JaguarConsumer Callouts – May 7 (BWMX, DRI, RUTH, RRR)

![]()

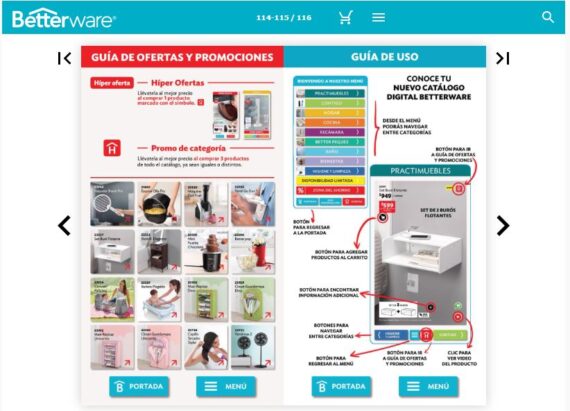

Betterware de Mexico (BWMX) is a leading direct-to-consumer retailer in Mexico that is focused on the home organization and solutions segments. After reviewing the company’s May catalog, Small Cap Consumer Research analyst Eric Beder noted that the SKU count of 338 slightly surpassed the April catalog by 6 SKUs to claim the position as the highest SKU count he has recorded since he began tracking the Betterware catalog at the end of 2020. He adds that May’s record 74 “New” SKUs were up 15.6% Y/Y and rose for the third time on a M/M basis. In addition, May saw even further drops in discount levels, with an overall discount rate of 32.9% of SKUs, down 210bps from the prior month and a decline of 720bps from the peak level in March 2023. Finally, he points out that April Mexican inflation was 6.24%, the lowest reading since October 2021. “With Y/Y increases in pricing for Betterware remaining above the inflation rate, we believe, coupled with lowering logistics costs and increased availability, there is the potential for the division to capture higher overall margins.”

On Wednesday, May 3rd, Darden Restaurants (DRI) announced it would be acquiring Ruth’s Hospitality Group (RUTH) for $21.50 per share or $715M. Ruth’s has 154 locations (52% company-owned) generating systemwide sales of $860B and revenue of $500M+. In 2022, RUTH’s SSS were +13.8% Y/Y and 10.9% above 2019 levels. Oppenheimer saying that with $500M+ in revenue and $860M in system-sales, RUTH will represent approximately 5% of DRI’s total revenue on a pro-forma basis.

In year one, they calculate $0.11 of EPS accretion assuming RUTH generates $50M of EBIT, funding the acquisition entirely with debt at a mid-single-digit interest rate and incorporate no synergies. The initial synergies would then add $0.04–0.07 in year one and additionally $0.10–0.15 in year 2.

Meanwhile, BMO Capital saying that the RUTH acquisition further fills out Darden’s steak and fine dining portfolio, with Darden citing data that The Capital Grille overlap is minimal. “We have concerns about fit, though, as we wonder if growth aspirations will create greater overlap over time. Moreover, DRI’s appetite for a brand with franchised locations was surprising, while RUTH’s beef exposure creates a medium-term risk given the cattle cycle.”

![]()

This past week, Red Rock Resorts (RRR) reported Q1 earnings in which EPS came in at $0.75 vs $0.53 estimate and Revenue of $433.6M vs $411.75M estimate. Management said that revenues were the best in the company’s first quarter history, while Las Vegas Locals adjusted EBITDA and EBITDA margin were the second best for the quarter in company history. 7 of its 10 properties were open during Q1 while the company has permanently closed the remaining three locations to prepare them for divestiture. Las Vegas EBITDA and Revenues increased 8% Y/Y, reflecting a 19bps margin expansion. Meanwhile, the non-gaming side of the business represented a point of strength as management noted Food & Beverage and Hotel revenues delivered gains of 18.9% and 19.5% Y/Y, respectively. Hotel revenues were driven by increased ADR of 18% Y/Y and an even better occupancy improvement, reflecting RevPAR growth of 34% Y/Y. Growth in F&B was stemmed primarily from larger average transaction size in the restaurant business. In a post-earnings note, Stifel would add:

“Something not to be overlooked is the fact RRR recently announced that the Oakland A’s purchased 49 acres of a 96 acre parcel from the company’s undeveloped land bank. While the A’s prospective move to Las Vegas would likely benefit all casino operators in the region, RRR stands to capitalize on a tremendously unique opportunity if they are ultimately able to build a casino directly next to an MLB stadium. Even if they don’t build a casino we believe the company’s remaining ~40 acres that would sit next to the ballpark complex would become extremely valuable if they wanted to eventually sell those acres. We estimate that land sold around the Raiders new stadium was valued in the $5M-$6M range and believe RRR’s untapped acreage around the prospective A’s ballpark could go for more than that.”