Cedar Fair (FUN) – Winter is Coming

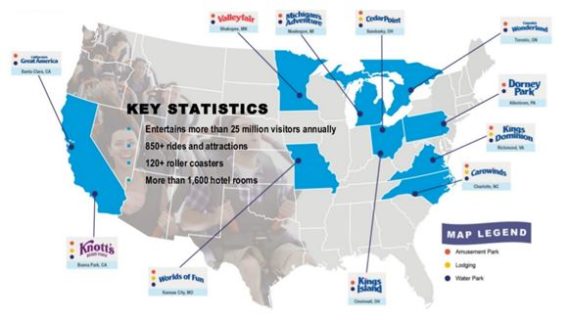

As one of the largest regional entertainment operators, Cedar Fair operates amusement parks, outdoor water parks, indoor water park, and hotels. Per their recent investor presentation, here is a complete breakdown:

Earnings Recap

Last week, the company reported the following Q3 results:

-EPS of $3.38 vs $3.23 estimate – Beat

-Revenue of $652.7M vs $652.7M estimate – In-Line

-Net Revenues increased 1%

-Attendance increased 1%

-In-Park Guest Per Capita Spending increased 1%

CFO Brian Witherow would say, “Attendance trends through the Labor Day weekend were below expectations due to more than a few instances of unfavorable weather on some of our traditionally peak attendance days. For example, on Labor Day weekend, Kings Island and our new Cedar Point Shores Water Park were each forced to close for a day due to extreme weather conditions. While disappointing at the time, over the years, we’ve come to realize that during the course of every season there will be ups and downs in attendance as a result of macro factors outside of our control. Our job is to manage through these cycles and not let these factors become an excuse. Consistent with what we would have expected, as the weather normalized, we have seen attendance recover since Labor Day, and trends improved over the remainder of the third quarter and into October, indicating once again the powerful draw of our attractions.”

Potential Catalysts

WinterFest – On the call, management would highlight the fact that they are coming off their best post-Labor Day performance in the company’s history. However, the season isn’t over yet as they will have 5 parks preparing for their upcoming WinterFest and holiday celebrations in November and December., compared to 2 last year. Based on guest feedback from the 2 events in 2016 and the sale of season passes and other advance purchase commitments this year, management expects the new events in 2017 to entertain at least an additional 500,000 guests.

Hilliard Lyons analyst Jeffrey Thomison, in a post-earnings note would say that this year could end on an encouraging note. “4Q will bring an increase in park operating days, with more parks (5 vs. 2) participating in the WinterFest event in November-December. This is in addition to what we believe were generally successful Halloween events at numerous parks in October. For 2018, new attractions, additional hotel capacity, some pricing power, and a decent economy are key factors in our thesis. We expect record revenue and adjusted EBITDA this year and next.”

Food & Beverage – Christopher Prykull of Goldman Sachs would ask management about its Food & Beverage segment on the Q3 conference call.

COO Richard Zimmerman would respond by saying, “All Season Dining has been tremendously popular. We continue to see increase in penetration rates. But in addition to that, we also have invested in higher-end food facilities and built 4 of them in 2017, more on the way in 2018, that allow us to provide both a better culinary experience but really capture a lot more throughput and a lot more ability to service more transactions per hour. So both of those items are driving what we saw on food and beverage.”

CFO Brian Witherow would go on to add, “And just dovetailing off of Richard’s comments, those same enhancements to the overall F&B experience and physical locations has been something we’ve been focused on, as you know, in the catering area. This is an area that we see a lot of opportunity for. And so it’s just a continuation — ’18 is a continuation of what we’ve been rolling out in ’16 and ’17, our upgrades to those areas, bringing up to our standards. And so what you can expect is parks like Knott’s and Canada’s Wonderland that were the next on the list to be addressed, those are going to be focuses for us in 2018.”