JaguarConsumer Weekly Callouts – March 12 (BBW, COST, DIS, ELF, MAT)

Specialty Retail

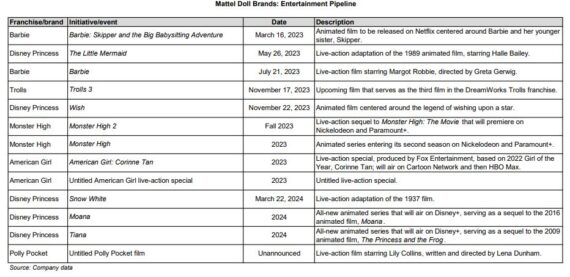

—Mattel (MAT) held a virtual Investor Day this past week. The company is calling 2023 “The Year of the Dolls.” At $2.08B, Dolls were the company’s largest category last year at 34% of gross billings. Will this be a source of growth this year? If this comes true, Stifel analyst Drew Crum says it will be underpinned by 1) The addition of new licenses (Disney Princess and Frozen, Trolls), 2) A strong line-up of entertainment initiatives, with 4 feature films including Barbie, and 3) The global re-launch of Monster High.

Full Disclosure: We have been bearish on Hasbro (HAS) since making it a Top Short in the JaguarAnalytics Q3 2022 Outlook.

–A shout out to shares of Build-A-Bear Workshop (BBW) this week, which finished higher by 16.5%. On Thursday morning, the company reported its Q4 earnings in which Revenues came in at $145.1M, an 11.6% increase vs the $130M last year. Per management, this reflected a net retail sales increase of 10% to $138.2M from the fiscal 2021 fourth quarter, primarily driven by an improvement in store productivity across company-owned stores in North America and in the U.K., with growth in transactions driven by store traffic. E-commerce sales, meanwhile, rose 0.9%, improving sequentially from third quarter. CFO Vojin Todorovic said performance has continued positively at the start of the first quarter, likely driven by Valentine’s Day offerings, the ramp to Easter, and a continued expansion of accessories and new launches. Small Cap Consumer analyst Eric Beder pointed out how FY23 will see the continued expansion of the company into film with the rollout of a documentary on the history of Build-A-Bear as it celebrated its 25th anniversary (scheduled Summer release). For Christmas, the first animated movie built around a Build-A-Bear character, Glisten and the Merry Mission, is scheduled for release. The Glisten character has registered historical revenue of over $100M for the company. “We believe this movie, if successful, has the potential to be lucrative as a stand-alone item, but also as a material driver for Xmas driven sales at the company stores and to be a potential harbinger for shifting other Build-ABear driven franchises (Pawlette, Promise Pets, Rainbow Friends, etc.) to the silver screen.”

Leisure

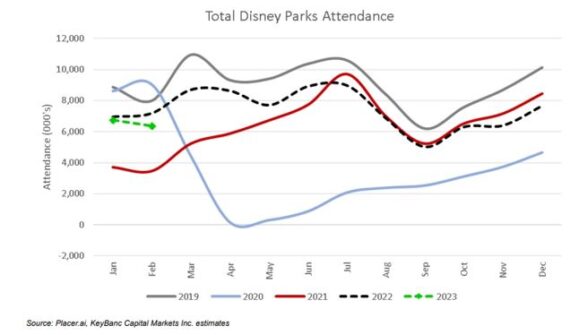

–Using geolocation data from Placer.ai, KeyBanc highlighted that total Walt Disney (DIS) theme park attendance for February was -12% Y/Y and -6% M/M. The decline in Y/Y attendance was worse vs. the prior three-month average, while the M/M change was also below the 2017-2019 average, suggesting a deceleration from historical seasonal trends. Walt Disney World (Florida) attendance was -16% Y/Y and -6% M/M, worse than the recent Y/Y data and also below the pre-pandemic seasonality. Disneyland (California) grew by +9% Y/Y and -5% M/M, better than the recent Y/Y data and better than pre-pandemic seasonality. Analyst Brandon Nispel believes weather played a key role here.

“When we overlay the daily data with the corresponding data in the prior year, we notice: 1) a deterioration in trends in Florida toward the middle of the month corresponding to incremental weather; and 2) a deterioration in trends in California toward the end of the month corresponding to incremental weather. Disney was likely negatively impacted by the Splash Mountain closure at Magic Kingdom at the end of January, and Rock ‘n’ Roller Coaster at Hollywood Studios in mid-February.”

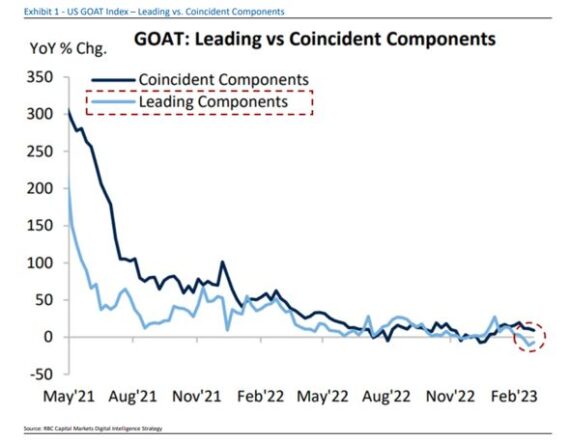

–I wanted to reiterate a comment/chart from last week which came from RBC Capital. Regarding their proprietary GOAT Index (Get Out And Travel), they highlighted that leading indicators have inflected weaker over the past 3 weeks and have turned negative for the first time since the early days of the pandemic when their Digital Intelligence Strategy team started to collect this data. Search interest in air travel, car rental, accommodations, and train transport have also aligned directionally lower over recent weeks (-6.8%, Y/Y on a 3-week rolling avg). Although 3 weeks of data may not constitute a trend, the trajectory certainly brings into question the state of the consumer in the near future given the economic backdrop, dried up COVID stimulus, and potential returning student loan payments. “The dichotomy in the data which suggests that consumer resiliency is currently strong, but may be starting to fade is consistent which what we’ve hard from companies over this earnings season.”

Kellogg (K) – CEO Steven Cahillane said, “So overall, the consumer in the US is in a good place. And when you look at the categories that we play in, it remains very strong, right? So they are cutting out discretionary items, which, we all know, high-ticket items are under a lot of pressure.”

PepsiCo (PEP) – CEO Ramon Laguarta said, “The way we feel about the consumer is based on employment data and wage growth around the world is positive. In our assumption for the year, we’re thinking elasticities might get worse going into the second half of the year based on multiple scenarios that we have.”

Food/Staples

–When Costco Wholesale (COST) reported its Q2 earnings earlier this month, the discussion surrounding a membership fee hike came up. CFO Richard Galanti made the comment that the last 3 hikes, they averaged around 5 years and 7 months, which is “about now.” In their view, it’s a question of “when, not if” the next hike will be announced.

Oppenheimer’s Rupesh Parikh said his model does not currently incorporate the financial impacts related to membership hikes on the P&L. Meanwhile, JPMorgan analyst Christopher Horvers would say that based on prior disclosures, he estimates that approximately 70% of Costco’s household members are in the US/Canada implying around 46M households made up of 26M executive members and 20M regular members (based on the assumption that 57% of paid members in the US/Canada are executive).

“For simplicity purposes, assuming a $5 and $10 membership fee increase for Goldstar and Executive members, respectively, in the US and Canada that goes into effect at the beginning of COST’s 4Q23 implies a ~$370M lift to MFI that is recognized over 23 months (as each monthly cohort renews). Given the end of FY timing, this would result in a 40-bp lift to our FY23E MFI, 6%e in FY24, and 2%e in FY25. This equates to a $0.60E total EPS benefit weighted primarily to FY24. Importantly, this math is similar to the last MFI increase, but the EPS accretion percentage is much smaller given the larger EPS base and more productive clubs.”

Beauty

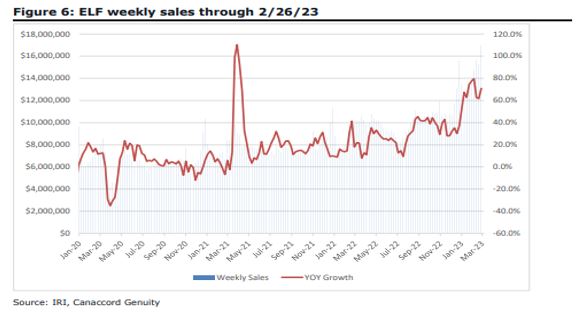

–Canaccord Genuity analyst Susan Anderson, in her Health, Wellness & Lifesystle note, highlighting that e.l.f. Beauty’s (ELF) weekly sales in the mass channels through February 26th continued to remain strong, with approximately 66% growth during the two-week period. Y/Y compares have started to get more difficult as we move away from the easier Omicron comps from January 2022. Growth has also seen a healthy mix between units vs. pricing, with units now starting to drive more than half the sales growth. She also believe ELF’s new product lineups, including the “Lash N’ Roll” mascara and the “O Face Satin” lipstick, continue to do well with recent store checks at the mass channel showing out-of-stocks. “We believe ELF will continue to see strong sales as management has shown its willingness to spend on traditional advertising to attract a new customer segment. Additionally, ELF should be able to benefit from expanding its offering in existing doors (TGT, WMT, CVS, and Shoppers Drug) and expanding into Skin Care.”