Canadian Natural Resources (CNQ) – Bright Spot in Energy

CNQ is up +6% today, a bright spot in energy sector today which is being dragged down by crude oil selling off by -2%. We previously in June 2016 discussed prospects of Horizon Project, the growth driver for future stock performance. Here are major takeaways from today’s earnings report.

Reported 4Q results this morning to the delight of investors

- 4Q EPS C$0.32 vs C$0.11 estimate, beat

- 4Q Net Income of C$348M vs C$115M estimate, beat

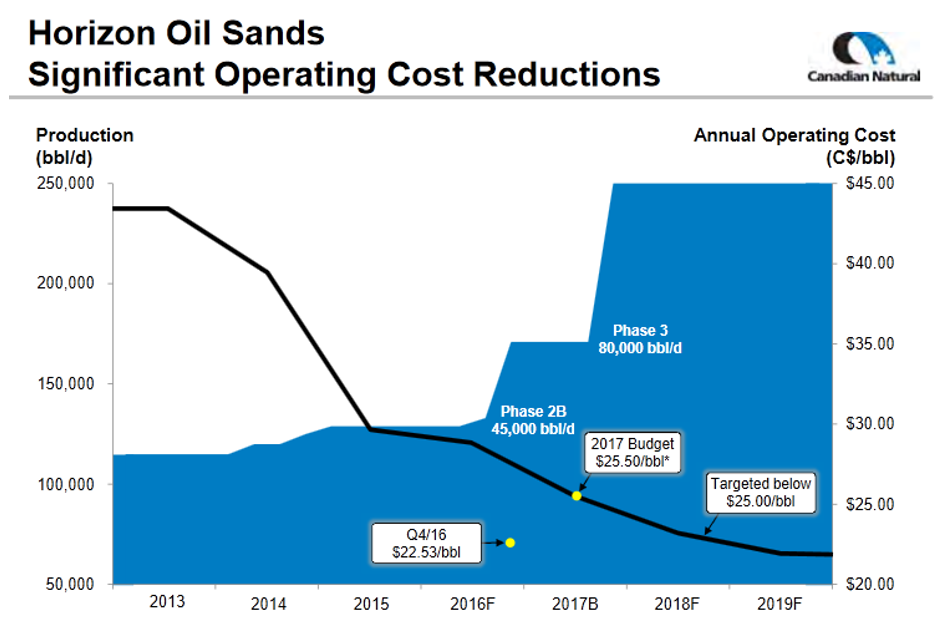

Commenting on the results, 2016 was said to be a milestone year with 4Q Syncrude production achieving a record at 178K bbl/d at its lowest realized operating cost of C$22.53 through improved efficiencies. Free cash flow for the quarter was C$1B after capital and dividends, resulting in stronger liquidity and balance sheet for the year.

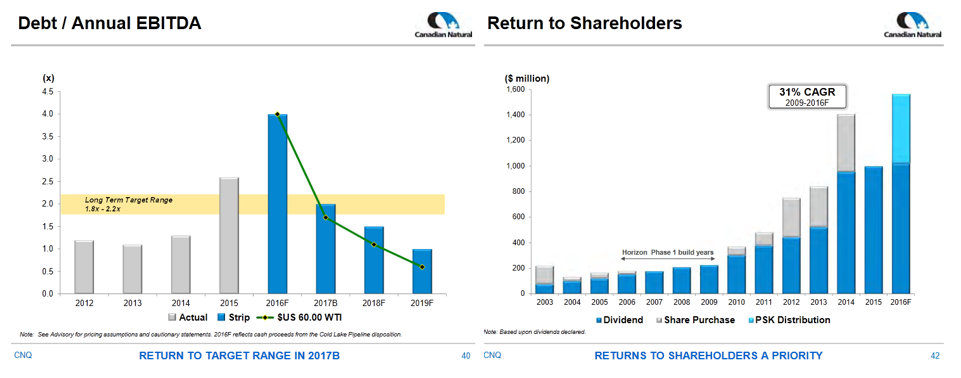

2017 outlook is expected to continue as “transformational’ with 6% production growth targeted through a C$3.89B capital program, on par with 2016, and of which C$1.06B is slated for Horizon projects. Cash flow is forecast to exceed capital expenditures by about C$230M per month, further strengthening the balance sheet. Management also announced a 10% increase in dividends to C$1.10/yr, a 2.9% yield paid out quarterly, and approved a 27.8 million share buyback over the course of the year, which is 2.5% of common float.

Horizon Project

CNQ’s largest project’s Phase 2A exceeded design rates and Phase 2B appears to be on track to do the same.

- December production was 184K bbl/d

- January was higher at 195K bbl/d

- February was again higher at 202.6K bbl/d

Phase 2B also accomplished a lower cost structure and Horizon 3 is on track to start on budget and on time in 4Q2017.