JaguarConsumer Weekly Callouts – November 12 (BIRK, BURL, BVH, CHDN, COST, DPZ, GO, KR, ROVR, RRR, STKL, TGT)

**PDF Version is also available HERE

Winners & Losers

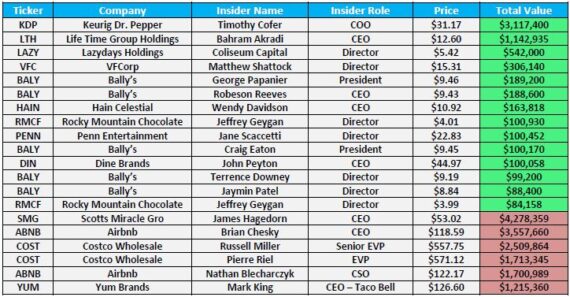

Insider Action (Latest Form 4 Filings)

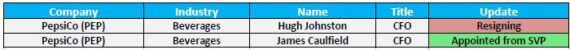

C-Suite Changes

Industry News

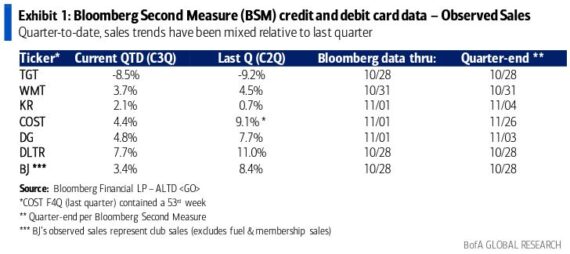

-BofA looked at Bloomberg Second Measure credit and debit card data quarter-to-date. The data provides aggregated analytics from billions of credit card and debit card purchases from a U.S. consumer panel that includes 20+ million members. Based on the chart below, sales trends for Target (TGT) and Kroger (KR) improved while sales trends for Wal-Mart (WMT), Costco Wholesale (COST), Dollar General (DG), Dollar Tree (DLTR), and BJ’s Wholesale (BJ) decelerated.

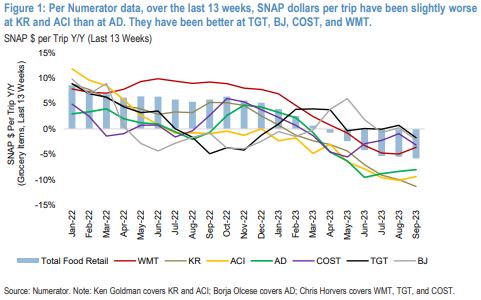

-This past week, Ahold Delhaize reported disappointing Q3 earnings with CEO Frans Muller saying, “The reduction in SNAP benefits resulted in approximately a 4% headwind to sales growth in the third quarter…[This was] higher than we expected earlier. We were counting roughly on a 2% sales impact and we see now a 4% sales impact.” In the wake of these comments, which sent the AD stock down by -7%, JPMorgan was asked by investors whether other food retailers might expect a similar headwind. To this end, they worked with alt-data provider Numerator to accumulate information on the subject. “The results seem clear to us: In terms of SNAP dollars per trip spent on grocery, over the three months ending September 30, 2023, the year-on-year declines at Kroger (KR) and Albertsons (ACI) were just as soft as at AD. In fact, they were slightly worse. In contrast, SNAP dollars per trip spent on grocery at Target (TGT), BJ’s Wholesale (BJ), Costco Wholesale (COST), and Wal-Mart (WMT), are down Y/Y by much lower degrees.”

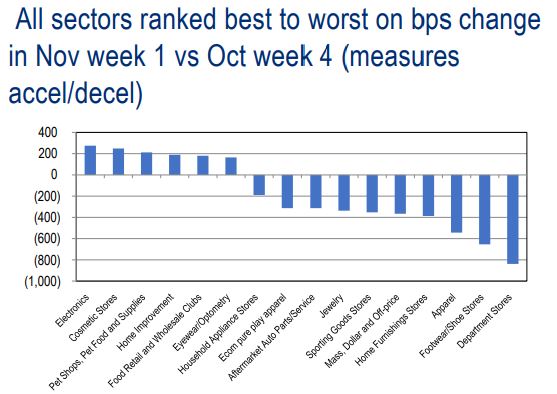

-Citigroup’s credit card data for the 16 sub-sectors they track show that total spending in November Week 1 (ended 11/04) decreased 9.3% vs October Week 4 (ended 10/28) at -11.6%. Ex Food spending was -9.9% in November Week 1 vs -11.9% in October Week 4. Halloween was on Tuesday of November Week 1 this year vs Monday of November Week 1 last year, so more Halloween shopping may have fallen on Sun/Mon of November Week 1 this year versus just Sunday of November Week 1 last year. “While a -9.3% spending decline this week doesn’t sound like something to celebrate (nor the -9.9% ex-Food), directionally (which is what we focus on rather than absolute), the ~200bps improvement is a positive. Next week results may help determine if there was an impact from Halloween timing.”

-On Thursday morning in Conversations, the RV industry was discussed. According to preliminary data from Statistical Surveys, September North American RV retail registrations declined -21% Y/Y (U.S. -21% and Canada -23%) to 27,836 units. North American towable registrations declined -22% Y/Y in September. Motor home registrations declined -16% Y/Y, Class B declined -14% Y/Y, Class A retail registrations declined -14%, while Class C dropped -19%. Related Tickers: Camping World Holdings (CWH), Thor Industries (THO), Winnebago Industries (WGO)

-In a report from Macau Daily Times on November 7th, the tourism industry expects a daily average of 100,000 arrivals during the upcoming 70th Macau Grand Prix, forecasting that even hotels on the Macau Peninsula will be at 90% occupancy. The two-week Grand Prix is being held in conjunction with the 23rd Macau Food Festival, which will be held Nov. 17 to Dec. 3. Andy Wu, chairman of the Travel Industry Council of Macau, attributed the group’s expectations to the fact that this year’s edition of the Grand Prix will feature the comeback of international races FIA Formula 3 and Macau GT World Cups and TCR, which were put on pause due to the pandemic. Related Tickers: Las Vegas Sands (LVS), Melco Resorts (MLCO), Wynn Resorts (WYNN)

-On the Cannabis front this past week, OrganiGram Holdings (OGI) announced a C$124.6M follow-on strategic equity investment from BT DE Investments, subsidiary of British American Tobacco (BTI). VIII Capital was out saying, “This is the second big tobacco player to make a large cannabis investment in the last few months (recall PM’s up to $650M investment in Syqe right before the Rescheduling news in August). These companies are dialed into Washington and it looks like they’re taking a view on U.S. catalysts. We maintain a high degree of confidence that cannabis will be moved to Schedule 3, with an announcement potentially coming at any moment now.” Speaking of Schedule 3, Marijuana Moment was out on November 10th reporting that at a former Food and Drug Administration official said he’d be “shocked” if the Drug Enforcement Administration doesn’t reschedule marijuana by next year’s presidential election. “I would be really shocked if it took the DEA longer than the second quarter of next year to come up with its final rule,” said Howard Sklamberg, former FDA Deputy Commissioner for Global Regulatory Operations and Compliance. “Even when I was at FDA, we knew that important regulations that you wanted to get done in an election year, you want to get done by the summer before.”

Company Commentary

Bluegreen Vacations (BVH) – Shares were the clear outperformer this week, up over 100%, after it was announced it would be acquired by pure-play timeshare competitor Hilton Grand Vacations (HGV) for $1.5B. The all-cash transaction is expected to close in 1H24. B. Riley sees this deal as a great outcome for all stakeholders, including the BVH shareholders who enjoyed the 107% share-price increase on 11/6, and for HGV, which gains scale to member base package, pipeline, and resort network, as well as what its CEO Mark Wang bills as “the highest quality, independently branded vacation ownership operator.” HGV also gains BVH’s coveted Bass Pro/Cabela’s exclusive sales channel, one which the company concurrently extended for ten years in a partnership that B. Riley believe will benefit HGV’s Ultimate Access experiential platform, as well as HGV’s reach down-market to a younger, more moderate-income demographic.

Birkenstock (BIRK) – Initiations were rampant this week from the sell-side community on this footwear company. As one would expect, there were plenty of Buy/Overweight/Outperform Ratings from the likes of Baird, BMO Capital, Citigroup, Evercore ISI, Goldman Sachs, Jefferies, JPMorgan, Piper Sandler, Stifel, Telsey Advisory, William Blair, and Williams Trading. Meanwhile, firms like Bernstein, BofA, Deutsche Bank, Exane BNP Paribas, Morgan Stanley, and UBS initiated at EqualWeight/Hold/Neutral. BofA would say that Birkenstock’s key product differentiation is its footbed, which the company promotes as the “next best option to walking barefoot.” Roughly 75% of its sales come from core silhouettes and embedding the footbed technology into new products is a key strategic expansion opportunity. What also sets the company apart is its vertically integrated manufacturing base. The company produces almost all its products in Germany at primarily company-owned factories, which allows for top-notch quality control. The company is also in the process of ramping a new factory and expects to double capacity over the next three years. “BIRK expects to achieve 10-12% unit growth over the next several years (compared to 5% from ’18-’23). The improvement would be aided by expanded capacity, but this could prove difficult to achieve if the global macro backdrop remains bleak. Other risks are brand heat slowing, decline in full price sell through (currently 90%+) and a potential ramp in marketing costs as the brand scales (below peers, forecast includes marketing costs at 2.5-3% of total sales).”

Burlington Stores (BURL) – The company will be reporting Q3 earnings on November 21st before the open. Citigroup expects Q3 EPS in-line w/consensus and near the low-end of management guidance. They are at $0.99 vs consensus of $0.97 and guidance of $0.97-1.17. They model comps +5.0% vs consensus of +6.4% and guidance of +5-7%, and sales of +13.0% vs consensus of +12.6% and guidance of +13-15%. “Our Placer foot traffic data show a deceleration in trends in 3Q and imply sales closer to the low-end of the range. Given the sensitivity to weather at BURL, warmer-than-normal weather may have had a negative impact on traffic trends. It will be important to hear whether trends have picked up in 4Q-to-date, especially once cooler weather kicked in. We expect mgmt to reiterate its annual guidance of $5.60-5.90. The stock is more crowded (from a long perspective) than it was prior to the 2Q call, making the setup less favorable into the print.”

Churchill Downs (CHDN) – It was Election Day this past Tuesday and in a positive development, Governor Andy Beshear was reelected for a second term in the State of Kentucky. As JMP Securities stated, “Decisions within the gaming industry are often subject to the gaming board, but political certainty in a vastly important jurisdiction bodes well for Churchill Downs.” The company has established a historical horse racing (HHR) footprint, which JMP estimates will increase to >5k units by 2025E, and will look to add in electronic table games and layering in the Churchill Downs Racetrack. On the flip side, Virginia voters rejected a referendum to build a casino in the City of Richmond, a commonwealth with a population of 1.3M people. Through its $2.75B acquisition of P2E in 2022, Churchill Downs gained the right, through a 50/50% JV with Urban One, to build a casino in Richmond if it passed during a referendum. This is the second time the referendum failed after it narrowly got rejected in 2021 with only the backing of Urban One. The proposal was to build a $562M resort and casino to complement its six historical horse racing assets and two incremental new builds in progress, along with the four other land-based casinos in the state. JMP Securities would say, “We estimate, but have not factored into our model, that the casino would have generated $80M to $110M of EBITDA at maturity, worth $0.50 to $2.00 per share for Churchill Downs (50% interest). That said, CHDN operates a 700-unit HHR facility in Richmond already ($124M TTM GGR) and we expect its 2.8k HHR units in the state will benefit from a slot refresh stemming from the recent Exacta acquisition, and the ban of gray market machines in the coming years.”

Clarus (CLAR) – Shares finished lower by over 11% on Wednesday following Q3 results. The company’s Precision Sport sales declined 45% Y/Y as retail inventories remained elevated, and the turn of the hunt season did not catalyze the replenishment demand that was expected. While CLAR noted a slight uptick in domestic ammo demand in recent weeks, this has been overshadowed by the aforementioned headwinds. Lake Street lowered their price target to $7 from $14 as they anticipate the challenging operating environment will persist over the coming quarters and that ongoing softness in ammunition will further impact results. Meanwhile, Outdoor gross margins declined 240 bps Y/Y as the company continued to work down balance sheet inventory with a focus on aging merchandise. The company indicated they will be having an analyst day in late January, where segment leaders will share strategies and growth plans.

Domino’s Pizza (DPZ) – BMO Capital hosted CEO Russell Weiner for an investor meetings. Among the takeaways:

• Delivery Trends Improving Ahead of National Uber Eats Rollout: DPZ noted the delivery channel has begun to “pivot” higher, an indication initiatives are working. Contributions from the new loyalty program were cited as a contributor, as well as service times back to 2019 levels and labor no longer a constraint. Q4 trends likely are on track with DPZ’s expectations. Notably, comp contributions from Uber Eats roll out may ramp quicker than loyalty.

• Don’t expect Uber Eats update at Investor Day on December 7th, though DPZ appears comfortable with pilots and potential sales contributions. Focus of pilots is ensuring operational execution, technology integration, and local pricing optimization. DPZ noted franchisee excitement about projected sales contributions. Uber Eats transactions not only drive topline, but also accretion from supply chain profits and digital income.

• Greater Focus on New Menu Innovation in 2024: DPZ noted menu innovation cadence will be 2+ launches per year — a pace achieved in 2023 for first time since 2011. Innovation will focus on menu platforms rather than LTOs.

European Wax Center (EWCZ) – Shares fell by nearly 11% on Wednesday after a disappointing Q3 earnings report. Total sales of +1% came in well below consensus of +8% due to weaker comps of +3.4% vs consensus at +5% and a timing shift of promos that impacted non-comp sales. The comp shortfall in the quarter came from weakening non-wax pass guest trends, which management attributed to a tough macro in addition to a digital media mis-execution in the quarter (3rd party vendor error, now a new vendor in place). Management lowered their Q4 comp outlook to flattish vs +MSD prior, based on continued weakness in non-wax pass customers. While management believes there is opportunity to drive upside in Q4 from better digital ad execution, Citigroup said visibility into non-wax pass customer trends remains low.

Grocery Outlet (GO) – Shares fell by 4.6% following Q3 results. Net sales grew 9.3% Y/Y vs. the Street at 9.7%, reflecting 6.4% comps vs. the Street at 6.5% & contributions from 24 net new stores Y/Y. Comp sales, despite a 150bps headwind from GO’s new systems rollout in late August, were driven by +8.6% traffic, while average ticket was -1.9% on lower units. Gross margin of 31.4% slightly beat the Street of 31.3% and was up 80bps Y/Y on healthy deal flow & favorable buying that more than offset inventory inefficiencies from GO’s systems upgrade. BofA is modeling Q4 $0.15 adj. EPS & +2.0% comps. “This reflects our outlook for continued disruption related to GO’s systems upgrade (see ~300bp headwind to 4Q comps & ~150bp to gross margin), which should be greater vs. 3Q (which only had 2/3 months impacted). Despite near-term headwinds (which are not expected to persist into 2024), we think GO’s system enhancements position the company better long term given improved functionality, scalability & data analytics capabilities.”

Coca-Cola (KO) – In an opinion issued on Thursday night, the US Tax Court ruled in favor of the IRS, as fully expected, on the Brazil portion of KO’s tax dispute with the IRS. Coca-Cola issued a press release indicating it will move on with the appeal: “While we disagree with the court’s interpretation of the facts and law in this case, we are pleased to move closer to a final resolution of the Tax Court case so that we can pursue an appeal, where we can assert our claims and vigorously defend the company’s position.” Citigroup was out saying, “We had been waiting for the news since February and believe it now removes the headline risk on KO, which can now start its appeal process. While we could see some pressure on the shares today, we would be buyers on weakness.”

Rover Group (ROVR) – This company operates an online marketplace for pet care that connects dog owners with local dog sitters. Its services include dog boarding, in-home pet sitting, doggy daycare, dog walking, drop-in visits, and grooming. Admittedly, we should have revisited the stock prior to earnings as this was last covered in W/E Research on August 6th. Shares surged by 23% on Tuesday after Q3 results. The company’s active users increased by 40K Q/Q to 844K in Q3 (+18% Y/Y), and the total number of bookings grew around 20% Y/Y to 1.8M, with around 84% of bookings coming from repeat users (vs. 82% a year ago) and new bookings +9% Y/Y to 290K. Total GBV grew 25% Y/Y to $266.4M, while revenue grew 30% Y/Y to $66.2M, 6% ahead of consensus and above the upper end of the guidance range, with management noting that recent product improvements, including a simplified booking flow, as well as continued upper-funnel marketing investments, drove the strong performance, complemented by a 120bps realized take rate expansion as all US pet owners were transitioned to the 11% fee structure. Canaccord Genuity would highlight that the company’s International markets saw momentum accelerate as well in Q3, with European GBV up 71% Y/Y (vs. +59% in Q2), Canadian GBV up 35% Y/Y (vs. +34% in Q2), and cat-only GBV up 134% and 58% Y/Y in Europe and Canada, respectively. “The ongoing maturation of conversion drivers in Europe has allowed the company to expand its channel mix and incorporate upper funnel advertising while driving continued strong user acquisition, and Rover also launched its latest video campaign during the quarter. The company recently completed the global implementation of app-based support messaging along with a reengineering of its self-service support center, and Rover also addressed a key pain point in Europe by rolling out recurring booking functionality there.”

Red Rock Resorts (RRR) – In conjunction with the company’s Q3 earnings report this week, the company announced that its development project, Durango, is now slated to open on December 5th versus November 20th previously, as certain areas of the resort were turned over slightly later than anticipated, giving it more time to properly train staff. JPMorgan would say, “Looking ahead, we project LV Locals property-level EBITDA of $199M in 4Q23 (previously $195M) with no Durango EBITDA contribution. In 2024, we project property level EBITDA growing to $838M (previously $846M) and $764M of adjusted EBITDA (net of $74M of corporate expense), which includes a modest initial contribution from Durango.”

SunOpta (STKL) – Sales rose over 9% after reporting that Q3 sales increased 6% including 5.5% volume growth. Beverages and broths, which make up 80% of the business, realized 9% growth, while fruit snack sales increased 16%. The company believes plant-based milk category sales grew low-single digits in the quarter as strength in foodservice/club channels offset tracked channel softness. Back on October 13th, Nature’s Touch announced the successful acquisition of certain assets of Sunrise Growers, SunOpta’s frozen fruit operations. BMO Capital, in their post-earnings note, said that the long-awaited frozen fruit sale is a meaningful positive as it creates a more focused, less-commoditized, and faster-growing business with higher margins that should warrant a higher multiple. 2022 fruit segment operating margins were 1.8% vs. plant-based margins of 8.0%, while average sales growth from 2019 to 2022 was +1.1% in fruit-based segment compared with +15.5% in plant-based.