Casey’s General Stores (CASY) 2Q17 Earnings Takeaways – Reduced Fuel Margins But Buildout Continues

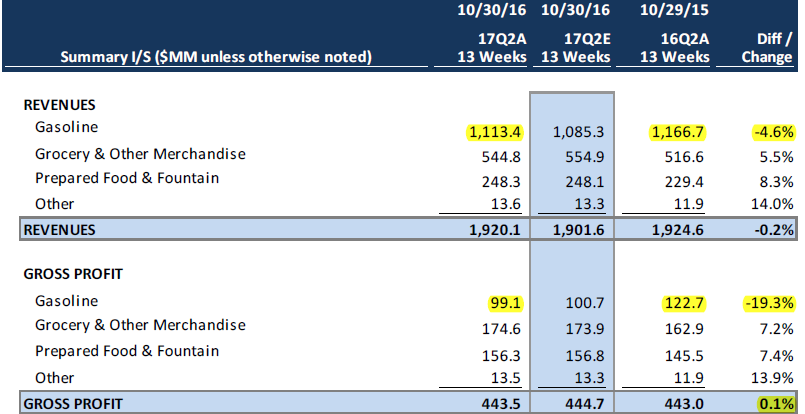

Casey’s General Stores (CASY) reported 2Q earnings came in below analysts’ consensus with a flat gross margin, hindered by a 19.3% gross profit decline in gasoline sales and higher operating expenses.

Despite a 7.1% increase in total gallons sold, lower pump prices contributed to a decline in revenues, hindered further by fuel margin dropping by 6.1 cents, or 19.3% YoY. Excluding this segment, gross profit showed a 7.5% increase YoY. Operating expenses rose by 10.2%, led by increases in labor costs from increased staffing levels, expansion activities as well as conversion of stores to 24-hour operations and the addition of pizza delivery to more outlets.

Management commented that as most of their operations are in the Midwest, grocery sales were impacted by reduced spending of their clientele affected by lower farming incomes. As with other food service operators, prepared foods saw softer in-store traffic resulting in lower than forecast same-store-sales.

The Company plans to add 77-116 stores for 2017 through a combination of new builds and acquisitions. They will also remodel about 100 locations.