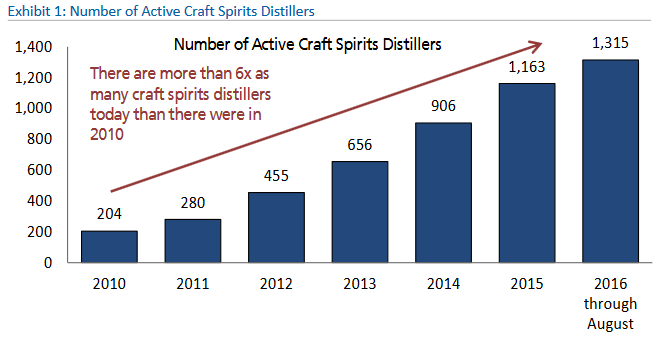

The second measure of difficulties comes from increased market share competition. In the past six years, the number of craft spirits distillers has increased six fold to over 1,300, although the label “craft distiller” should be taken lightly as a lot of the startups purchase off-the-shelf products from the likes of MGP Ingredients (MGPI) and then bottle it straight or with some added flavors. Either way, the number of competitors could reach over 2,500 in the next three years, assuming current growth rate. This would put even further strain on BF’s US market share from which 40% of sales are derived.

Recent Sales Data

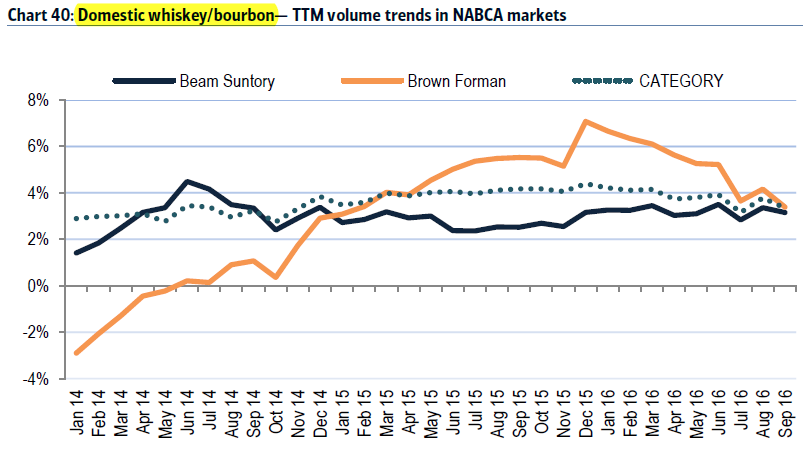

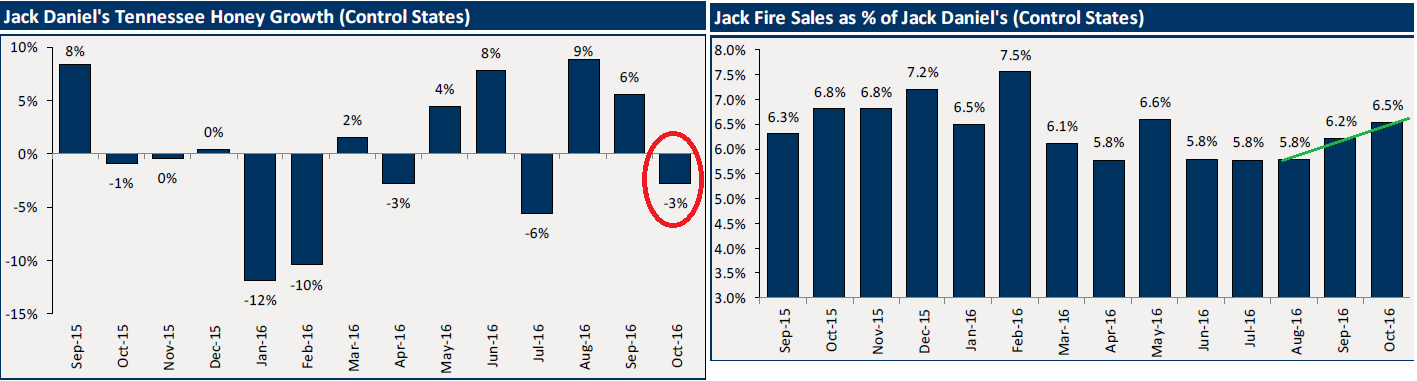

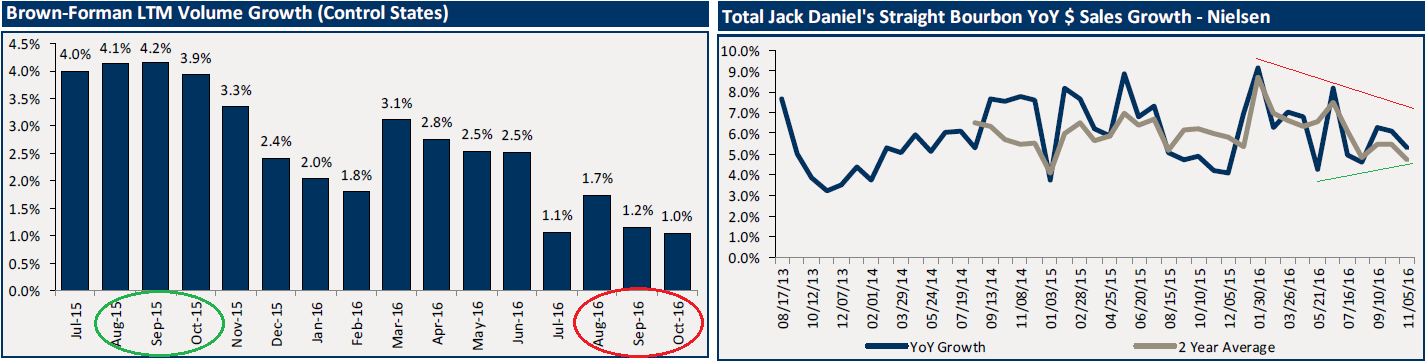

BF’s trailing 12 month volume deceleration trend is a cause for concern, especially when category and competitor Beam Suntory’s numbers have remained relatively stable. The latest Nielsen and NABCA data show an overall decline in volume growth; while some of its products are faring better, the main-core Jack Daniel’s straight bourbon as well as Jack Honey continue to worsen, Given the added woes of recent currency headwinds, management’s FY2017 sales guidance could fall by the wayside. In addition, European travel retail spending continues to be weak.

Jack Daniel’s Straight Bourbon sales declining for the quarter and overall volume growth is far below last year’s numbers.

Shifting Focus

Back in March, BF had warned of headwinds in EM hurting sales and had started to refocus advertising and promotional spending in more stable, developed markets in Europe, as well as back in the USA. These plans are expected to be temporary in nature, until adverse conditions begin to ease.

It’s Not All Bad News

While global alcohol consumption is on a global decline, whiskey’s popularity appears to be on the rise. In an early November report, Moody’s reported that spirits are expected to outpace beer and wine growth in both volume and organic sales. Differing reasons for this shift are mentioned, from older and younger consumers preferring spirits and wine over beer, and the availability of more varied flavors that might appeal to those wanting to try out different tastes along with the base product. There is also a lean towards more premium brands.

American whiskey consumption, more commonly known as bourbon, has declined from its 1950s popularity peak. However, it has seen resurgence in the past 15 years and this cycle is expected to last as long as 20-30 years with the fastest growing segment being Western “brown” spirits, mainly whiskeys and bourbon, of which Brown-Forman should be a beneficiary.

In early November, Beam Suntory reported mid-single-digit US growth in the for the nine-month period YoY. They also noted strong YTD international sales showing share gains and growth particularly in Australia, Spain, India and Russia. In July, Diageo (DEO) reported US sales growth helped by their whiskey brands Bulleit and Crown Royal.

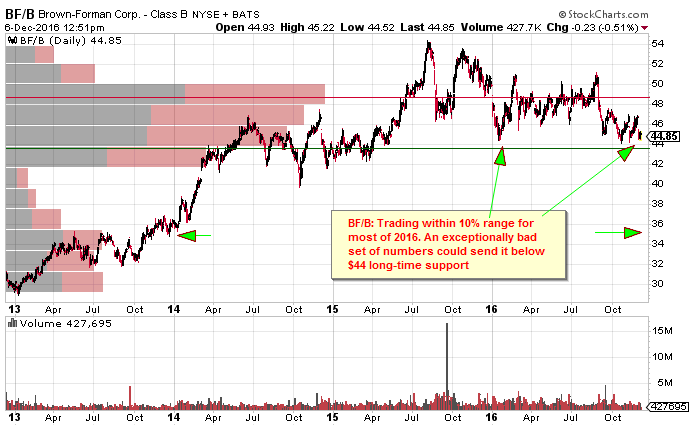

Precarious Position

Brown-Forman reports 2Q2017 earnings December 7th pre-market. This quarter could set up net year’s outlook as management should have a clearer view of Emerging Market and FX situations. Analyst coverage is sparse with median price target at $50.A strong report could send it out of its near year-long consolidation to above $46 overhead resistance, but a weak report could see it break support with little support until about $36 zone.