Earnings Preview – Limoneira Company (LMNR)

Tomorrow, after the close, Limoneira will be reporting financial results for the fourth quarter and full year ended October 31st, 2016. Estimates show EPS at -$0.06 and Revenue at $14.94M. Now, you may be asking yourself, who is Limoneira?

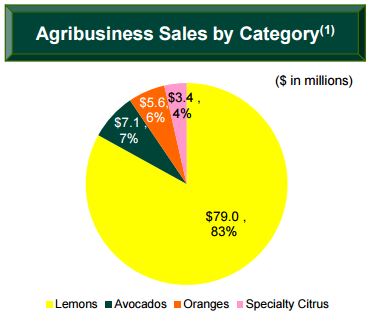

Limoneira is an agribusiness and real estate development company in the United States and internationally. With nearly 11,000 acres of agricultural production, Limoneira is one of the largest providers of lemons and avocados in the United States. At a recent B. Riley Investor Conference, here was the breakdown within its Agribusiness division:

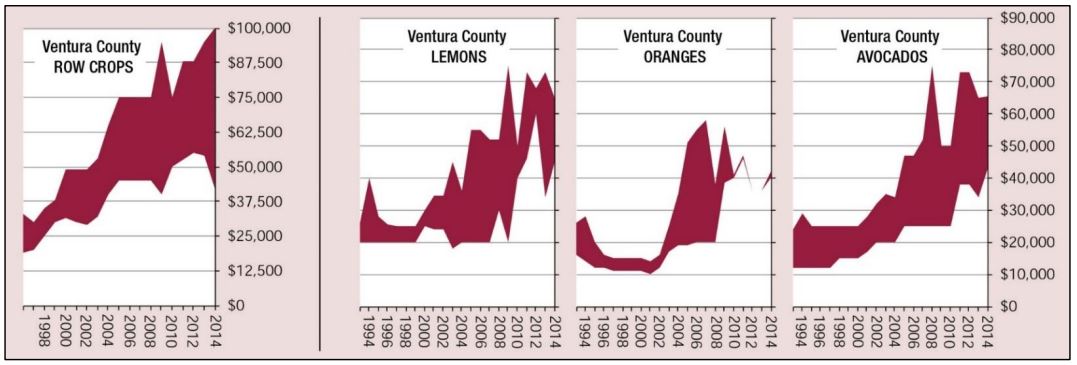

Limoneira represents ~5-10% of the fresh lemon market in the United States and ~12% of the U.S. lemon export market. Fresh lemons represent a ~$400M market in the United States and a $1.9B market globally. In addition, California is the largest lemon-producing state in the United States, with about 47,000 acres of bearing trees out of about 55,300 acres nationwide, according to the USDA. Ventura County accounts for more than one-third of California’s lemon acreage. For Limoneira, it has 3,900 acres of lemons, 1,200 acres of avocados, 1,500 acres of oranges, and 800 acres of specialty citrus in Ventura County.

Looking to the future, the company expects to add 1,500 full bearing lemon acres by FY 2020. Its 10-year growth plan includes an increase from 2 million cartons sold to 10 million. To assist with their growth potential, the company, in March 2016, opened a new packinghouse in Santa Paula, California that is expected to increase efficiency and double the annual capacity of lemon packing operations with significantly less labor costs.

Now, looking back to September 8th, the company reported Q3 earnings. Here was the breakdown:

• EPS of $0.71 vs $0.58 expected – Beat

• Revenue of $39.9M vs $37.69M expected – Beat

• Revenue increased 34% Y/Y

• Operating Income increased 81% Y/Y

• Lemon sales of $26.2M vs $23.9M a year earlier

• 846,000 lemon cartons were sold at an average price of $27.19

• Avocado sales of $9.6M vs $3.0M a year earlier

• Oranges sales of $1.9M vs $1.0M a year earlier

• Specialty Citrus sales of $759,000 vs $560,000 a year earlier

The company said that for the fiscal year ending October 31st, 2016, it continues to expect to sell between 2.7 million and 3.0 million carts on fresh lemons at an average price of approximately $24 per carton.

However, one piece of news to keep an eye out for in tomorrow’s report dates back to December 20th, when the USDA’s Animal and Plant Health Inspection Service (APHIS) published its final ruling on allowing Argentine lemons into the United States. The ruling was immediately condemned by California lemon growers over concerns that the South American country would be shipping citrus from areas infected with disease and pets. Furthermore, the administration acknowledges that “lemon producers, packinghouses, wholesalers and related establishments will be adversely affected economically.” The report estimated that annual imports of fresh lemons from Argentina are expected to range between 15,000 and 20,000 metric tons, with an average of 18,000 metric tons. Despite huge losses for growers, the USDA forecasts that the price of lemons will drop by 4%.

Joel Nelson, President of California Citrus Mutual, said, “The USDA is going to create a price war. This will mean a significant drop in the revenues for lemon growers.”

In terms of sell-side coverage, Limoneira’s Investor Relations page only shows 3 analysts:

• Roth Capital – Anton Brenner

• Feltl & Company – Brent Rystrom

• Janney Montgomery Scott – Jonathan Feeney

So far, this year, Roth Capital reiterated its Buy rating on March 12th.

Finally, after the company releases its earnings, they will be presenting at the ICR Conference on Wednesday.