JaguarConsumer Weekly Callouts – August 13 (Retail, Restaurants, COTD

On August 10th, in Conversations, I mentioned how when you look past the major headline of that day (TPR/CPRI merger), you would have seen some disaster earnings reports from the likes of Hanesbrands (HBI), Ralph Lauren (RL), and Wolverine World Wide (WWW). In addition, I also said to take a look up north at a company called Canadian Tire (CTC.TO), an Ontario-based retail company that operates in the automotive, hardware, housewares, sports, and leisure sectors.

Revenue in the quarter was down 3.4% Y/Y with comparable sales only up 0.1%, following strong growth of 5.0% in Q2 2022. In the press release, management said, “As inflation persisted and rate hikes continued, consumer demand for discretionary goods softened, particularly in the latter half of the quarter, and Canadians shifted to more essentials within our multi-category assortment…Since early 2022, the cumulative effect of increasing inflationary pressure and higher interest rates on consumer spend and financing costs, along with higher inventory costs, has significantly impacted the company’s ability to deliver against its previous expectations. Given the slower pacing of growth, and the noticeable slowdown in retail sales during the second quarter of 2023, the Company is withdrawing its previously disclosed financial aspirations at this time.”

This brings me to another Canadian retailer that reported earnings last week, Leon’s Furniture (LNF.TO), which is headquartered in Toronto. They are a retail conglomerate specializing in major home furnishings, mattresses, appliances, and electronics.

The company reported that revenue declined 8.2% Y/Y to $593M, which came in below BMO Capital’s $612M estimate. Same Store Sales fell 8%, which also came in below BMO’s (5%) forecast as a softening macro environment weighed vs. a tough prior year comparable (Q2 2022 SSS +10%). BMO Capital analyst Nevan Yochim highlighted how mattresses held up comparatively better than other categories, supported by a recent partnership with Resident. Meanwhile, Ecommerce sales fell by 16% Y/Y to $65M.

1D Earnings Price Reaction (via Koyfin):

HBI: Down 1.13%

RL: Down 4.82%

WWW: Down 25.68%

CTC.TO: Down 4.09%

LNF.TO: Down 0.75%

Mark Kalinowski of Kalinowski Equity Research, following the latest Consumer Price Index print, pointed out that CPI data showed that prices for food-at-home (i.e. grocery stores and supermarkets) rose by +3.6% in July. This +3.6% number compares with price for food-away-from-home (i.e. restaurants) that increased by +7.1% in July. Kalinowski said this marked the fifth month in a row for which restaurant pricing is outpacing grocery/supermarket pricing, following no such months during all of 2022.

“Even more noticeably, this gap widened sequentially yet again, to -350 basis points in July 2023. The gap was -300 basis points in June 2023, -250 basis points in May 2023, -150 basis points in April 2023, and merely -40 basis points in March 2023. We would note that the 20-year (2003-2022) historical average is a -60 basis-point gap, so July 2023 is the 4th month in well over a year in which the gap is in favor of grocery stores, and simultaneously, larger than the 20-year historical average gap. The July 2023 gap of -350 basis points resembles the full-year 2016 gap of -390 basis points. During full-year 2016, our Kalinowski Restaurant Industry (same-store sales) Index rose by only +1.1%. This was the second-lowest such performance of the last seven years, better only than the pandemic-hit -5.9% posted in full-year 2020.”

“With the gap yet again expanding in July, does this suggest that the gap will generally continue to grow – and remain quite large – over the remainder of 2023? If so, will this (all else equal) have an adverse effect on U.S. restaurant industry sales trends? These are open questions at this time. In general, we do not expect second-half 2023 U.S. restaurant same-store sales to be as good as first-half 2023 U.S. restaurant same-store sales, and this expanding gap is one reason why.”

On August 11th, Wolfe Research analyst Chris Senyek issued his Chart of the Day where he said:

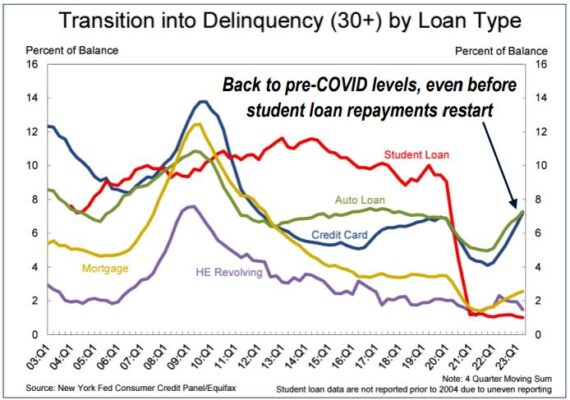

“The soft landing narrative has picked up steam this year largely on the back of solid job growth, wage gains, and rising consumer spending expectations. In fact, Bloomberg consensus now shows that, on average, economists don’t see any contraction in real consumption in the quarters ahead. While we don’t see an imminent downturn, we expect the lagged impact of rate hikes to cause real consumer spending to start to contract as early as 4Q. Several recent data points support our outlook, including (1) Revolving credit turning negative in June, and (2) Credit card and auto loan 30+ day delinquencies returning to pre-COVID levels even before student loan repayments restart. While the Consumer Discretionary sector may outperform as long as the “wealth effect” is driving the economy and stocks higher, we continue to favor Staples over the intermediate term.”