High Level View

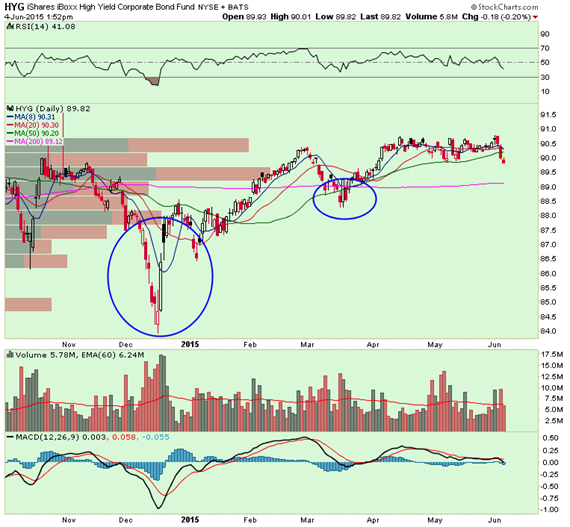

Two days ago we saw a large buyer of 50,000 IWM August 120/110 put spread as well as a buyer of 60,000 QQQ August 106/96 put spread. Meanwhile all week long we’ve been watching massive hedges in SPY including today another buyer of 15,000 x 30,000 x 15,000 July 203/193/183 put butterfly. Take this one step further and you will notice HYG is trading 87,000 puts today vs. 7,200 calls. Put volume is 3x daily average with large out of money put spreads being bought in September that suggest traders are looking for as much as 10% sell off in high yield.

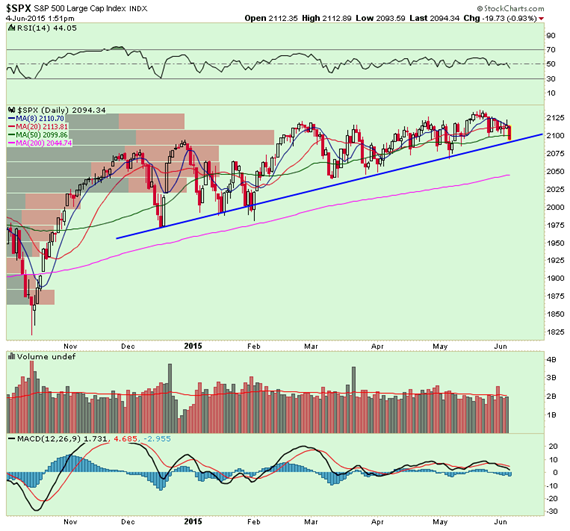

These large hedges or bearish bets are common. They happen frequently. But the intensity of these bets has certainly picked up this week and hence worth pointing out. HYG tends to lead the flows historically speaking. Question remains whether this is start of December-style heavy sell off or something more moderate like in March.