Insmed (INSM) – Bullish Bets on CONVERT Phase III

Back on March 6th, we covered Insmed (INSM) (link requires Pro subscription) after unusual buyer of 500 October 18/33 call spread, paying $4.60 on 17x daily volume which remain in Open Interest. Today, a buyer of 780 October 20 calls paid $6.40 with the bid/ask spread at $5.50 to $6.60, just under half a million bullish bet.

Background

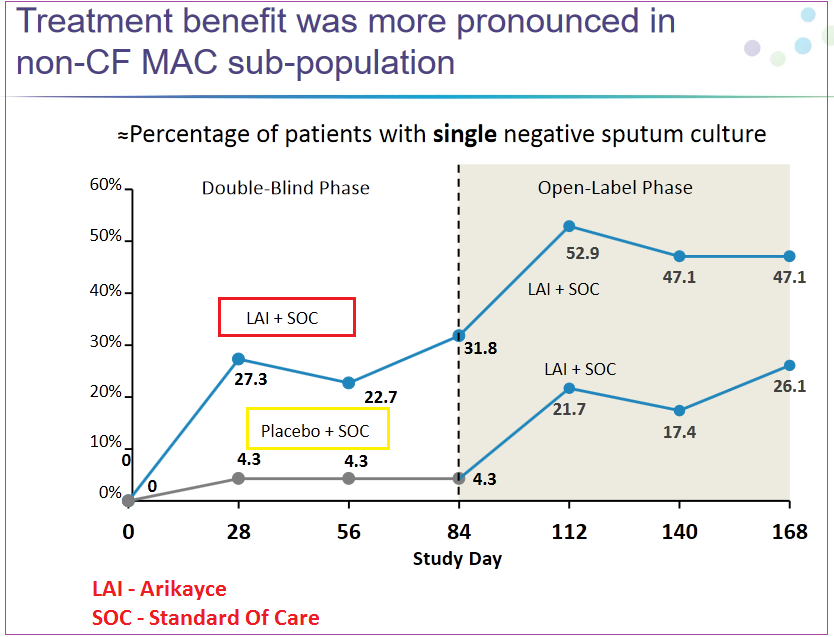

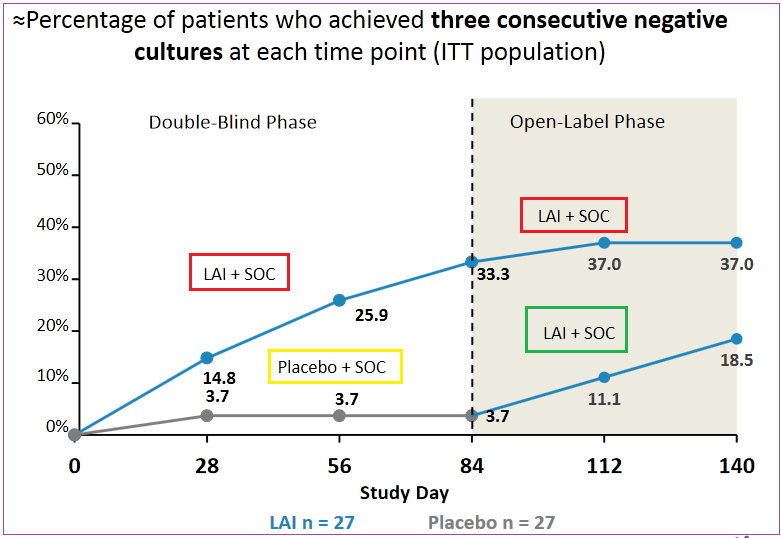

Insmed is a billion-dollar development phase biotech that is relying on the success of a key oncology drug, Arikayce (LAI), for the treatment of non-tuberculous mycobacteria (NTM) lung infections. It should be noted that its trial, which is labeled CONVERT, did not meet Phase II primary endpoint data back in October 2016, however it did meet secondary endpoint target versus a placebo.

In November 2016, INSM began the next phase of the trial study involving 330 patients in 125 locations worldwide. In early May of 2017 during their annual “Bus Tour” with management meetings, Leerink reported that 75% of enrolled patients in CONVERT Phase III trial had completed their 6-month treatment duration. While the company didn’t give out any definitive information on the overall picture, they are scheduled to host an analyst day on July 19th starting at 08:30 ET, in New York City

CONVERT Phase III trial completion is expected in 2H2017, anytime between August and October with the potential to file for accelerated approval in the US. The company plans to market the treatment independently in the US, EU and Japan.

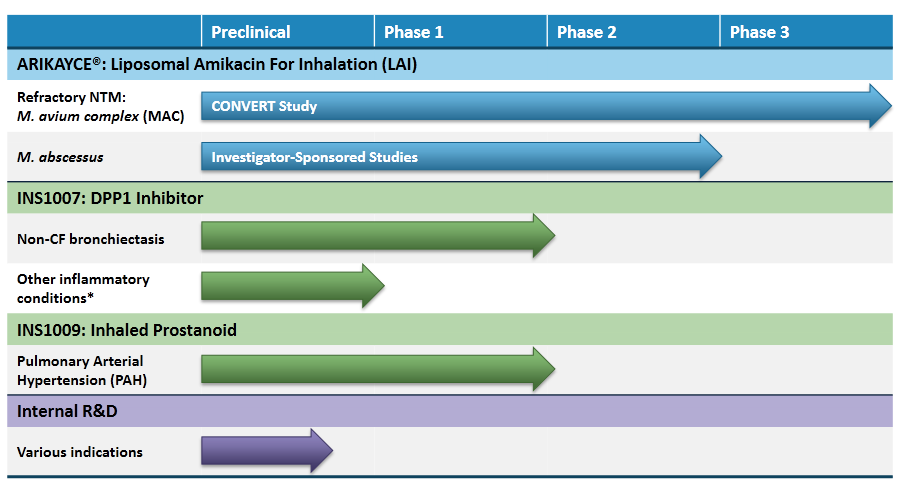

Pipeline – Two other studies are also under way.

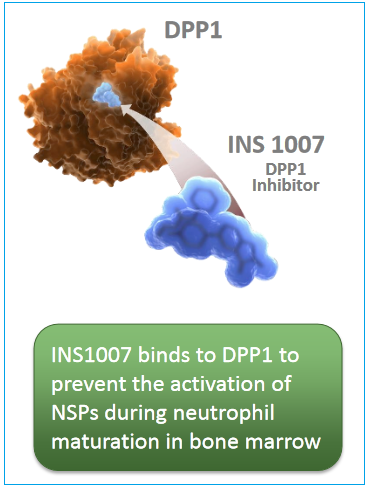

- INS-1007 Phase I trial that has so far shown positive results (as of May), and will be progressing to Phase II sometime in 2017. This treatment is targeted at Non-CF Bronchiectasis, a condition for which there isn’t any FDA-approved treatment therapy. Encouraging data has shown significant reduction in neutrophil serine protease (NSP) activity (neutrophils are white blood cells that are essential in mammalian immune systems).

- INS1009 study is in Phase I and so far has shown some early promise with tolerance levels being consistent with other inhaled prostanoids, leading the company to evaluate opportunities for further development.

Analyst Coverage

- Leerink attributes a 90% probability of success and, in the case of approval, values the shares would be worth $27

- Baird initiated INSM on July 10th with an Outperform rating and $23 price target

- Stifel rates the shares as a Buy with a $27 price target

- Citigroup has a Netural rating with a $17 price target

Insmed remains financially sound with $126 million in cash and $55 million debt and will report earnings on August 2nd.