JaguarConsumer Weekly Callouts – August 26 (Delinquencies, Boating, Shein, Rolex, WOSG.L, MNST, HAS, MODG

**PDF version is also available HERE**

-This past week saw a slew of retail earnings announcements. Among the topics investors were focused on were related to credit cards/delinquencies. This topic was certainly present during Macy’s (M) and Nordstrom’s (JWN) earnings call:

Macy’s: “During the quarter, credit card revenues declined 130 basis points or $84 million year-over-year to $120 million, and represented 2.3% of net sales. We experienced an increased rate of delinquencies within the credit card portfolio across all stages of aged balances. While we had expected delinquencies to rise as part of our normalizing credit environment, the speed at which the increase occurred for us and the broader credit card industry since our first quarter earnings call was faster than planned. This negatively impacted second quarter results and led to an increase in the portfolio’s bad debt outlook.”

Nordstrom: “Offsetting the tailwinds are headwinds with respect to our credit card business. Our credit card revenues were up 10% in the first half of the year from higher revenue recognized in connection with our credit card partner agreement and with lower-than-expected credit card losses. That said, we have seen delinquencies rising gradually, and they are now above pre-pandemic levels, which could result in higher credit losses in the second half and into 2024.”

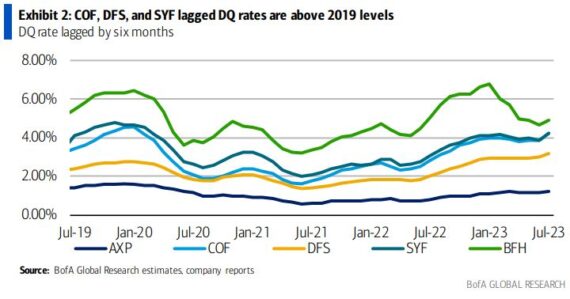

In their Consumer Finance note on Friday, BofA said they expect credit metrics to continue to weaken over the next few months keeping the normalization vs deterioration debate front of mind for investors. “We analyzed delinquencies (DQ) on a lagged basis to account for the robust loan growth and current lagged delinquency rates are well above 2019 and historic levels. We believe looking at delinquencies on a lagged basis, mitigates the denominator effect on DQ rates from strong loan growth…We believe the trend of DQs and lagged DQs implies higher net charge-offs prospectively, which will pressure credit metrics and sentiment in the fall.” While companies like Synchrony Financial (SYF) and Bread Financial (BFH) have diversified their businesses, apparel and physical retail still drive meaningful volume and weaker outlooks from retailers are a negative read-thru, according to BofA.

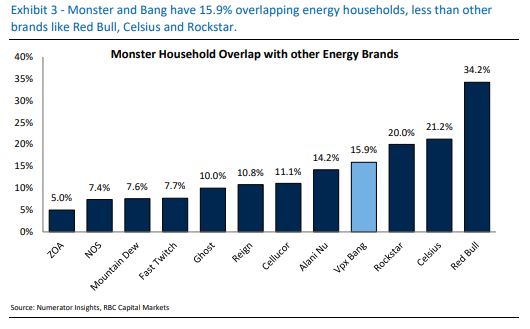

-As RBC Capital analyst Nik Modi points out in his “Picture of the Week” note, Bang Energy was once a key thesis to the Monster Beverage (MNST) bear case. Bang Energy exploded onto the scene, with dollar sales growing +263% Y/Y in 2019 while its energy drink market share in IRI/Circana data went from 2.5% in 2018 to 8.3% in 2019. Since then, Bang Energy has struggled with brand health, supply chain, and eventual bankruptcy issues which allowed Monster to acquire the brand and its Arizona production facility.

According to Numerator Insights data, Monster Energy and Bang currently have 15.9% overlapping households within the overall energy category. This is below other major energy brands like Red Bull at 34.2%, Celsius Holdings (CELH) at 21.2%, and Rockstar at 20%, suggesting lower overlap between Monster’s core energy portfolio and the existing Bang consumer. “We believe this bodes well for the brand as it enters/interacts with the rest of the MNST portfolio and helps round out exposures to emerging sub-segments of energy like lifestyle energy, wellness energy, performance energy with continued momentum in “traditional” energy.”

With the Bang acquisition closing, Monster Beverage is planning to fully integrate the brand into the Coca-Cola (KO) bottler network system while also expecting some near-term disruptions from the integration. “With the proper support from MNST and the Coca-Cola bottling distribution system, we believe the [Bang Energy] brand can regain its footing over time and fits nicely within the MNST portfolio. Bang is also expected to carry a similar margin profile to Reign and Ultra which should be margin accretive in the long term.”

-This past week, Sweetgreen (SG) announced it had hired Chad Brauze as Head of Culinary and Michael Kotick as Head of Marketing. According to the press release, Chad Brauze will be responsible for the chain’s menu development and innovation, while Michael Kotick will be responsible for overseeing the chain’s marketing and menu strategy. Mr. Brauze recently worked at Burger King as Senior Director of Culinary Innovation. Prior to Burger King, he worked at Chipotle as Director of Culinary and Menu Development. Similarly, Mr. Kotick’s previous role was Senior Director, Brand Marketing at Chipotle.

–Roark Capital has agreed to buy Subway, in a deal that values the U.S. sandwich chain at up to $9.55B, according to Reuters. This acquisition adds yet another restaurant to the Roark portfolio, which currently includes names like Arby’s, Buffalo Wild Wings, Dunkin Donuts, Auntie Anne’s, Cinnabon, and Sonic.

–Instacart, the grocery delivery company, filed paperwork on Friday to go public. The stock will be listed on the NASDAQ under the ticker “CART.” In its prospectus, CNBC points out that the company said net income totaled $114M, while revenue in the latest quarter hit $716M, a 15% increase Y/Y. Instacart has now been profitable for five straight quarters, according to the filing.

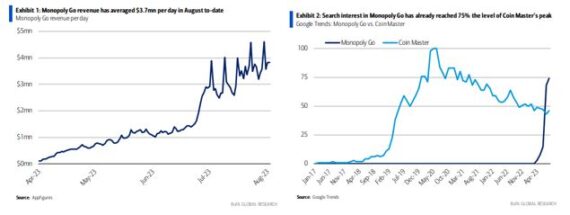

-A bullish piece on Hasbro (HAS) came out on Tuesday from BofA, who said they were encouraged to see two recent digital game launches—Monopoly Go and Baldur’s Gate 3 — performing exceptionally well.

Per Appfigures, Monopoly Go has made $200M of revenue since its launch in mid-April and has generated $3.7M/day so far in August. Per Google Trends, search interest in Monopoly Go has already reached 75% the level of Coin Master’s (mobile game released in 2015) peak. Monopoly Go has social casino elements similar to Coin Master which reached its peak popularity in 2020 when the game generated $1.2B. “If Monopoly Go generates $500M of revenue in its first year, we estimate this will contribute $60M of revenue for Hasbro or $0.33 to EPS, largely benefiting 2024.”

Meanwhile, Baldur’s Gate 3 is a role-playing game produced by Larian Studios featuring intellectual property from Dungeons & Dragons, which Hasbro owns. Larian recently disclosed that Baldur’s Gate 3 had already sold 2.5M units during early access ahead of the August 3rd release on PC. The game recently saw a peak of 875K concurrent players on Steam, the ninth highest ever. This is just 8% shy of Elden Ring, a 2022 role-playing game that sold over 20M units in its first year. Baldur’s Gate 3 is also number one in PS5 pre-order sales ahead of its September 6th launch. “If Baldur’s Gate 3 can sell 10M units, we estimate this will contribute $61M of revenue for Hasbro or $0.34 to EPS, split between ’23 and ’24.”

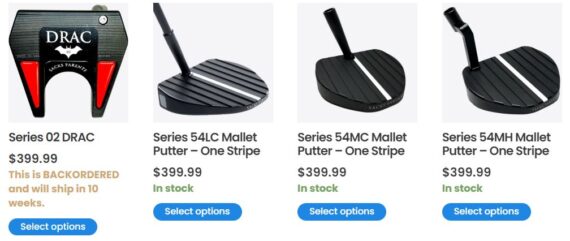

-A new addition to my consumer watch list, specifically under the Golf category is Sacks Parente Golf (SPGC), a California-based company, whose website states, “Our patented physics create THE ONLY mallet putters in golf that naturally improve your stroke and tighten your putt dispersion.”

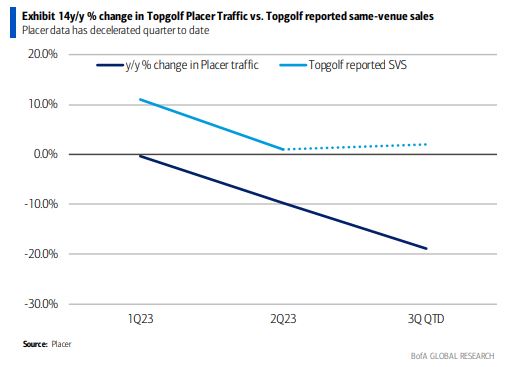

Moving along to industry checks, overall golf club sales were up 0.6% Y/Y in July vs.-1.5% in June in the channels that report to Golf Datatech. BofA added that Topgolf Callaway Brands (MODG) golf club sales declined 0.1% in July vs. -0.2% in June as declines in irons (-2.0%) and wedges (-11.1%) were partially offset by increases in putters (+8.1%) and woods (+1.6%). Callaway ASPs increased 3.7% Y/Y in July which partially offset a 3.6% decline in units. On a Y/Y basis MODG market share is down 100bps given additional competitor launches this year. Lastly, according to Foot Traffic data from Placer.ai, Topgolf visits are down 18.9% in Q3 QTD (thru 8/13), which is a deceleration from -9.7% in Q2. Placer foot traffic data was approximately 11pts lower than reported Topgolf same-venue sales in Q2.

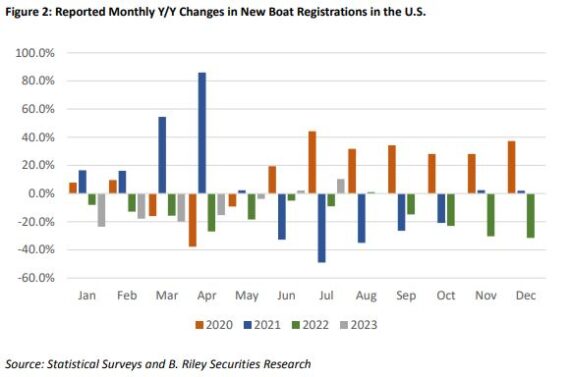

-Statistical Surveys (SSI) released preliminary July boat registration data on Wednesday. SSI captures data around new boat registrations in early reporting states that typically make up more than half of the U.S. boat market. As B. Riley cites, the month of July historically represents approximately 15% of annual boat industry retail sales. SSI reported a Y/Y increase in registrations for July of 10.3%—which represented the second consecutive monthly Y/Y increase since December 2021. These results also improved the YTD decline in registrations to -8.5% from -11.2% as of. By category, Aluminum Fish was +30.2% Y/Y, Pontoon was +8.1% Y/Y, Ski wake was +2.5% Y/Y, Outboard Fiberglass was +4.9% Y/Y, and Stern/Inboard was +1.4% Y/Y. Related tickers are Brunswick (BC), Malibu Boats (MBUU), MasterCraft Boat Holdings (MCFT), Marine Products (MPX), and OneWater Marine (ONEW).

–Shein, the global online fast-fashion retailer, and Sparc Group Holdings announced they have entered into a strategic partnership under which Shein will acquire an approximately one-third interest in Sparc Group, a joint venture that includes Simon Property Group (SPG) and Authentic Brands Group. As Chain Store Age reported, the partnership is expected to expand Sparc Group’s distribution of Forever 21, leveraging Shein’s extensive global customer base. It also gives Shein the opportunity to test customer-focused experiences in Forever 21 locations across the U.S. including shop-in-shops, enabling return to store and other initiatives.

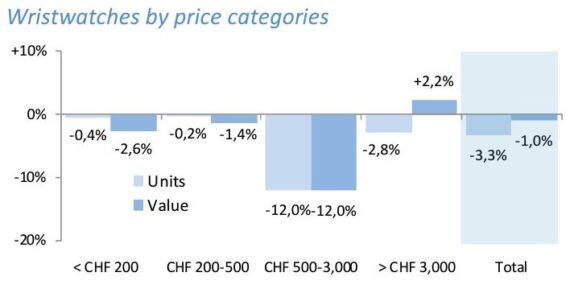

-As discussed in Webinar on Tuesday, Swiss Watch exports in July reached CHF 2.2B (-1% value) with 1.4M units (-3% volume). Per RBC Capital, this was softer than internal expectations against a flat comp in value and 10pt easier comp in volume terms. Most regions decelerated, led by China (-17%) given a materially tougher comp. France was also soft at -14%, while the U.S. and Hong Kong decelerated. By price point, only higher price watch category (CHF>3k) registered modest growth, while all other price points declined in both value and volume terms. CHF 500-3,000 saw the largest declines at -12% value/-12% volume. “Today’s data will likely read fairly cautiously for Swatch Group, Richemont, and Watches of Switzerland.”

–Rolex announced it has agreed to buy Swiss-based Bucherer, a 135-year-old watch retailer, for an undisclosed amount. Following this news, the UK’s biggest seller of Rolex watches, Watches of Switzerland (WOSG.L) came under heavy pressure. According to Reuters, investors fear Rolex might start selling through its own shops. Analysts would also weigh in with Peel Hunt’s Jonathan Pritchard downgrading Watches of Switzerland to Hold from Buy noting that Rolex accounts for half of the company’s sales. Jefferies analyst James Grzinic wrote, “Inevitably the market is debating today the extent to which the news signals a growing risk of a weakening future relevance of Watches of Switzerland to a key supplier for the group.”