Ingredion (INGR) – Sweet Emulsion

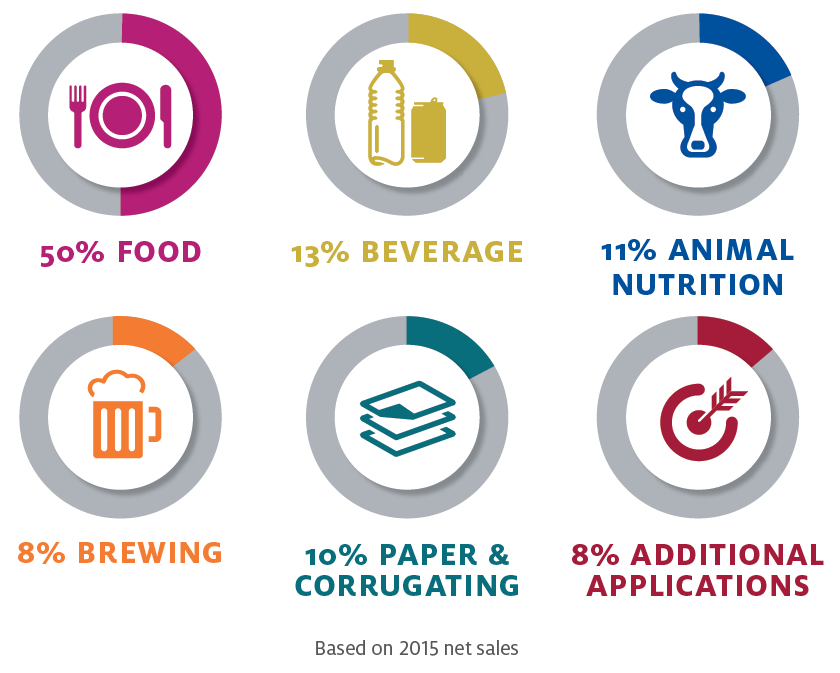

Ingredion (INGR) is an “ingredients solutions” company. You may not have heard of their brand or what they make, but odds are very high that you have at some point consumed their ingredients as part of another product. Their lineup includes sweeteners, starches, biomaterials and nutrition ingredients for a wide range of industries manufactured at 41 plants across the globe. The largest geographical segment is North America, primarily USA, with approximately 60% of net sales, followed by South America at 18%.

Credit Suisse thinks that the market is underestimating of Ingredion’s 2016 performance continuing into 2017. Their research notes post-3Q bring forth the following points:

- Strong demand for High-Margin specialty starches from ingredient reformulations towards consumers’ demand for “clean label” products and manufacturers’ cost reduction plans

- Corn sweeteners have increased pricing power from high utilization rates and stronger global sugar prices

- Cost efficiencies in North and South America from plant consolidations (4 Brazilian plants merged into 2)

- Revenue synergies from Penford M&A that has global potential

Ingredion’s 3Q sales grew 3.6% led by Specialty Starches demand increases especially in North America and Asia. Due to political instability and macroeconomic events, South America remains a weak spot, and with 18% of overall revenue generation from this geographical segment it impacts overall numbers. While it was the only segment that showed negative operating income growth in 2016, it did show positive operating margin increase, as did all other regions. With two-thirds of their revenues being in the USA, their hedged exposure to currency fluctuations is not overly punitive.

Input Cost

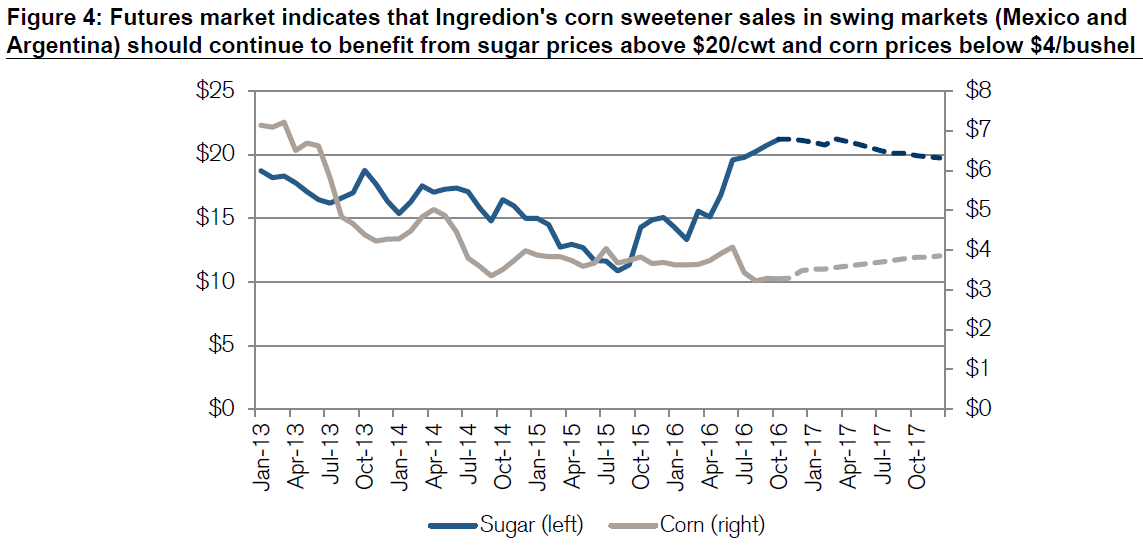

Corn and Sugar prices remain at beneficial levels for the company’s production costs with both commodities expected to stay near current levels. Sugar has dropped from its September highs but weather and production forecasts point to stable or higher levels for 2017. Corn price is expected to remain low.

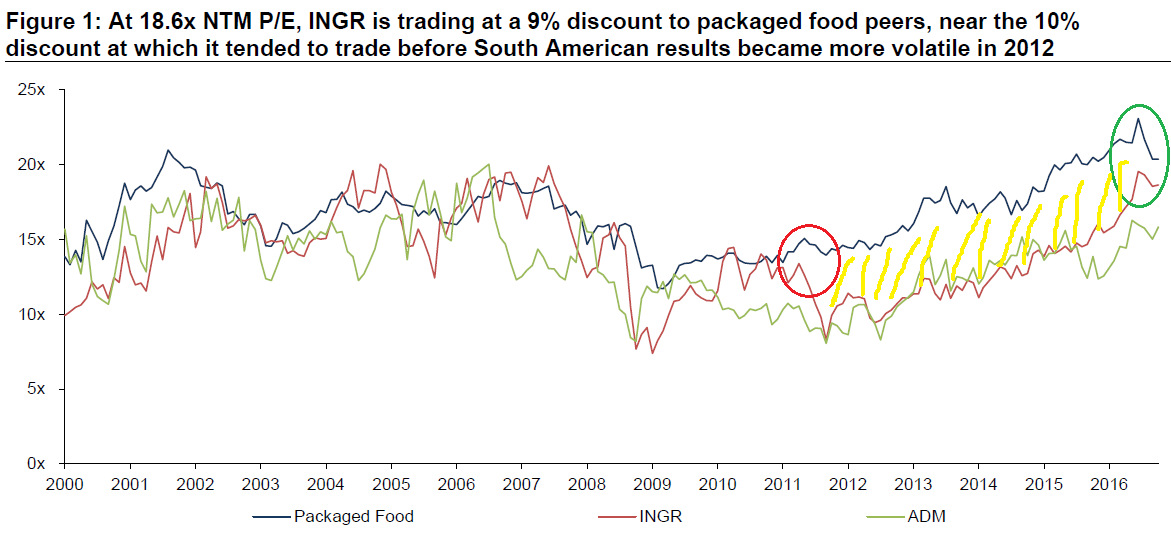

Ingredion has been trading at a discount to Packaged Foods peers since 2012’s South American related drop. However in 2016, it started to close the gap and get closer to par.

Product Segments

Specialty Products – Consumer tastes and desires have been trending progressively towards nutritionally denser foods using natural ingredients of which Ingredion produces. For example, take pasta: over the past decade this simple food has seen alterations from its original flour/water/egg preparation to having added nutrients, vegetable proteins and fiber. These same consumers also want simpler, natural ingredients on the labels of their foods. Ingredion management mentioned in their last earnings conference call that this trend, which started in Europe and gravitated to North America, shows a lot of growth opportunities as they try to innovate new ways to incorporate these healthy ingredients into a wider base of products.

Sweeteners – With the shift to lower calorie foods, producers have increased their offerings to included calorie-free versions which is another trend that Ingredion keeps benefiting from as they offer a variety of Stevia-based sweeteners.

Biomaterials – Another trend shift is towards plant-based packaging materials, so-called bioplastics that depart from petroleum-based ones. With consumers being more aware and concerned about non-decomposable materials ending up in landfills, companies in almost all industries are changing over to more environment-friendly products that appeal to their customers. Biomaterial usage is found in electronics, automotive, cosmetics and food service and include coatings, flexible films, high-temperature molded parts and packaging.

Stabilizers and Foaming Agents – This segment includes emulsifiers that can also be used in alcoholic beverages, egg-replacement formulations, gums and agents that extend the distinctive frothy foam on colas and beer.

Texture Enhancers – This wide-ranging segment includes all ingredients and products that improve texture and the mouthfeel we discussed earlier. Their application helps baked goods retain their flavor, moisture and increase shelf life using natural products. With a push towards lower-calorie treats, these ingredients are formulated to replace eggs, reduce fat and calories, while adding fiber and viscosity. Other applications include yogurt, cheese, ice cream, juices, teas, cereals, in short, anything that is packaged food.

The “H” Word

HFCS – A lot of negative consumer reaction has been centered on High Fructose Corn Syrup (HFCS) usage in everyday products. A sweetener derived from processed corn starch, its use as a less costly alternative to sugar came into popularity during the 1970s helped by subsidies that kept corn prices low, combined with import tariffs that made sugar less appealing price-wise to food preparation companies. Its usage peaked in the late 1990s and with increasing concern over “empty calories” and refined products, manufacturers have been removing it from their ingredients list and replacing it with alternatives, including a shift back to sugar. The largest users of HFCS include the beverage industry (41%), processed foods (22%), and bakery/cereal producers (14%). The dairy industry also uses it in flavored beverages. According to Credit Suisse, HFCS makes up just 8% of Ingredion’s sales.

HFCS prices have seen increases since 2014 when privately held Cargill shut down its corn syrup plant in Tennessee, followed in 2016 by Ingredion’s sale of its Port Colborne, Ontario plant whose new Swiss owner Jungbunzlauer will not be producing any HFCS. There is also a 3-4% increase for 2017, with demand outpacing production.

At the outset this would make a compelling bear case for Ingredion, but it is not the case. The foods and drinks that use HFCS also benefit from “mouthfeel” from the sugary concoction and this is an important aspect of any edible product. Therefore, to replace this loss, manufacturers replace them with other ingredients which, conveniently, Ingredion makes as well. In addition, they also make high intensity sweeteners (HIS), more commonly known as artificial sweeteners. These alternative ingredients are derived naturally from the starches of corn, rice, potatoes and tapioca which, keeping in line with the health oriented public’s demand, are also gluten-free.

M&A

Expanding Reach – In order to increase their production market share, Ingredion has acquired various companies through the years. In August of 2016, they bought the rice starch and flour division from Sun Flour Industries and in 2015 they bought out privately-held Kerr Concentrates for $102 million. Management has said that they are always interested in bolt-on accretive M&A.

Their latest $400 million acquisition is privately-held TIC Gums, a creator of textural products using a blend of gum-based ingredients that caters to small and medium-sized food and beverage companies. TIC has been growing at 11% per year and once operational synergies are put in place, it will further expand Ingredion’s reach and market mix.

Final Observations

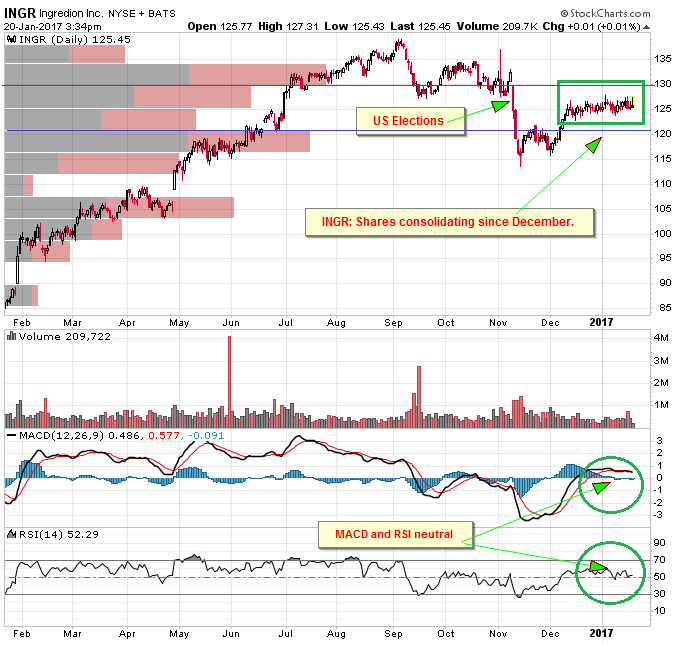

Post US-elections, Ingredion share dropped 15% on uncertainties. They have regained most of that and have been consolidating near $125 since mid-December. Aside from commodity prices and increasing specialty product demand, there is the proposed corporate tax rates from President Trump. Ingredion’s present rate is 30-34% and this would benefit quite a bit even with a cut to 20% rate, and given customer preference shifts outlined above, shares should appreciate during 2017.