Children’s Place (PLCE) – Still the Place to Be?

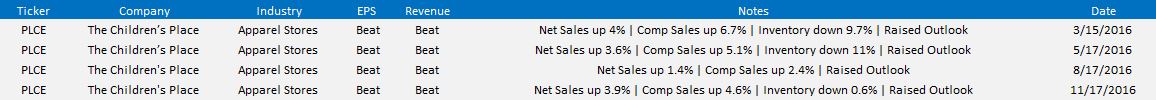

For those that do not know, Children’s Place is a specialty retailer of value-priced apparel and accessories for newborns and children up to 12 years of age. Over the past year, the company has been a true standout in the retail world. They happen to be one retail name with consistent “beat and raise” reports. Here is a quick snapshot of the company’s last four earnings releases:

Last week, the company reported November/December comparable store sales of +6.9%, far exceeding certain analyst expectations. For example, BAML had estimates at only +2%. Management said they are expecting comps for the entire quarter to be up 6-7% (compared to previous guidance for a low single-digit increase) and lifted its Q4 EPS Guidance to $1.53-$1.58 from $1.43-$1.48 and full-year outlook to $5.10-$5.15 from $5.00-$5.05. This news correlated to the recent SpendTrend data for Children’s and Infant’s Wear Stores that showed a material acceleration over the Black Friday shopping weekend, where comps accelerated 560bps from down 6.1% in the first half of November to -0.5% for the entire month. Plus, PLCE resorted to fewer promos Y/Y during the holiday period.

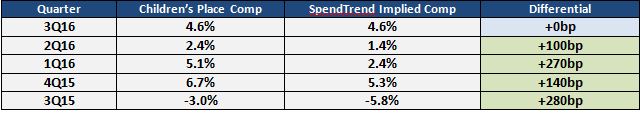

To add on to the SpendTrend data, an interesting piece of research that was mentioned by BAML noted that PLCE’s comp growth has outpaced SpendTrend in the last four out of five quarters by an average of 200 bps. (Table shown below).

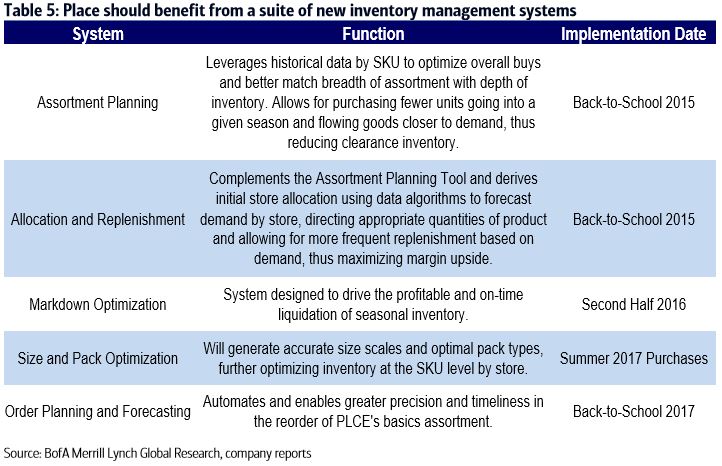

Children’s Place is in the midst of upgrading its archaic inventory systems to a more modernized planning infrastructure. Implementation should result in faster inventory turns and better allocation and replenishment. Management introduced the first phase of its new systems, an assortment planning tool and an allocation & replenishment tool, for its F2015 Back to School purchases. The assortment planning tool has significantly reduced the amount of inventory that Place buys ahead of season, which has limited the amount of excess product and markdowns, driving average unit retail (AUR) and merchandise margin gains. The allocation and replenishment tool has allowed for more frequent and smarter restocking of merchandise in response to customer demand, helping to maximize gross margin upside. Since the debut of both systems, PLCE has boasted an average of 140bp of y/y gross margin expansion over the last four quarters. According to BAML research, the company’s inventory system has two additional implementation dates this year (Table shown below).

In addition, a big boost to the stock over the past year has been due to the hiring of Creative Director Jennifer Groves. Ms. Groves joined the company in September 2014 with over a decade of experience working in Senior Design positions at Gap Kids, Baby Gap (GPS), Abercrombie Kids (ANF), Guess (GES), and bebe (BEBE) stores. Ms. Groves’ first product delivery at Children’s Place launched in September 2015, and the company’s comps have shown a material acceleration. CEO of Children’s Place Jane Elfers credits Groves and her team for the recent improvement:

“We continue to see very strong product acceptance from our customer. We have seen it as we’ve talked about, Jennifer Groves, our head of design and the team that she has onboard is a very strong design team. We have a strong merchandising team.”

Lastly, Children’s Place currently has a wholesale relationship with Amazon (AMZN). PLCE management commenced a replenishment pilot with Amazon in the second quarter, in which PLCE took a selection of items from its existing assortment and had them specifically sourced for Amazon. The pilot involved no planning or allocation, as product was shipped directly from PLCE’s distribution center to the customer within 72 hours. Only 20% of PLCE’s styles were used in the pilot, so there is still a long runway as the company continues to ramp with Amazon.

Wall Street currently has 8 Buy Ratings, 7 Hold Ratings, and 1 Sell Rating on the stock with a consensus price target of $92. Some of the more recent actions have included:

• On 1/6/17, Williams Capital kept its Buy rating and boosted its price target from $107 to $117

• On 1/5/17, Mizuho kept its Buy rating and boosted its price target from $105 to $110

• On 1/4/17, FBR & Co. kept its Outperform rating and boosted its price target from $102 to $113

• On 11/30/16, BAML upgraded shares from Underperform to Buy with a $92 price target

• On 11/19/16, BMO Capital reiterated its Hold rating

• On 11/18/16, Wolfe Research kept its Outperform rating and boosted its price target from $98 to $107

In terms of option flow, it should be noted to investors and traders that back on 12/9, there was a buyer of 1,500 March 90/80 Put Spreads for 1.05 that remains in open interest.

The company’s Investor Relations page does not list any upcoming events. However, based on prior history, the company will be reporting its Q4 earnings sometime in mid-March.