Healthcare Pulse – Week of February 26th (LMAT, NARI, ZBH, Kaufman Hall)

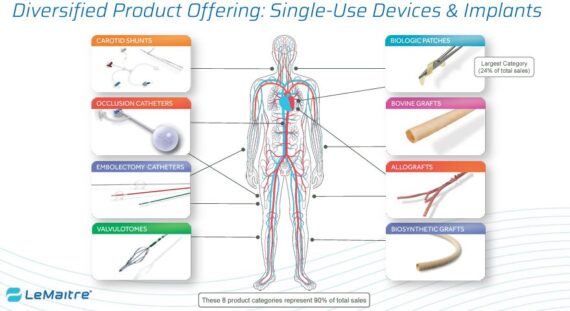

LeMaitre Vascular (LMAT) – This is a medical device company that develops, manufactures, and markets disposable and implantable vascular devices to address the needs of vascular surgeons. Shares closed higher by over 14% on Wednesday following Q4 earnings.

-Q4 EPS of $0.38 vs $0.36 estimate – Beat

-Q4 Revenue of $48.9M vs $49.02M estimate – Miss

-Sees Q1 EPS of $0.36 – $0.41 vs $0.34 estimate – Beat

-Sees Q1 Revenue of $50.5M – $52.9M vs $50.21M estimate – Beat

-Sees FY24 EPS of $1.60 – $1.71 vs $1.53 estimate – Beat

-Sees FY24 Revenue of $209.7M – $214.3M vs $209.99M estimate – Beat

Geographically, its Americas segment grew approximately 20%, EMEA increased approximately 21%, and Asia Pacific climbed approximately 11%. Of note, APAC sales were driven by the opening of an office in Thailand, where it began selling direct. Management noted that it currently has plans to open a sales office in France, expanding its European footprint. The company also posted double-digit Y/Y growth across its key products including bovine patches (+18% Y/Y), allografts (+52% Y/Y), valvulotomes (+12% Y/Y), and carotid shunts (+16% Y/Y). Results were driven by higher ASP (13%) as well as increased volumes (1%), and the company further noted that top-line results were led by the return to hospital by staff and patients as well as the growth of its sales force. It ended the quarter with 136 sales reps (+15% Y/Y), up from 128 at the start of the year. Management commented that it expects to end 2024 with a headcount of 150.

Stifel would point out that also contributing to the company’s positive 2024 outlook, management expects continued gross margin expansion, guiding 68% overall 2024 gross margins, versus 65.7% in 2023. The 230bps Y/Y margin gross expansion guidance is supported by continued pricing increases and manufacturing efficiency initiatives. JMP Securities, in their post-earnings note, would remind investors:

“With a core competency in the peripheral vascular disease market, LMAT has an enviable track record of finding or creating niche markets in this arena (<$200M in annual sales) and building up dominant market share. Financial results have been impressively steady, and while a hyper growth profile has not been the primary end goal of the company, LMAT is about consistency — in finding good products, bringing them under its umbrella, and executing post close. LMAT is more focused on the bottom line, generating increasing profits and cash flow every year, and we expect more of the same in years to come.”

Inari Medical (NARI) – On Thursday, shares of this medical device company fell by over 20% following Q4 results. Headline numbers were essentially in-line with the company pre-announcement back on January 9th. However, two things were revealed. With the company changing its revenue reporting categories to VTE (FlowTriever and ClotTriever) and Emerging Therapies (InThrill, CVD, LimFlow, Artix, etc), we found that VTE sales came in at $127M, an increase of 19.5% Y/Y. However, this was down from 26.5% growth in Q3. Second, the company disclosed that it received a civil investigative demand from the U.S. Department of Justice in December relating to meals and consulting service payments to healthcare professionals. Management noted that they are cooperating with the investigation and that they do not expect it to have any impact on its ability to execute commercially. Morgan Stanley would say that we typically see fines (in a worst case scenario) after a CID, which can take multiple years to work through, so they expect this to be pushed aside over time by investors (or, at least until we receive further updates from management on resolution).

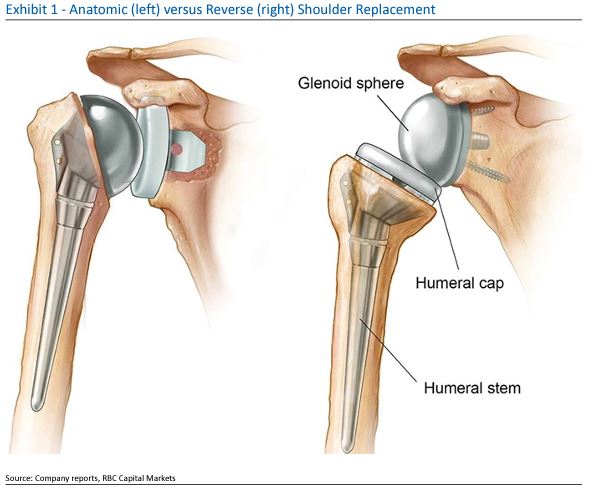

Zimmer Biomet (ZBH) – RBC Capital recently hosted a shoulder KOL discussion post-AAOS and Zimmer’s Rosa shoulder approval. The key takeaways were:

-This KOL uses Zimmer’s shoulder product and noted that he will most definitely adopt the robot in his practice. In fact, he believes Zimmer can successfully drive competitive account conversion as shoulder surgeons are keen, tech/precision-driven, and quick to adopt new technology. He believes Zimmer may have a small window to capitalize on its first-to-market status (SYK to launch YE-24E) and will likely balance driving positive initial outcomes versus driving meaningful initial sales. “Our KOL believes ZBH can monetize the platform with a premium on the software upgrade to the existing Rosa installed base (RBC estimates ~1,250 WW, including ~935 in the U.S. at YE-23E), new system placements (given greater value proposition of the orthopedic robotics with hips, knees, and shoulder), premium on robotic instrumentation (that may be limited initially), and implant pull through (which will be key long-term).”

-This KOL believes the shoulder market is seeing “exponential” growth and has much runway ahead. He noted that his own RVUs are up 25% Y/Y since they are a major feeder center, and he expects the solid pace to continue. He noted that much of the growth in his center is coming from reverse shoulders, and that Q1 shoulder volumes are tracking at a healthy pace as well. “On shoulder market dynamics, he noted that many shoulder surgeons do not have high volumes and with the standardization of robotics there is room for much broader penetration as patients are there. In terms of the market, he sees total shoulder replacement market split 70-75% for reverse and 20-25% for anatomical shoulders.”

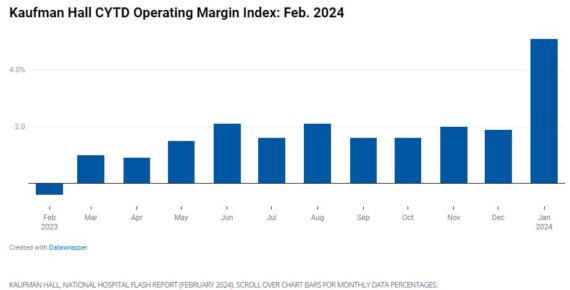

Kaufman Hall – This past week, Kaufman Hall released its monthly National Hospital Flash Report based on data from over 1,300 hospitals highlighting key financial trends including operating margins at both a national and regional level. According to Evercore ISI, overall financial metrics continue trending in the right direction, with the latest report showing >550 bps Y/Y improvement in operating margins. More specifically:

Hospital profitability continues to improve with January operating margins hitting 5.1%, well above the -0.5% margin seen in January 2023. Net revenues (per calendar day) were up 10% Y/Y in January (higher growth vs. December). Inpatient revenues (per calendar day) were up 9% Y/Y while Outpatient revenues (per calendar day) were up 10% Y/Y.