Healthcare Pulse – Week of February 12th (LLY, SYK, ZBH, Dental)

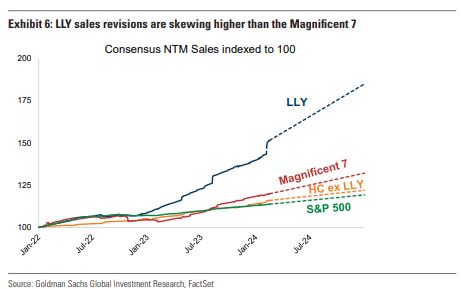

Eli Lilly (LLY) – On the back of Eli Lilly’s leadership and “hyperbolic price move,” Goldman Sachs comments on how there has been a growing discussion among investors and in press reports if the Magnificent 7 of Tech should include LLY to become the Magnificent 8, or remain the Magnificent 7 with LLY replacing another name — as the group of Mag-7 companies continues to evolve. While Eli Lilly has traditionally not been discussed as part of the Mag-7 club given it’s not a Tech stock, Goldman Sachs believes it is now well-established in the narrative of companies contributing to a major technological development that could have large societal ramifications. “We note that recent price action between LLY and TSLA, for example, has been exhibiting a clear rotational preference for LLY as the increasingly favored name between these two mega-cap compounders. It may not be surprising to see this rotation continue, in our view, as mutual-funds continue to right-size their LLY positions (recall our last quarterly positioning update showed there was significant room for MFs to add to this name).”

Separately, as most people probably saw, Morgan Stanley would issue a note on February 16th with the title, “Could LLY Be the First $1TRN Biopharma Stock?” Analyst Terence Flynn would discuss how in the near-term, the focus will be on the continued ramp of Zepbound for obesity and Mounjaro for type-2 diabetes. “While our 2024 estimates are now more in line with consensus following a solid 4Q print, within we discuss three potential drivers of upside (pace of auto-injector supply ramp in US from North Carolina, Trulicity OUS dynamics, and Kwikpen supply ramp in OUS markets). On 2025 numbers we are 4%/10% above consensus revs/EPS as we expect Zepbound/ Mounjaro supply to continue to ramp (where we are ~20% above consensus).”

Stryker (SYK) – Last week, the American Academy of Orthopedic Surgeons (AAOS) Conference took place in which a handful of medtech companies, including Stryker, presented. From a high-level, JPMorgan was able to catch up with CEO Kevin Lobo, who made it clear that the elevated demand it saw through 2023 has continued into Q1 with no significant dip seen in January and no warning signs that would indicate a potential slowdown. With regards to new products, there was plenty of items to call out:

Pangea System – During the Trauma product presentation, the company highlighted the upcoming Pangea plating product launch, underscoring once again that Pangea represents the “largest and highest impact” product launch in Trauma history. Addressing some of Pangea’s differentiating factors, Stifel said that Stryker indicated that Pangea has improved anatomic plating, providing a closer fit to the bone, as well as uniform operating trays. For hospitals with inventory constraints, the company highlighted the uniform operating trays as being particularly beneficial, enabling simpler workflow. Looking ahead, with Pangea filling the company’s Trauma portfolio gaps, Stryker emphasized their general expectation for Pangea to help expand the company’s current U.S. Trauma market share position.

Shoulders – Highlighting the company’s market-leading shoulder position, management noted that the previously-acquired Tornier shoulder portfolio has expanded its worldwide market share from 20% twenty years ago to 30% today, helped in part by the segment growing 20%+ during every quarter for the last six years. Looking ahead, SYK noted multiple positive factors that should continue supporting shoulder sales growth over the next several years. These include: (1) 5 new products set for full 2024 launch, including the Perform Fracture Stem, Polycarbon for hemiarthroplasty, Perform Reverse Stemless, HoloLens for virtual reality, and Shoulder iD. Of these meaningful product launches, Stifel noted that the company described the Shoulder iD product introduction as a “phenomenal” innovation, offering patient-matched glenoid 3D printed implants. Given each patient’s unique anatomy, management indicated that Shoulder iD leverages CT scans to create a personalized 3D printed implant, which doesn’t require augmentation, enables procedure time efficiencies, and offers improved implant fit.

Cameras – Launched in September 2023, the company indicated that its 1788 MIS video platform represents the latest iteration of the company’s camera technology, offering improved video resolution, better platform connectivity, increased ease-of-use, and a wider gamut of colors. Among other benefits, Stryker indicated that the 1788 camera’s advanced imaging and improved visibility enable surgeons to identify structures in the body like tumors. Management highlighted the 1788 camera’s broad application to a number of clinical subspecialties including ENT, neuro, and thoracic.

Zimmer Biomet (ZBH) – Along with Stryker, Zimmer Biomet also presented at the American Academy of Orthopedic Surgeons (AAOS) where the company introduced its Rosa Shoulder system. Notably, as RBC Capital pointed out, there was no hardware change to Rosa. There is a software upgrade for those who already own a Rosa that comes with an added ASP for the shoulder module, plus there are robotic-enabled instrumentation that are similar or at a slight premium to current PSIs, and there is pull through to implants. Zimmer noted that the robot helps in the preparation of the glenoid and humeral joints using its planning software. The penetration and adoption will drive the most value as it looks to get a greater share of the wallet. Management estimates that this launch will start as a slow and controlled launch, but ZBH expects meaningful first-mover advantage in shoulder robotics.

Meanwhile, in addressing the company’s recently-introduced cementless knee form factor, Persona OsseoTi, management highlighted the Persona OsseoTi product as an expansion and rounding out of the Persona product family offering. Zimmer pointed to Persona OsseoTi as not just increasing the company’s cementless knee sales mix over time, but also enabling the continued knee implant standardization under the Persona family of implants. “On the former, the company expects Persona OsseoTi to drive the company’s US cementless knee sales mix ~18%-20% exiting 2023 to the low-30s exiting 2024. On the later, the company emphasized their continued steady progress with driving surgeon standardization under Persona higher…with Persona implants today account for 80%-85% of knee sales vs. 55%-60% a few years ago.”

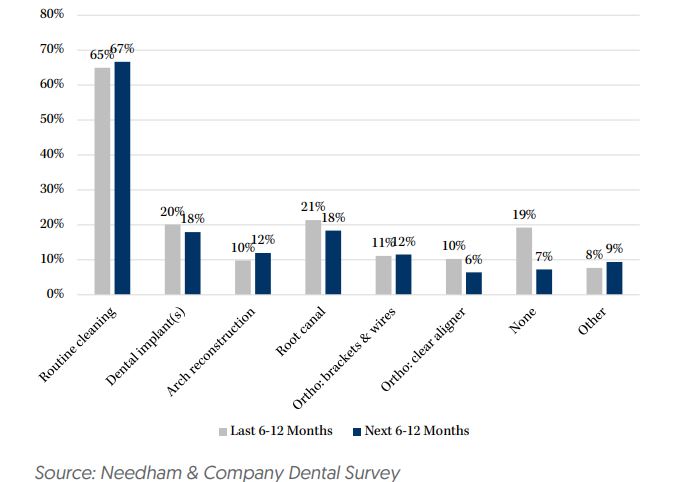

Dental – Needham recently surveyed 234 people between the ages of 30 and 70 years old in an attempt to measure patient demand over the next 6-12 months. 81% of respondents indicated they had some dental procedure done over the last 6-12 months while 93% of respondents expect to have some dental procedure done over the next 6-12 months.

Regarding orthodontics, these survey results were most negative for clear aligner demand. Specifically, 10% of respondents indicated they had a clear aligner over the last 6-12 months, while only 6% of respondents expect to have a clear aligner over the next 6-12 months. Companies have noted weakness specifically in adult orthodontics, and Needham believes their survey results indicate adult clear aligner volumes could continue to be soft in the U.S. into 2024. This is likely the most negative for Align Technology (ALGN).

In addition, for respondents who indicated they expect to have a dental procedure over the next 6-12 months, spending for dental procedures is expected to decline from $1,668 over the last 6-12 months to $1,589 over the next 6-12 months. Of the 234 respondents, 32% do not expect or are unsure whether they’ll have a dental procedure in the next 6-12 months. Of this group, financial concerns are the primary factor for 43% of respondents. Specifically, 16% cited not wanting to spend the money while 28% noted lack of or limited insurance coverage.