Healthcare Pulse – Week of February 19th (LIVN, PEN, XRAY, Hospitals)

LivaNova (LIVN) – Shares of this global medtech company finished up 14% on the week due in large part to the company’s Q4 earnings report on February 21st. Despite an intra-quarter cybersecurity incident that shut down business production, the company still delivered above-consensus performance. Specifically, net sales of $310.1M exceeded consensus expectations of $288.2M. The beat was mostly driven by the Cardiopulmonary division, with sales coming in at $161.5M. U.S. Cardiopulmonary growth was particularly encouraging, up 26.4% Y/Y, powered by the next generation Essenz heart-lung-machine (HLM) launch. In total, LivaNova indicated that Essenz helped drive 40% fourth quarter HLM growth.

New CEO Vladimir Makatsaria is getting ready to take over the reins on March 1st. In terms of upcoming catalysts, Stifel highlights that the company’s RECOVER trial Unipolar patient 12-month top-line data could be published as soon as June 2024 (pending regulator approvals), with the full data published late 2024/early 2025. Then, on obstructive sleep apnea, the company expects 1H24 OSPREY trial enrollment completion, and follow-up and data analysis to complete late this year or early next year. This would imply a 2025 U.S. FDA OSA approval timeline.

Penumbra (PEN) – On the flipside, this medtech company finished down 12% on the week due in large part to its Q4 earnings report. As Morgan Stanley cited, the company’s topline print came in slightly shy versus the Street, while they think investors were also looking for a more aggressive 2024 guide on the back of a blockbuster year. Headwinds from outside the U.S. (including a discontinuation of embolization and access products in some regions due to unfavorable reimbursement) will likely lead to a softer 1H than expected, although management anticipates a stronger recovery through the second half of the year. It’s worth flagging that U.S. thrombectomy growth is expected to remain robust (+27-30% range) across the whole of 2024, which should provide reassurance to investors they think, although they’re also aware of tougher comps here following 2023 product launches.

One item from the conference call worth flagging is that management said that its Flash 2.0 recently received FDA clearance, being the first of its four new CAVT products to enter the market across the next 15 months. Although initial details are limited, Flash 2.0 aims to remove a clot faster, with lower blood loss than before. On this, Morgan Stanley would flag that doctors they speak with are cautious to use Flash 1.0 for some patients given the potential for higher blood loss versus other devices, so they think addressing this feature could help to broaden product usage. Full launch for 2.0 is expected later in Q1, although we’ll likely see a clearer impact through Q2.

Dentsply Sirona (XRAY) – Evercore ISI recently attended the Chicago Midwinter Dental Meeting. Analyst Elizabeth Anderson noted that while the first day of the conference is never the busiest, the show felt sufficiently busy, and overall attendee sentiment was the best they have seen over the past year. Most of the major manufacturers attended, with a number of hardware/software launches/upgrades and more integrated workflow solutions. Dentsply Sirona showcased several new handpieces to help with resto procedures, discussed DS Core trends, while also commenting on how its One DS continues to drive tech/aligner sales. Regarding DS Core (company’s cloud platform), here were Evercore’s bullet points from the meeting:

o Implementing ongoing updates in cloud

o Seeing a big shift in how customers are using technology 18-months in

o Placing an emphasis on treatment planning, scanning, and efficiency

o Quarterly release cycle

o Expanded collaboration with A-dec announced this week (press release HERE)

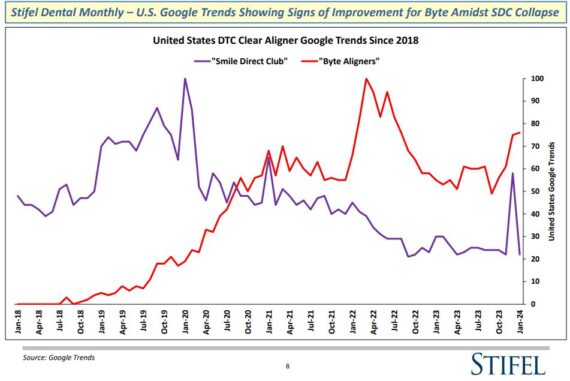

Separately, Stifel analyst Jonathan Block was out with his Monthly Dental Tracker note where he observed that Byte Google trends have now improved for four consecutive months. This is the first time that has occurred since mid-2020. This timing is notable as SmileDirectClub declared bankruptcy in late September and could signal some increasing Byte traction for XRAY in 2024. “A hypothetical +20% 2024 y/y Byte growth rate, instead of approximately +10% would add another ~50 bps to DENTSPLY SIRONA’s 2024 revenue growth rate.”

Hospitals – This specific channel check was already shared in JaguarLive this past week, but I thought it was worth calling out again. On February 21st, TD Cowen was out with a Hospital note highlighting that 325 hospitals reported +7.8% yty January revenue growth. This number was stronger than TD Cowen’s +6.1% December survey.

In terms of the mix, total hospital revenue growth in January now appears to be driven by both inpatient and outpatient activity. Per HHS, average adult inpatient occupancy vs the same period of 2023 is generally slightly up yty vs the first 5 weeks of 1Q24: TX (-0.2% yty), FL (-0.4%), U.S. (+1.8%), HCA (+0.9% yty, much better than 4Q23’s -2.6%), THC (+4.2%) and UHS (+0.8%). Flu appears to be a yty tailwind in January vs a yty headwind in 4Q23.

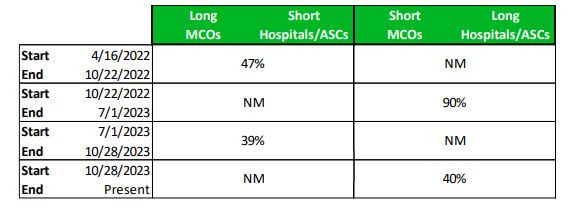

“The strong January revenue growth and upcoming calendar tailwind in February from Leap Year should provide sufficient fuel for the hospital vs managed care healthcare utilization paired-trade momentum to continue; this paired-trade has yielded +40% since late October.”