Insider Spotlight – Sally Beauty Holdings (SBH)

Sally Beauty is the largest distributor of professional beauty supplies to both professional stylists and consumers in the US. The company’s business is organized through two separate segments, Sally Beauty Supply and Beauty Systems. Here is the breakdown per their recent Investor Presentation:

On May 4th, the company announced its Q2 earnings results in which they beat on EPS, but missed on Revenue. They reported that Same Store Sales fell 2% with its Sally Beauty Supply segment down 2.4% and its Beauty Systems Group down 1.2%.

On the conference call, CEO Christian Brickman would speak about each segment:

Sally Beauty – We continue to be excited about the launch of our new natural segment in the multicultural category, which is up 7.6% in the quarter, continuing very strong performance by this emerging and growing category. In early April, we were very excited to begin testing our new consumer loyalty program in Georgia and Florida. We have received positive feedback from loyalty members that they love the value proposition, digital access to their account and no fees, renewals or plastic cards that they feel compelled to carry. We look forward to sharing more detail on our progress during next quarter’s call.

Beauty Systems Group – We have now wrapped the difficult sales comparisons, and we believe the second half of the year will be much stronger than the first. For the remainder of the year, we will continue to roll out new innovative brands, continue to leverage and utilize tactical pricing and better negotiations in order to drive gross margin, and finally, double down on our CRM and mobile app initiatives.

Robert W. Baird analyst Mark Altschwager issued a research note the day after saying Sally Beauty reported above consensus earnings with improved gross margins and lower SG&A. He said there was a comp shortfall at both the retail and professional divisions as a weak spending environment drove the downside. He believes, however, that pricing and sourcing initiatives are bearing fruit and the company is realizing its cost savings goals, leading him to increase his estimates. Mr. Altschwager likes the risk/reward at current levels and reiterated his Outperform rating and $26 price target on Sally Beauty shares.

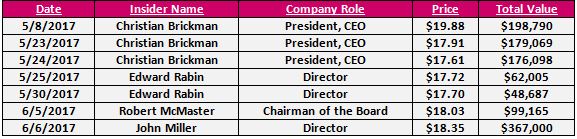

Several weeks after their Q2 earnings report, CEO Christian Brickman would begin buying a total of 30,000 shares between $17.61 and $19.88 for a total value of $553,957. These insider purchases are the first for the CEO since November 19th, 2015. Soon after these purchases, other members of SBH began acquiring shares. Here is the complete breakdown:

Then, last week, on June 6th, Oppenheimer was out with a note titled “Another Positive Data Point for SBH.” They say that there have been a few positive data points lately that we believe the market has ignored including:

1. Insider Buying by the CEO in multiple tranches and by other Directors

2. The announcement of a return to positive comps in April/May vs. a -2% decline in Q. Specifically, it reported combined April/May consolidated comps of +0.4%

3. Refinancing announcement which could lead to a modest reduction in borrowing costs

Oppenheimer said they will be back with more thoughts on SBH soon as they are quite attracted to the underlying cash generation, but continue to ponder the sustainability of positive comp growth against the current retail backdrop, which we believe is key for shares to outperform.