CACI International (CACI) – Playing Defense

US-based CACI International (CACI) is an information technology service and solutions provide mainly in support of national security missions, government intelligence, defense and federal civilian customers. Products include solutions to enable more efficient transactions, software and interface for military command and control situations, communications capabilities for both mobile and fixed networks in warfare applications, cyber security, intelligence, healthcare and various other related fields.

CACI derives 96.6% of its revenues domestically (94.4% of net income). The remainder is from clients in the UK and Netherlands. Revenue by customer type is 70.6% Department of Defense, 24.4% Federal Civilian Agencies and 4% classified as ‘Commercial and Other’.

For the curious types, CACI is an acronym for the company’s original name California Analysis Center, Inc, then re-branded Consolidated Analysis Centers, Inc. in 1967 and became CACI in 1973.

Last Quarter

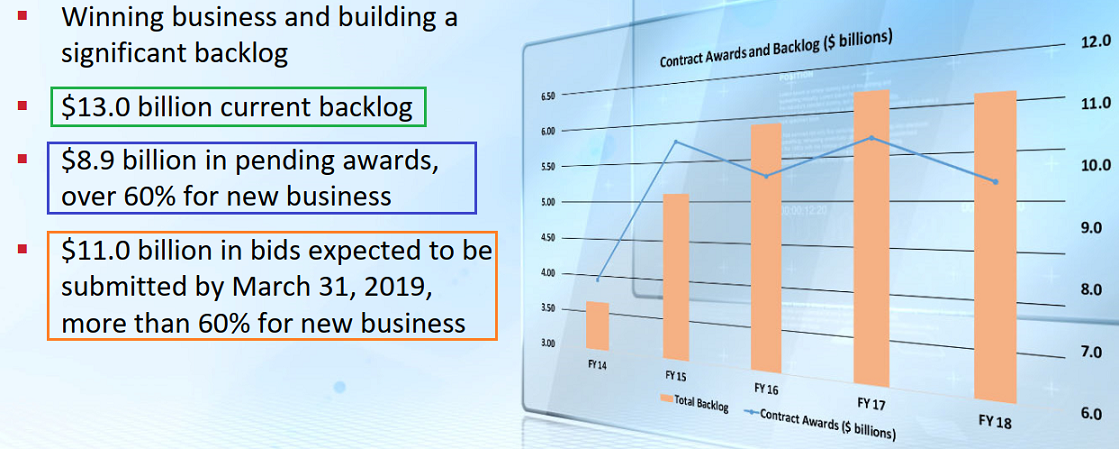

On January 30th CACI reported 2Q earnings, beating both EPS and revenue expectations. During the quarter, $1.3B in new contract awards were won bringing their book-to-bill ratio to 1:1x. 70% of these contracts came from new businesses, in line with management’s long-term financial goal of growing revenue by 1%-4% above their addressable market by bidding on fewer contracts and focusing on winning higher-value ones.

FY2019 outlook was higher in all metrics, guidance for EPS was raised from $9.77-$10.16 to $9.96-$10.35 vs. consensus $10.13 revenue from $4.7B-$4.9B to $4.875B-$5.025B, vs. $4.81B. This outlook is inclusive of $125M in new revenue from two acquisitions.

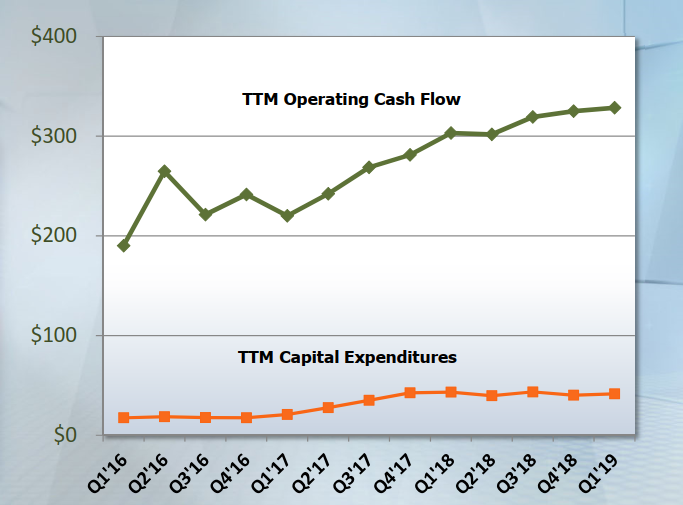

Operating cash flow continues to be seen as “at least” $340M.

Acquisitions

Concurrent to the earnings call, management notified investors of two acquisitions.

- LGS Innovations, a leading provider of real-time spectrum management and related complimentary solutions for the Department of Defense. LGS, purchased for $750M, counts over 900 scientists and engineers among its 1,300 employee count.

- Mastodon Designs, a leading provider of rugged signals intelligence, electronic warfare and cyber operations products with improved designs and capabilities over competitors. CACI paid $225M for this transaction.

Both companies will be accretive to revenue growth and will help expand exposure to high-growth sectors. It is expected that over the next 12 months, $480M in revenue and $82M in EBIDTA will be added from this two new streams.

Looking Forward

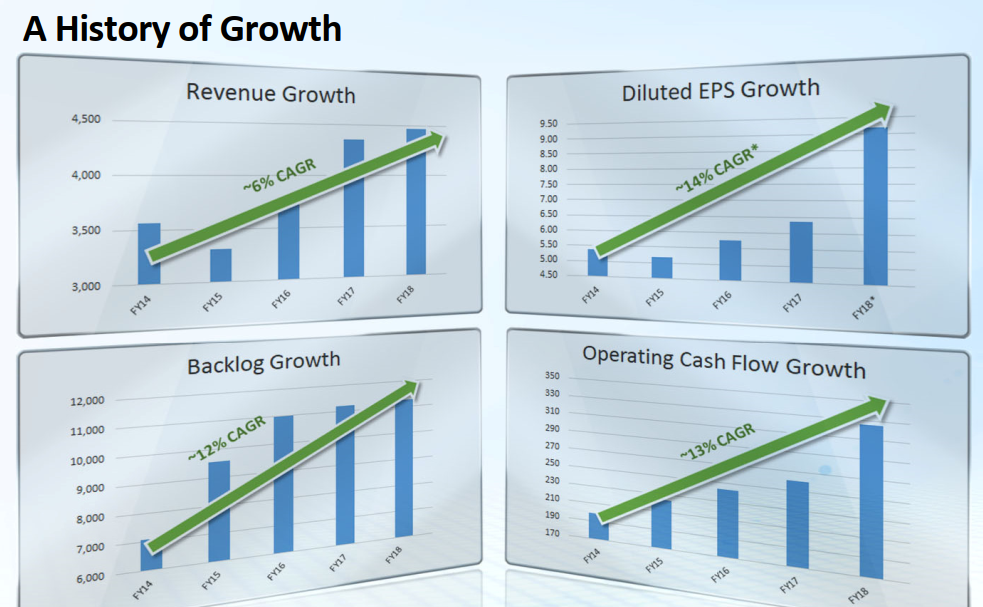

In a presentation file from December 2018, management notes that their total addressable market (TAM) is around $215B of which CACI currently has an approximate 2% share. The potential to expand into this is large with FY2019 company growth expected to be 2% and after that, about 3.5% CAGR. With its most recent acquisitions and possible future add-ons, this ingress is possible, resulting in much higher annual revenues and cash flow.

Management will be presenting at the Cowen 40th Aerospace/Defense and Industrials Conference to be held in New York City on February 6th and 7th.